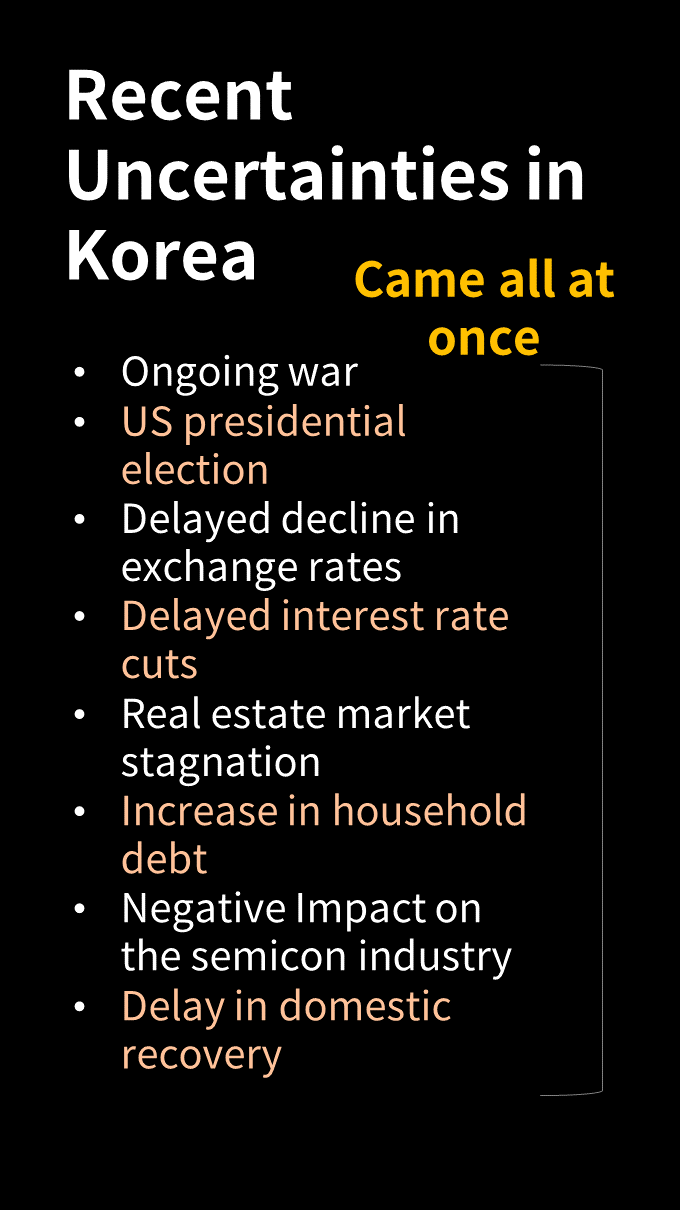

Analyzing the significant impact of Trump's election on various stock market sectors, particularly the decline of the battery sector. We'll explore how transportation, automotive, and other industries are affected, and track potential trends moving forward. Don't miss this critical market insight!

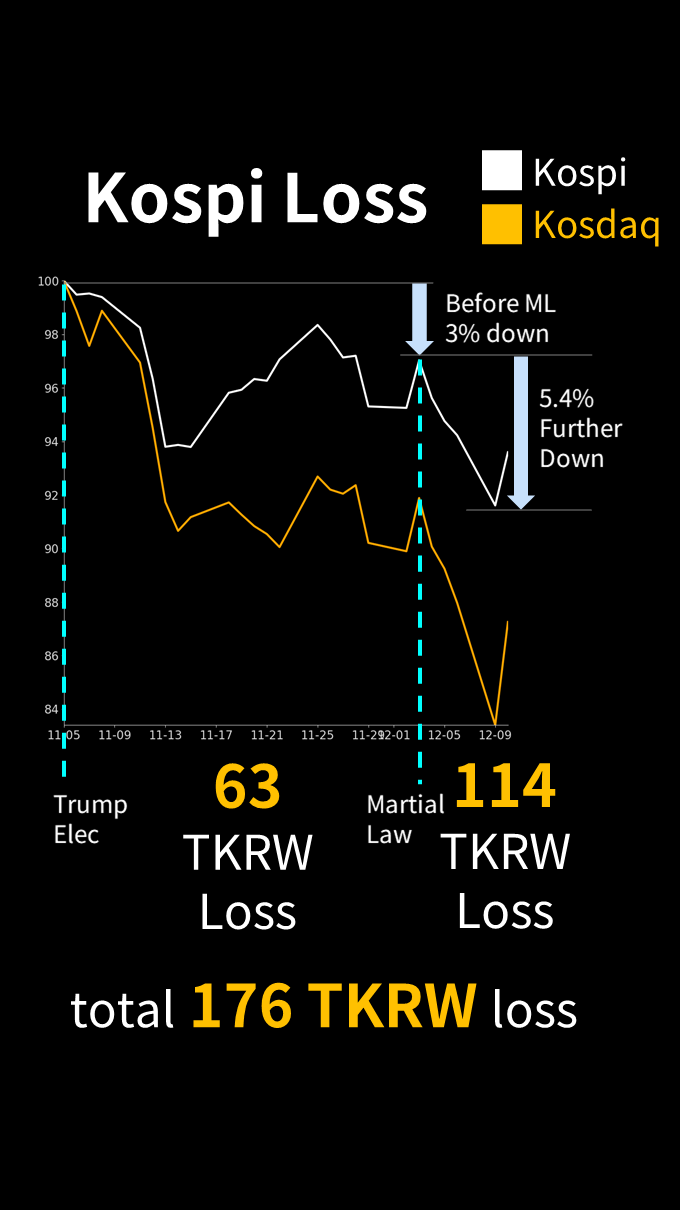

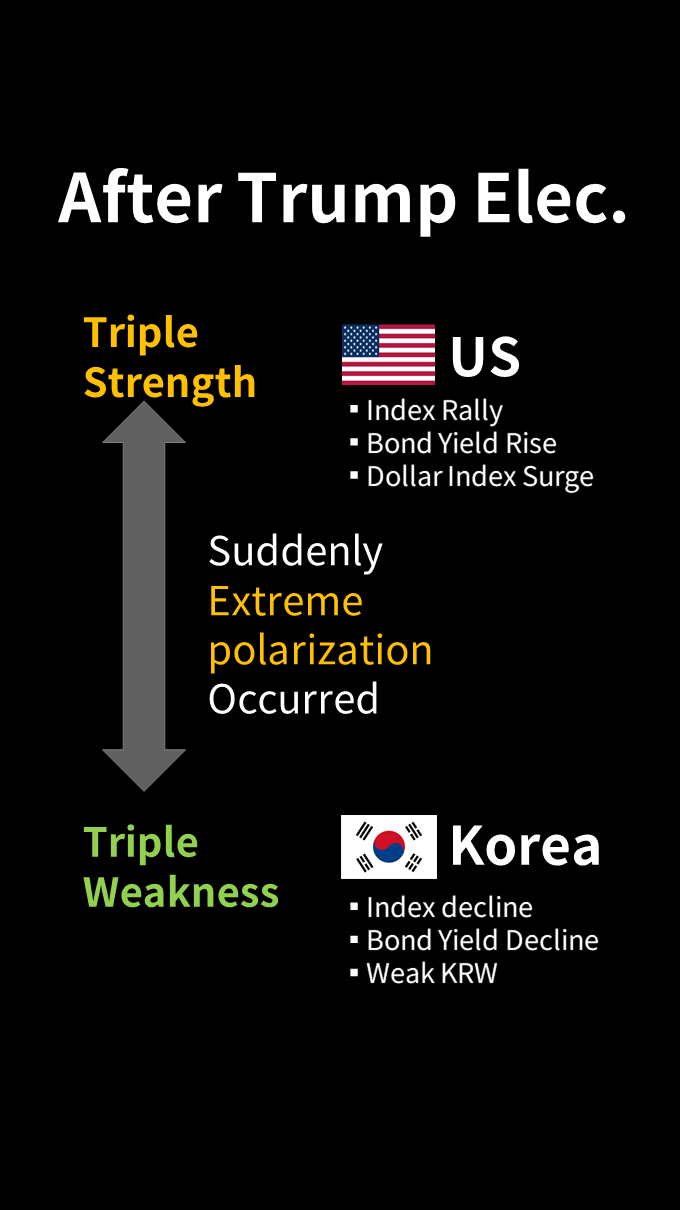

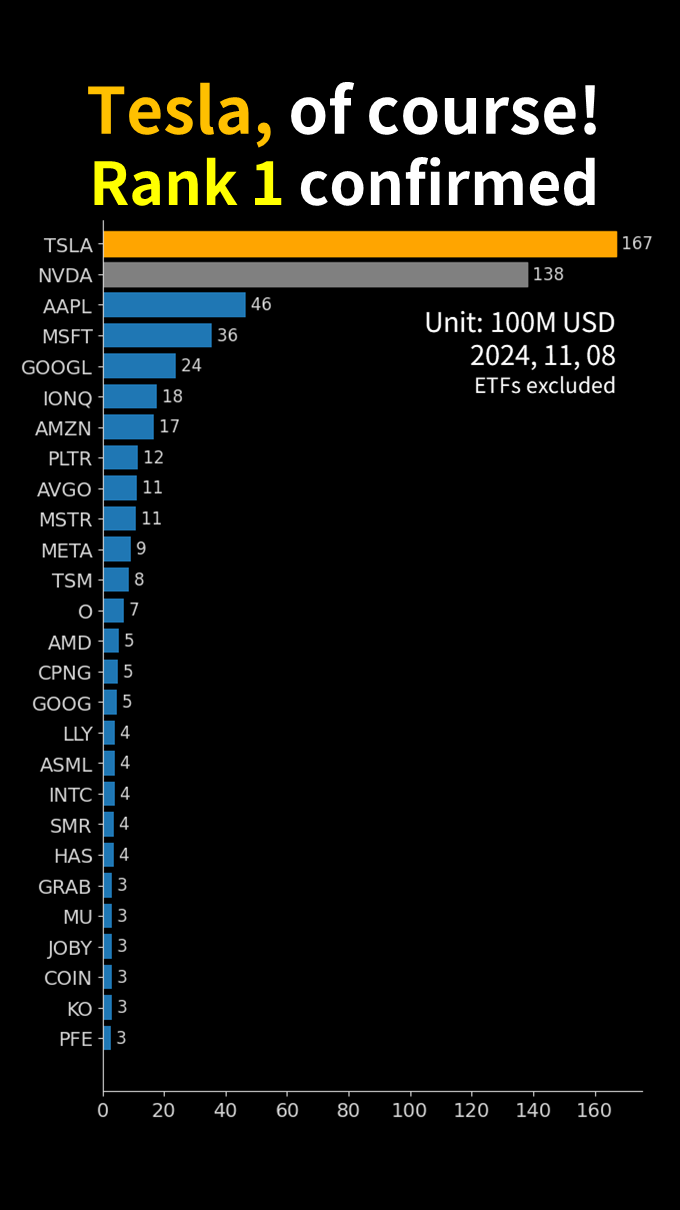

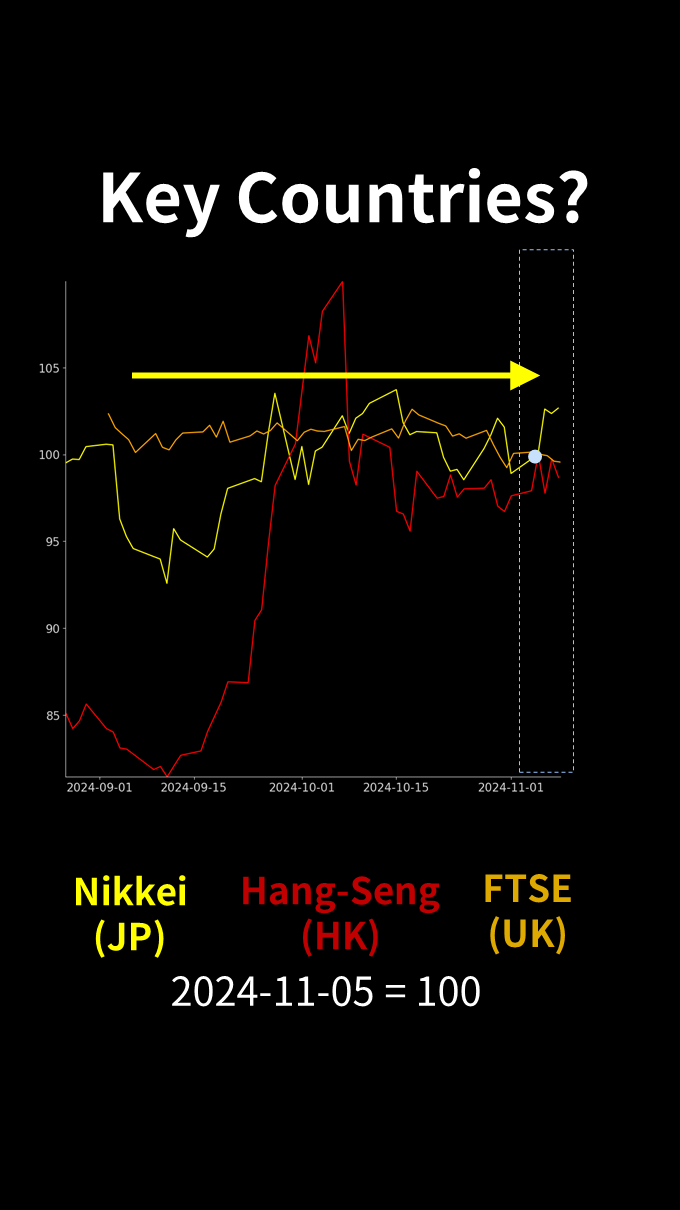

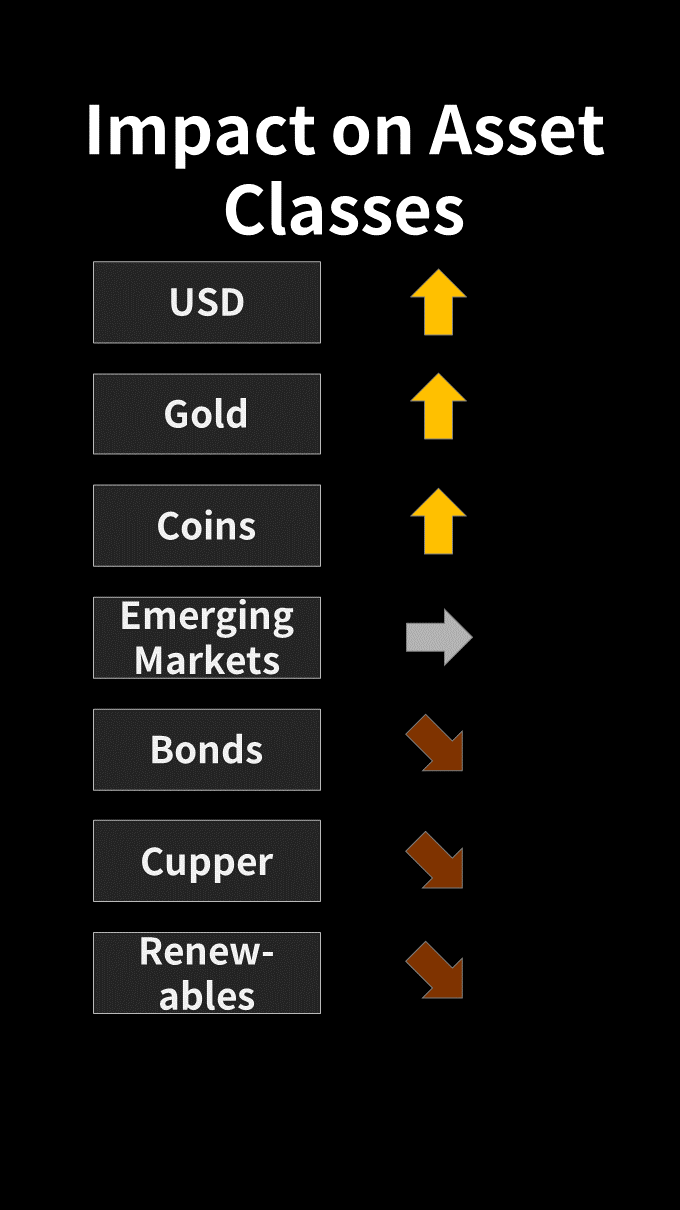

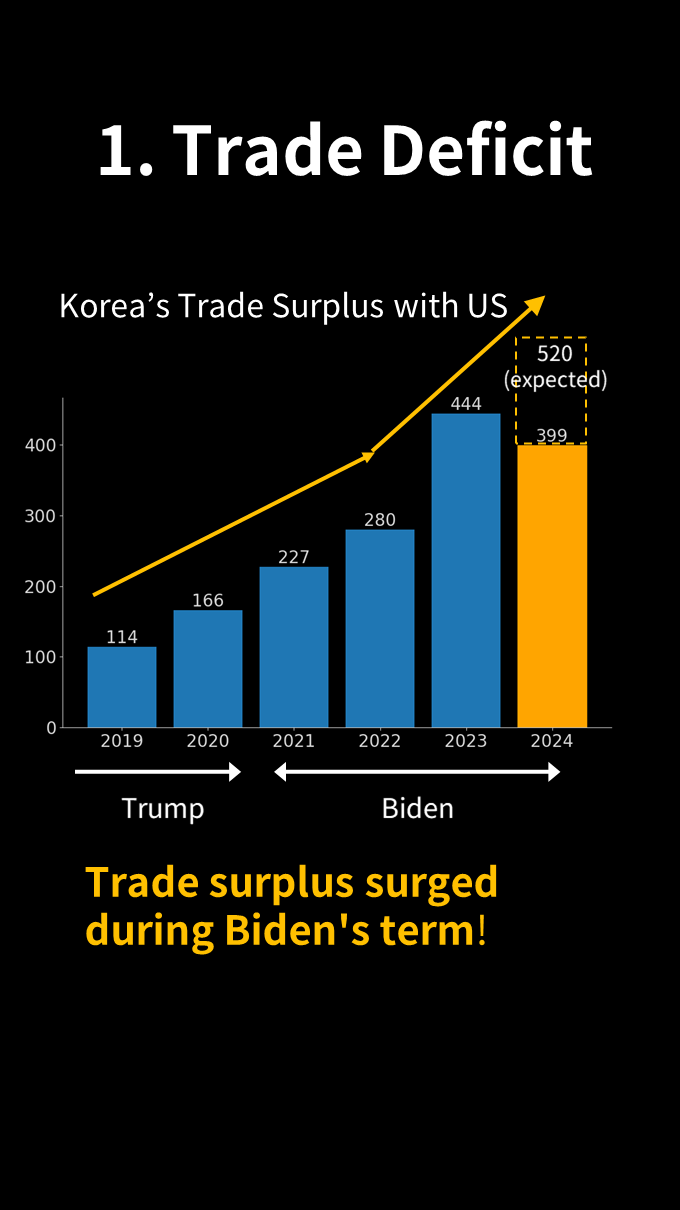

(p1) Today we will look at the impact of Trumps election on the stock market.

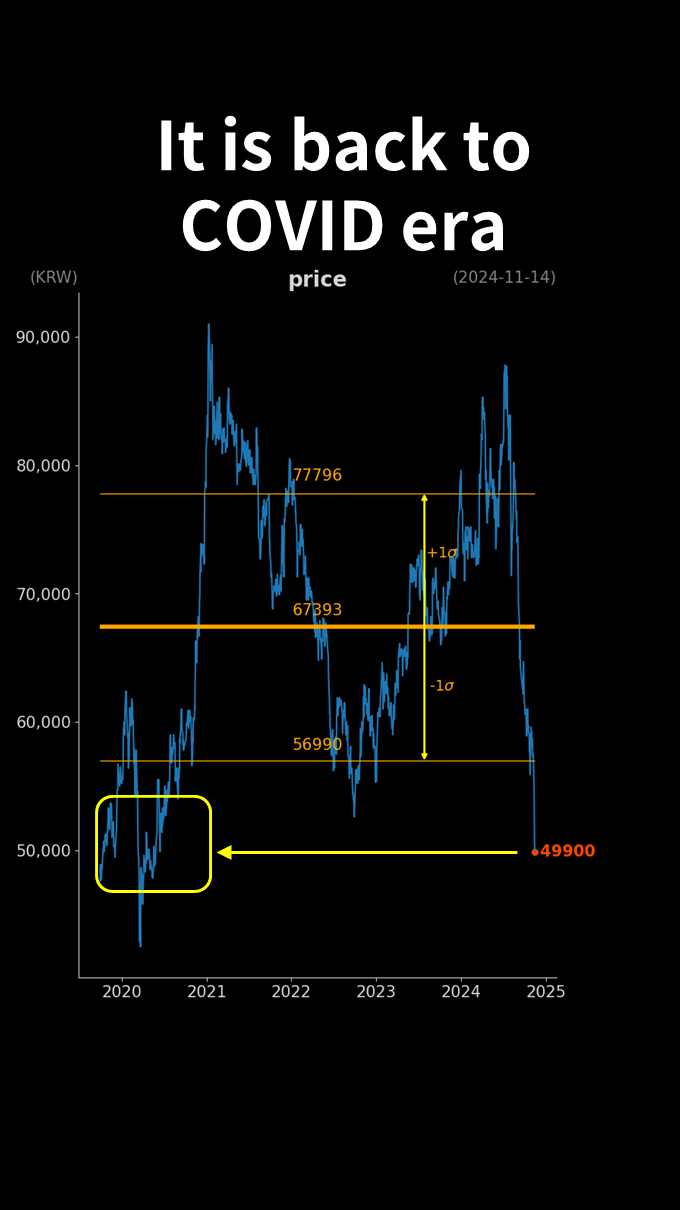

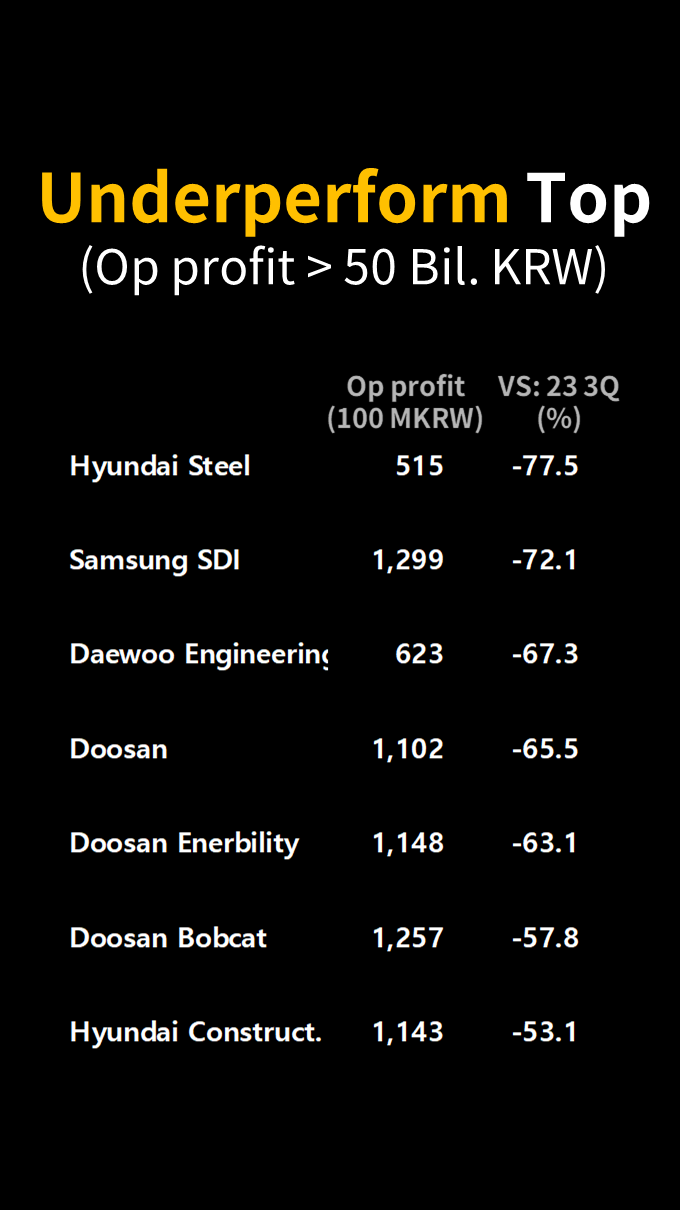

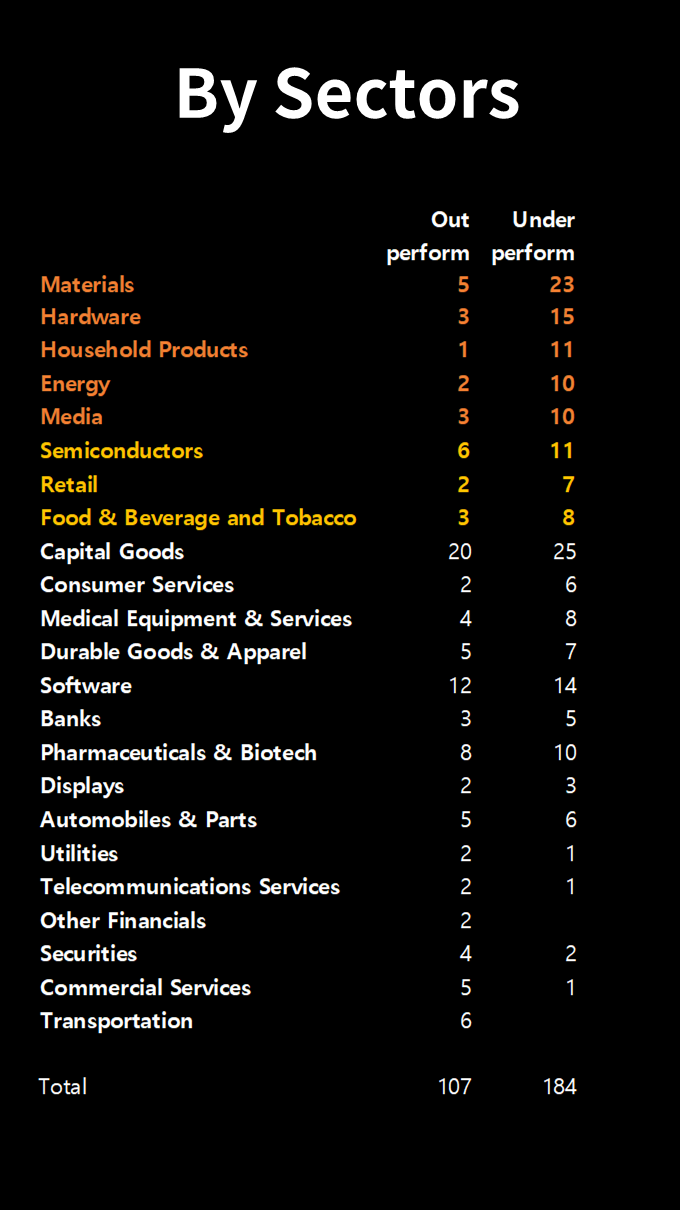

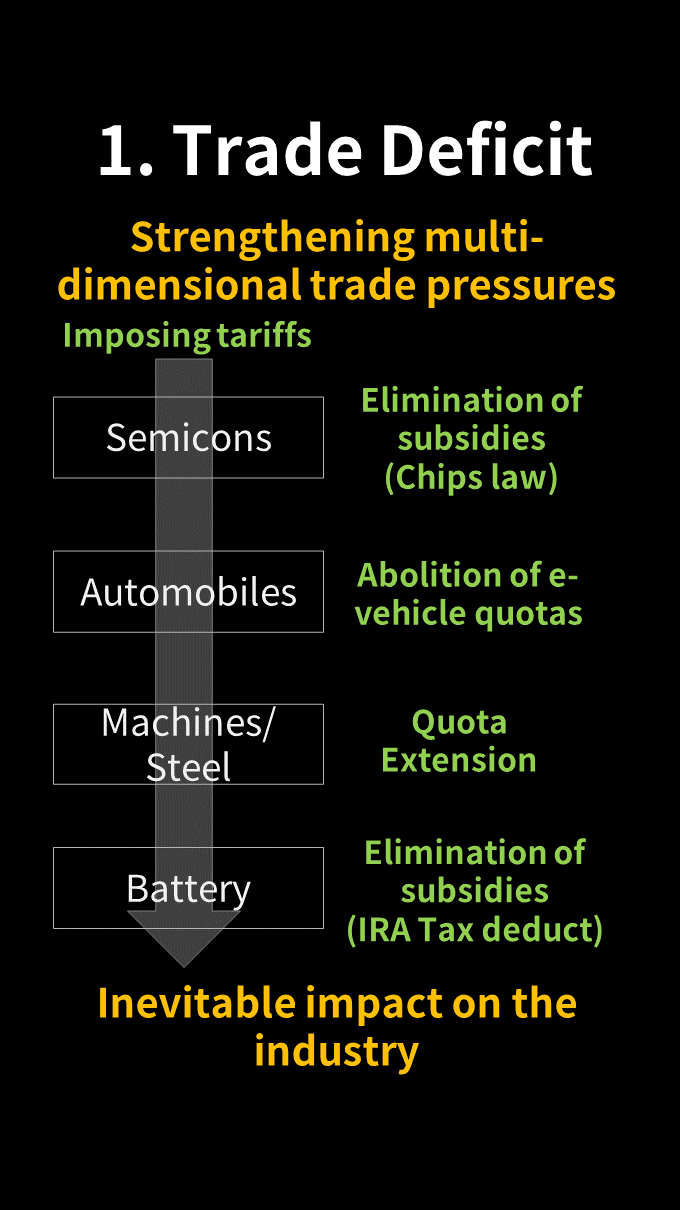

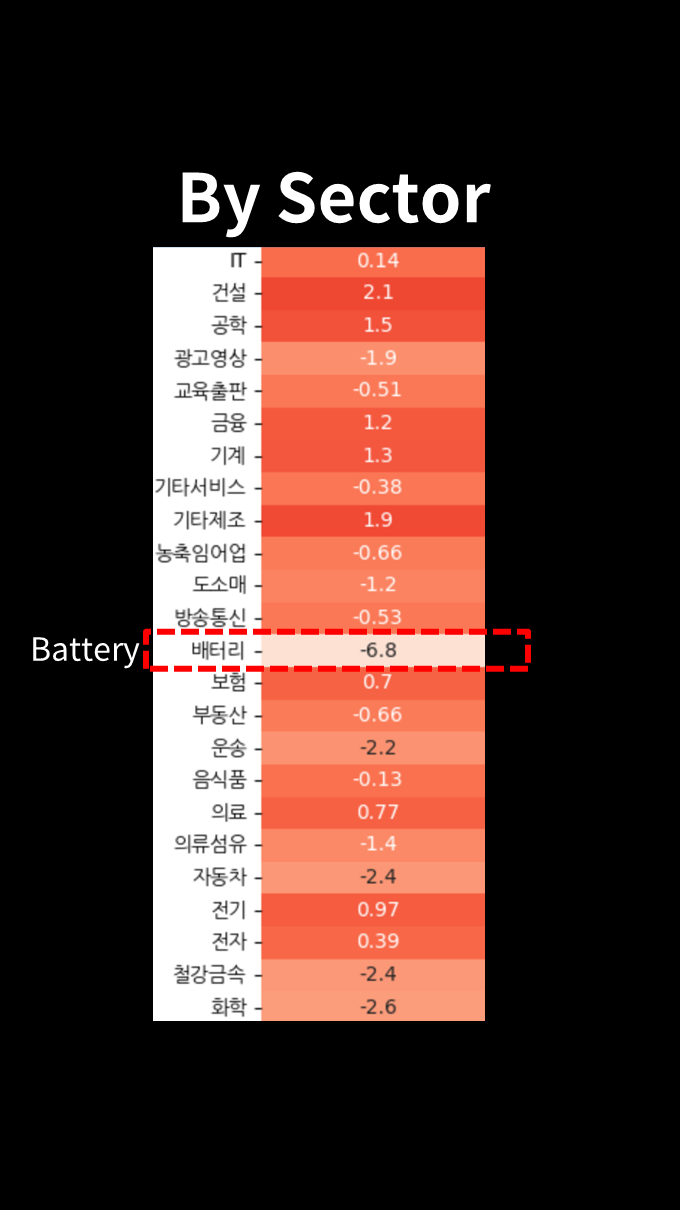

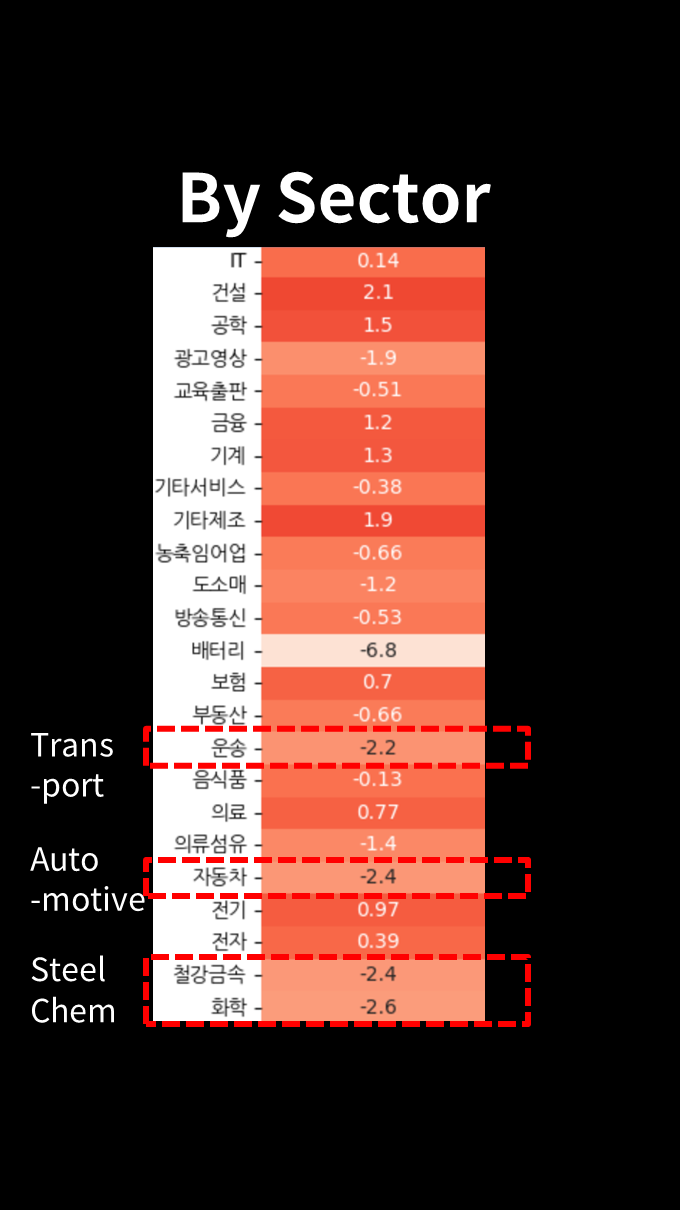

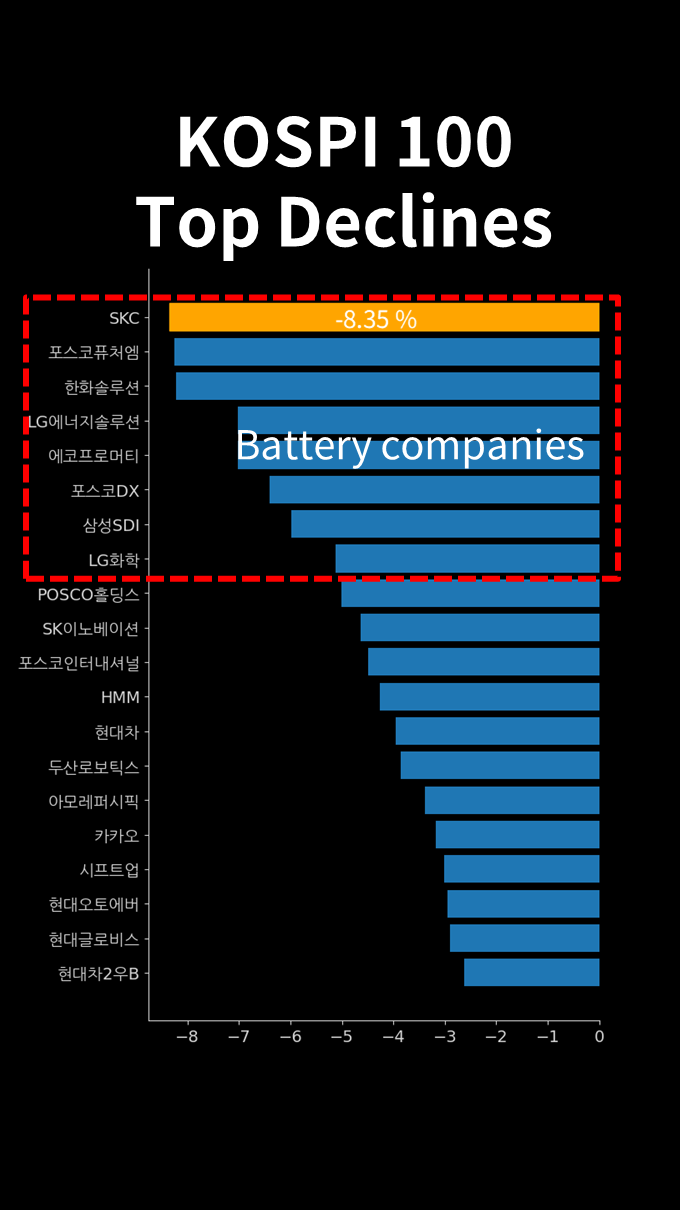

(p2) By sector, the battery sector has plummeted.

(p3) Additionally, transportation, automotive, steel, and chemicals have dropped significantly.

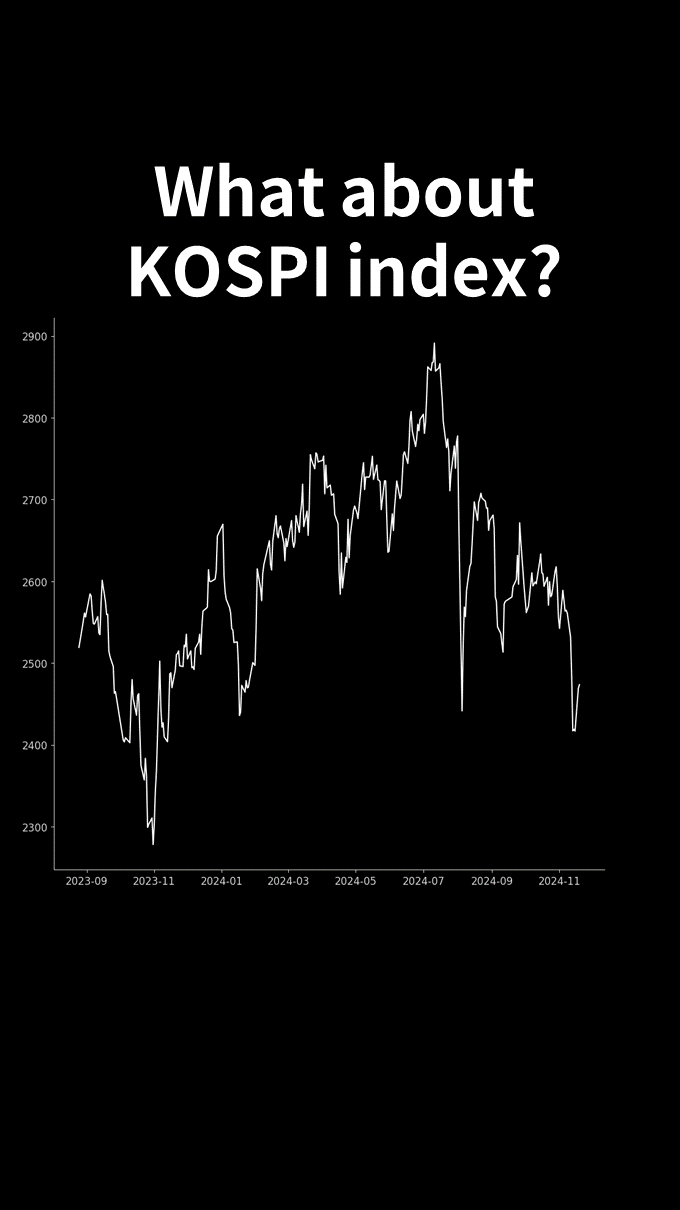

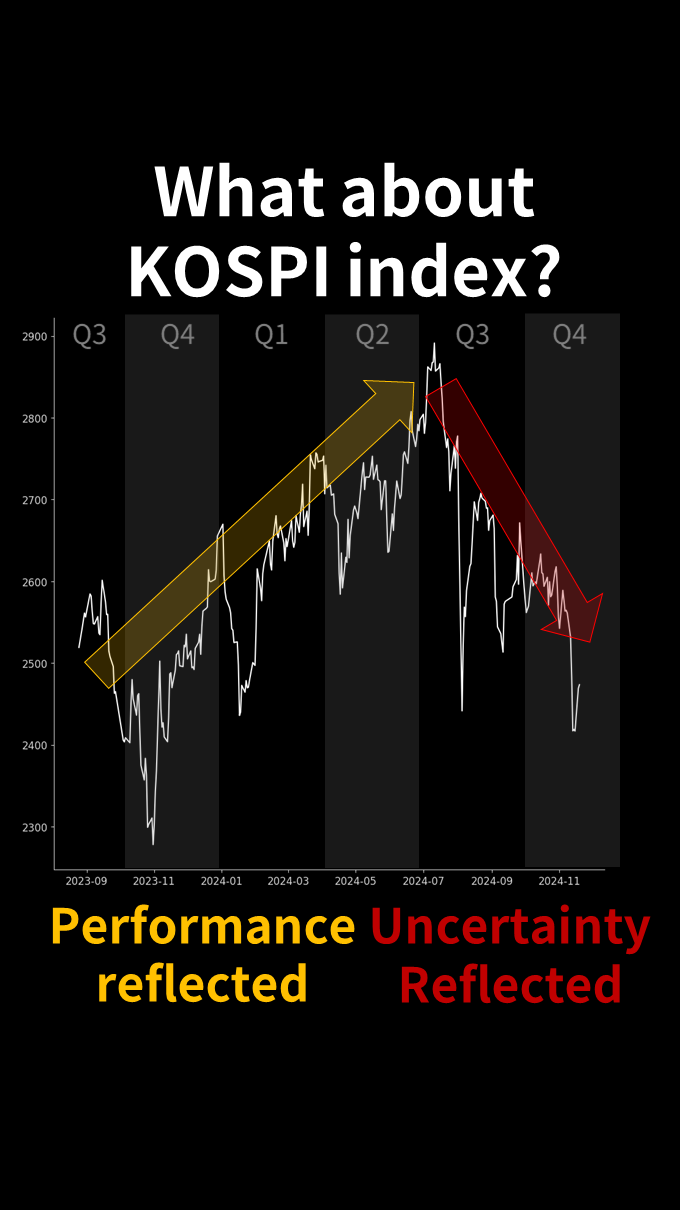

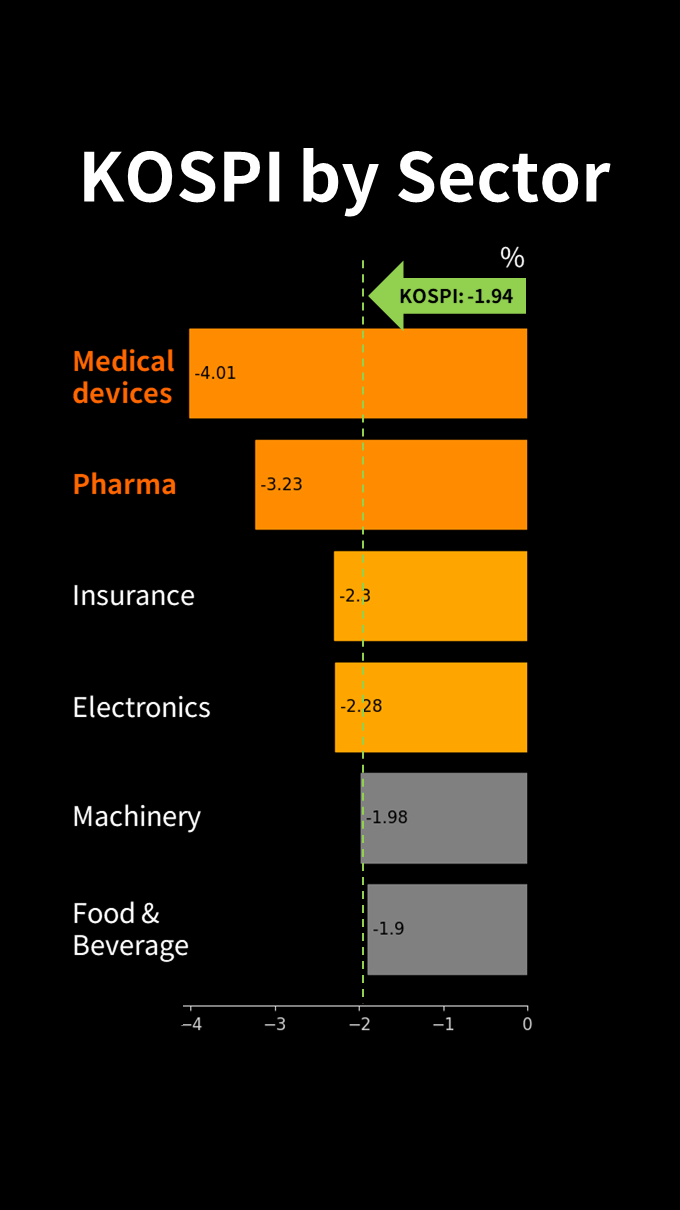

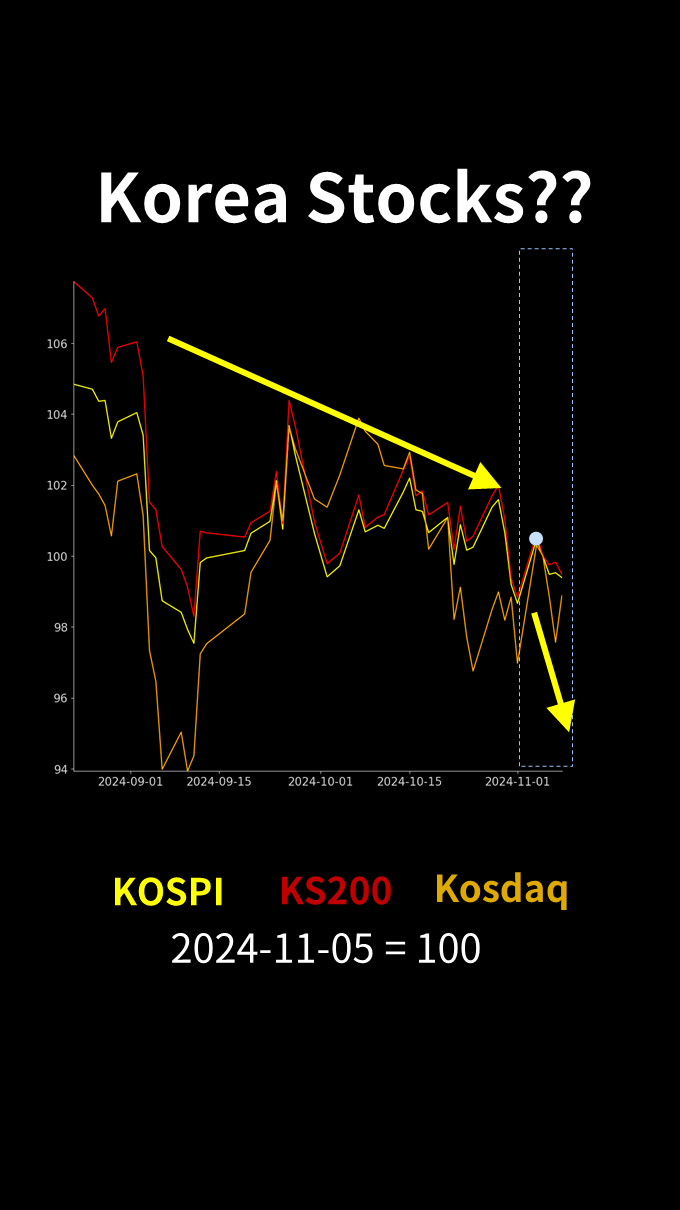

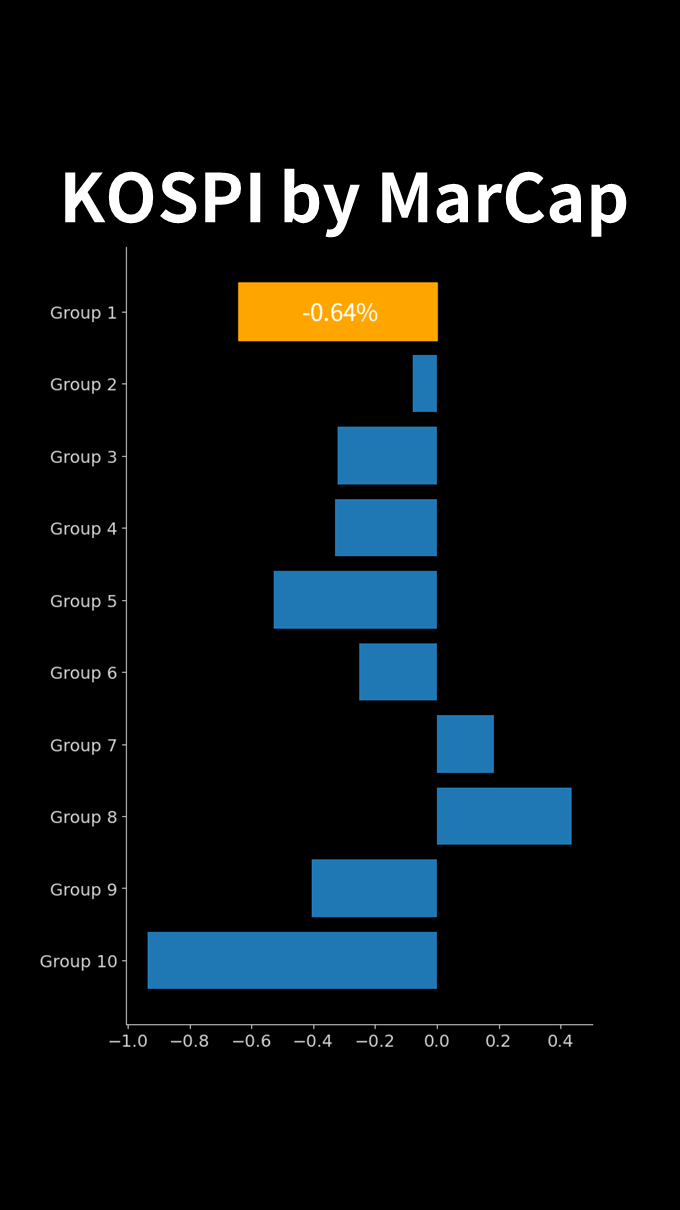

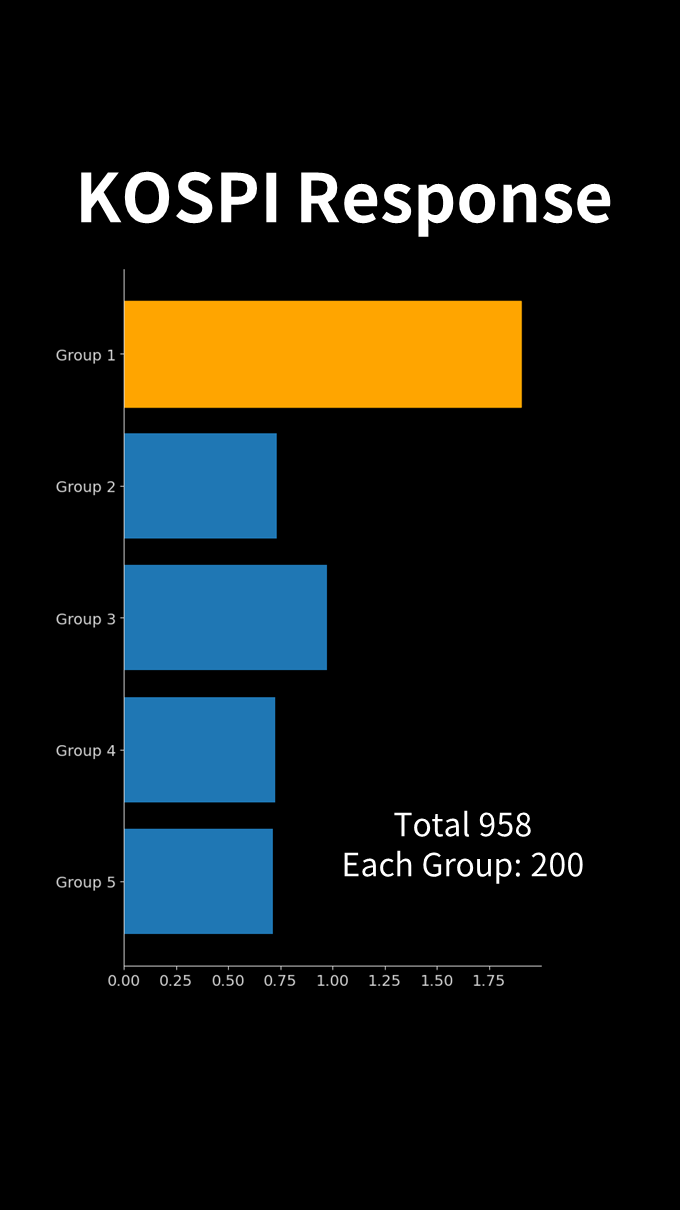

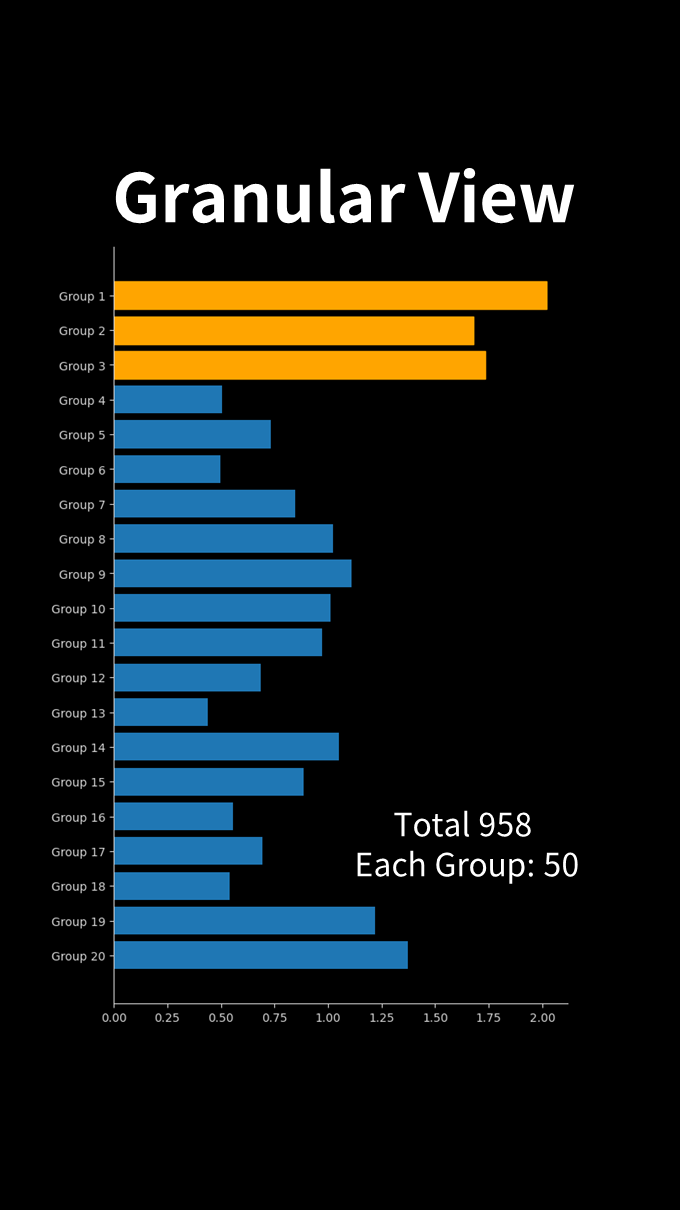

(p4) Looking at the KOSPI by market capitalization, most have declined, with the top 100 companies experiencing particularly large drops.

(p5) In terms of the rate of decline among the top 100, battery companies are prominently visible.

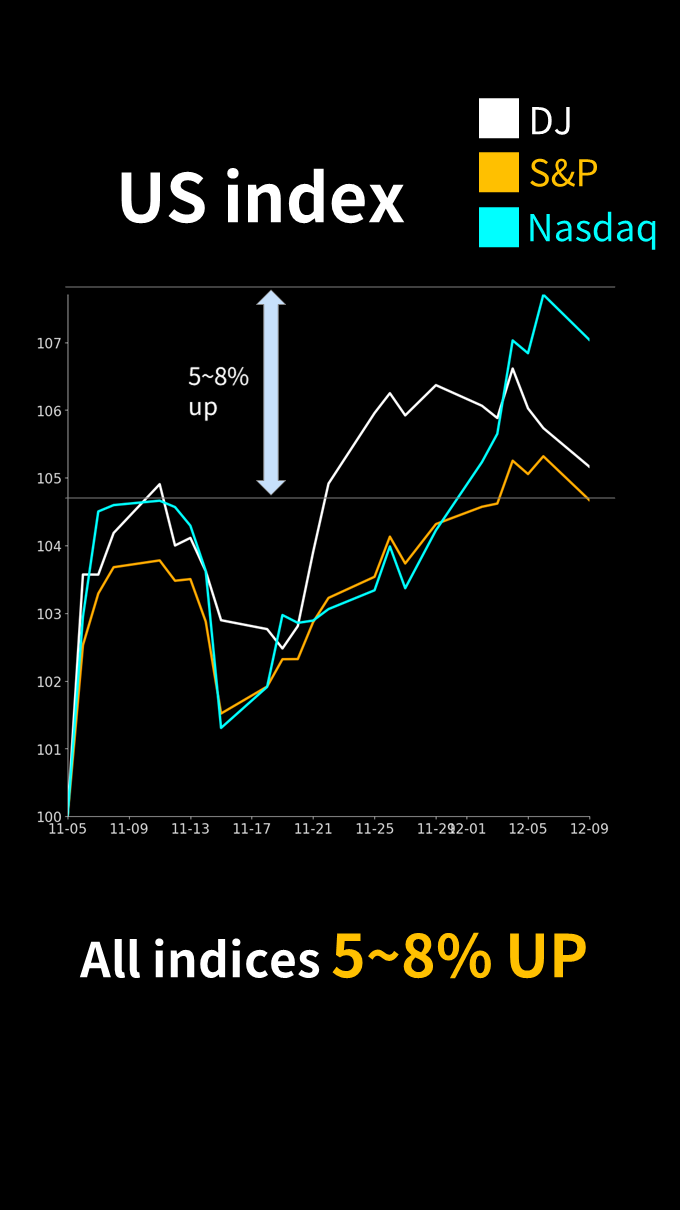

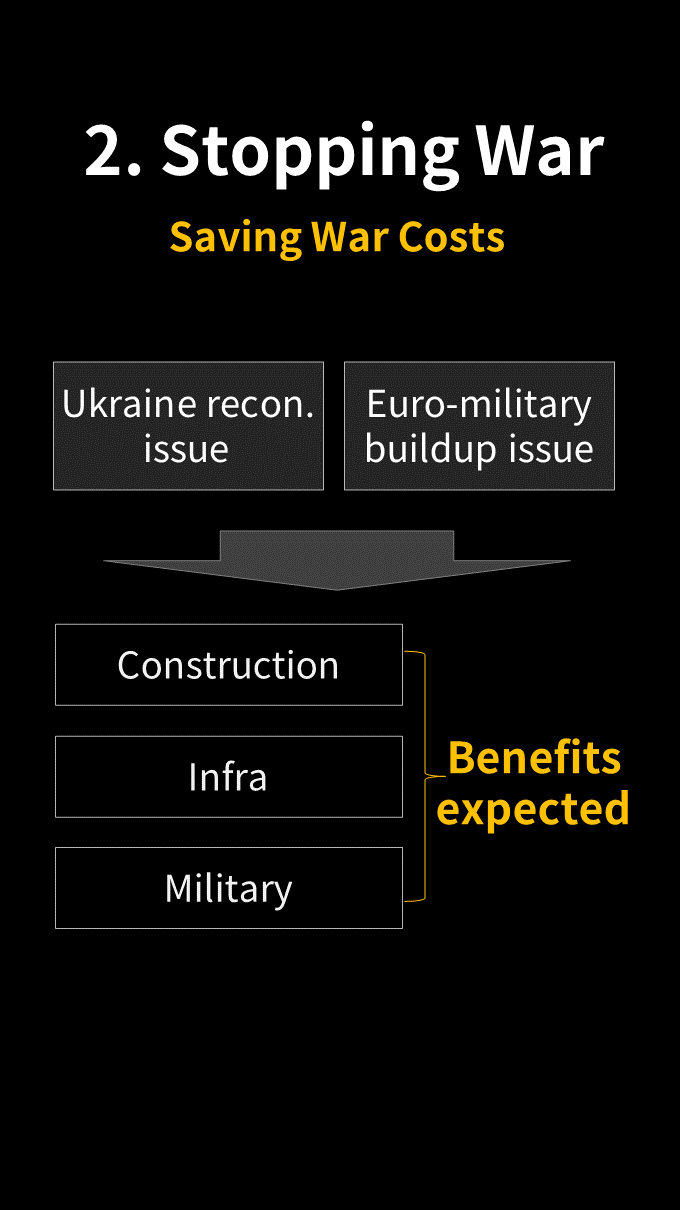

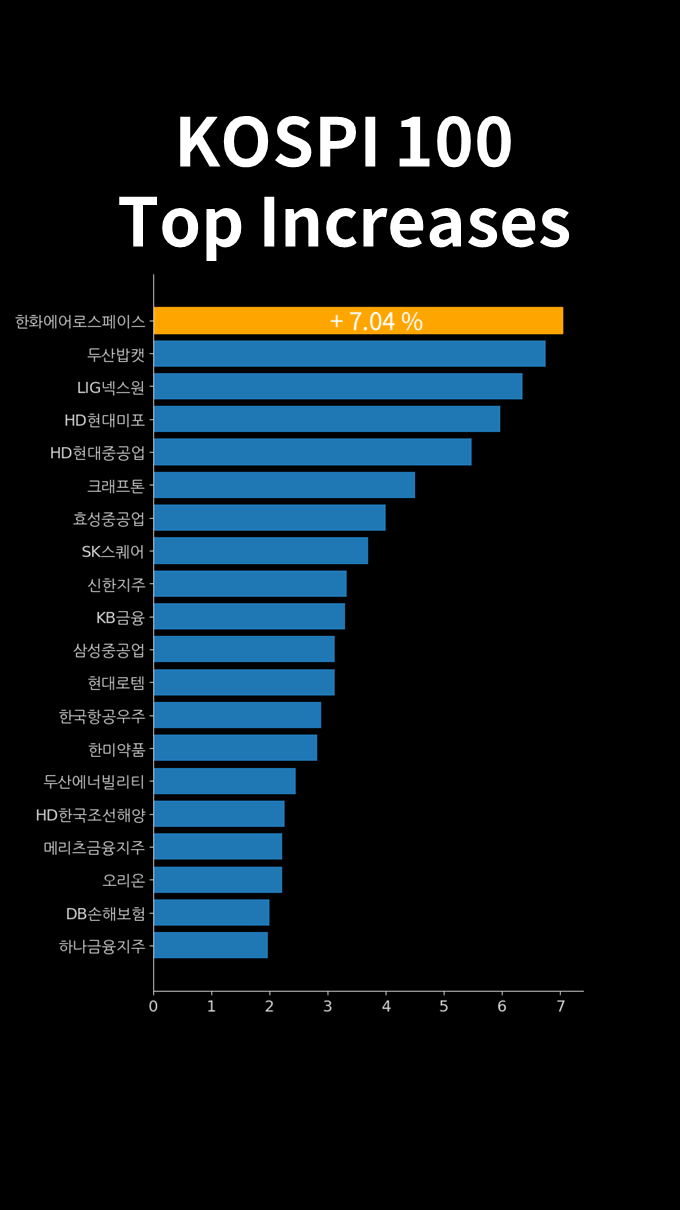

(p6) On the other hand, there were also sectors that saw quite a rise.

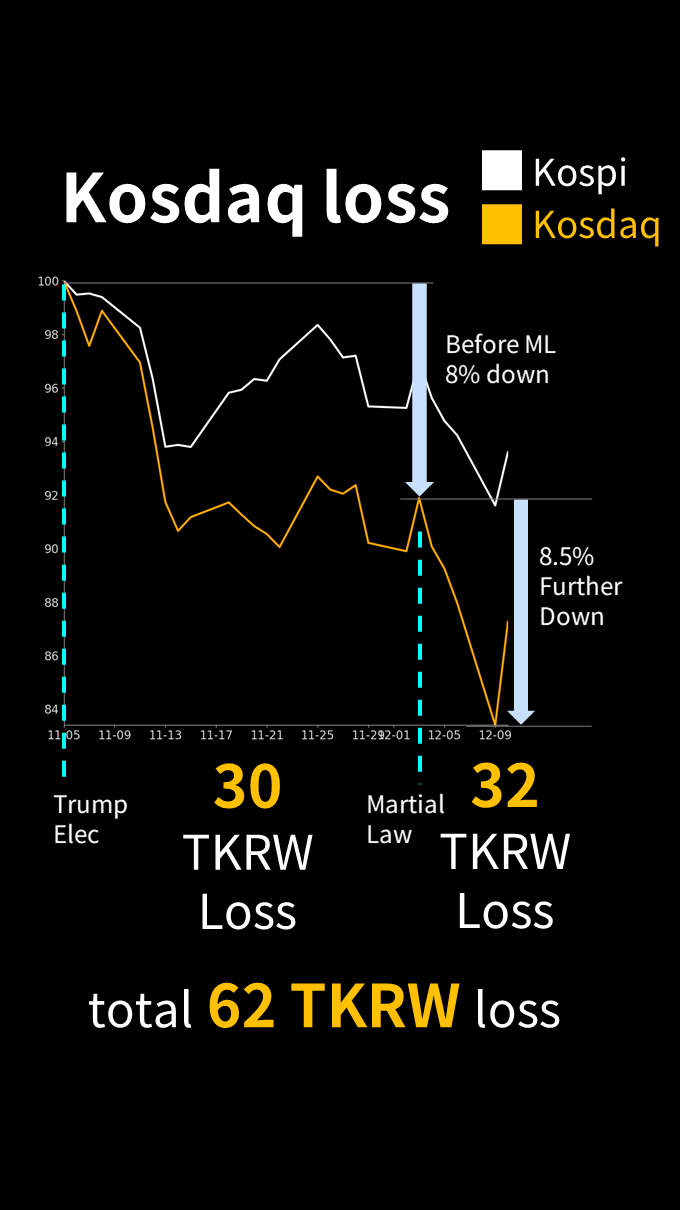

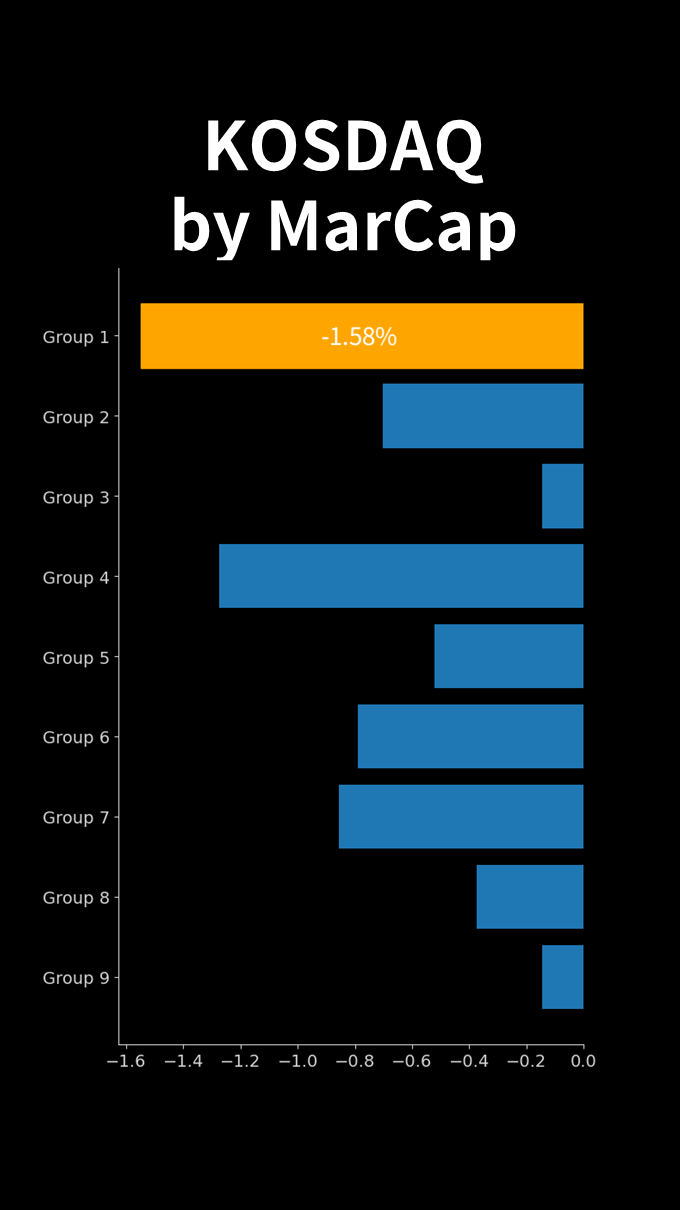

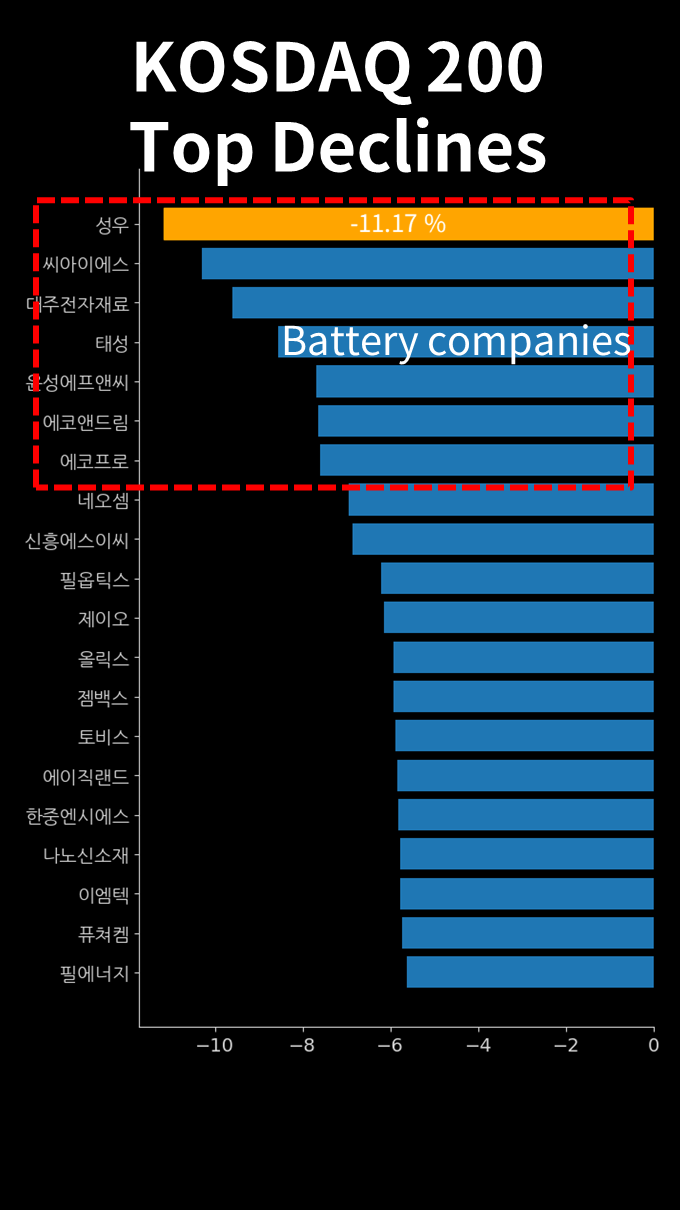

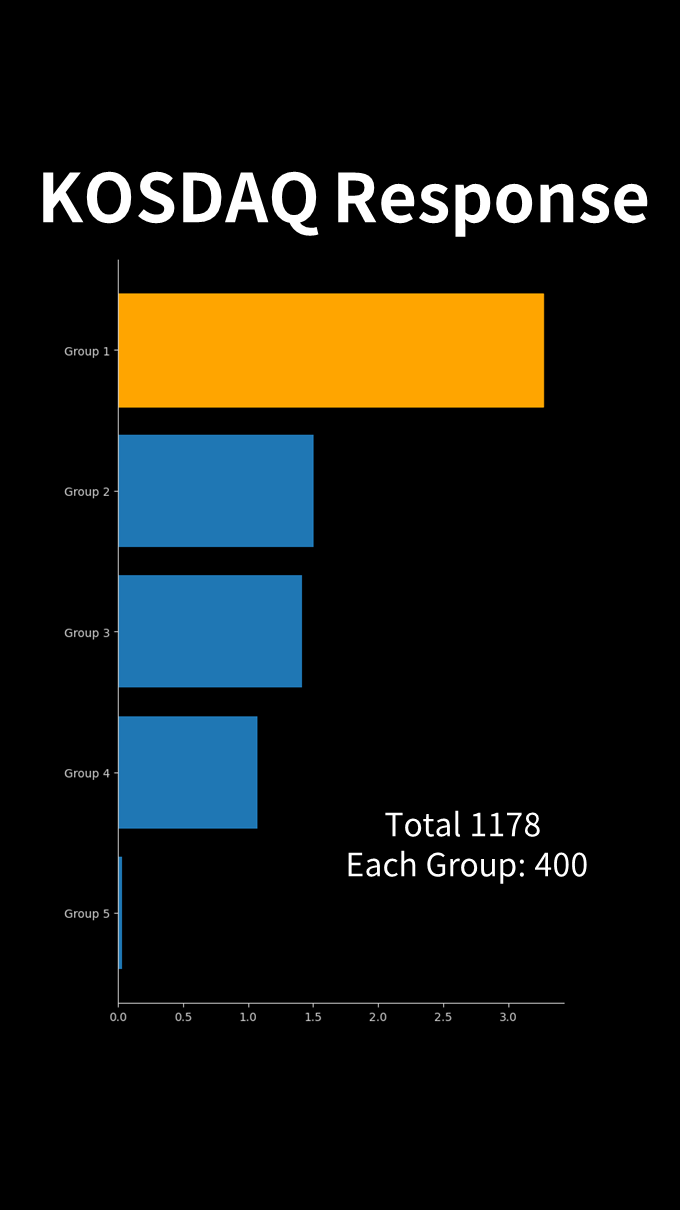

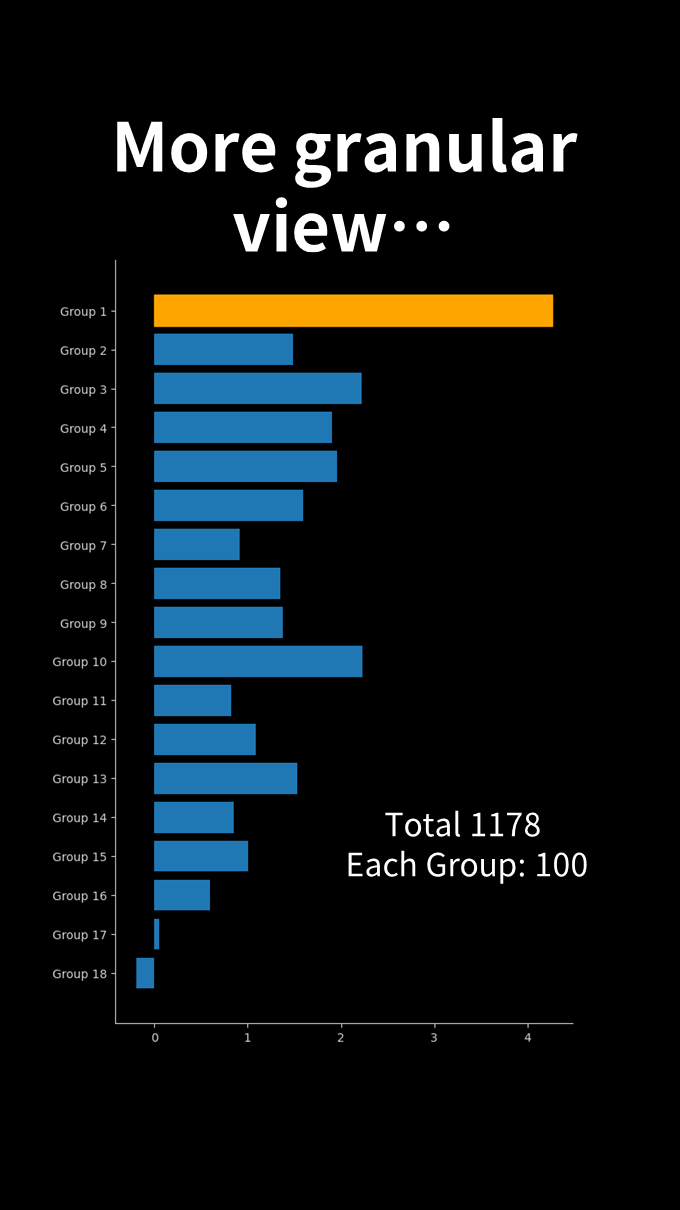

(p7) In the case of KOSDAQ, the top 200 experienced significant declines,

(p8) with all the top decliners being batteryrelated companies. Its a crash.

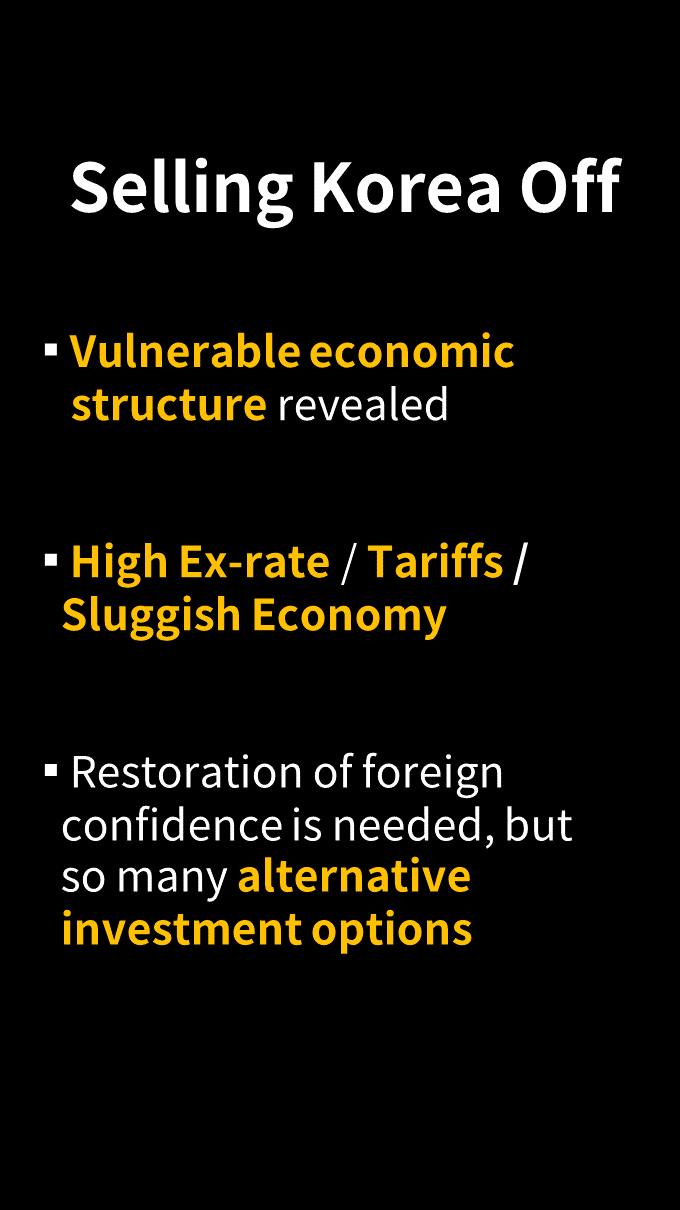

(p9) Around 1230 PM, when Trumps election started to look likely, the trend changed rapidly. The battery or secondary battery sectors have been particularly hard hit, and it would be good to monitor the trends moving forward. Thank you.

Youtube Link - Issue Tracker