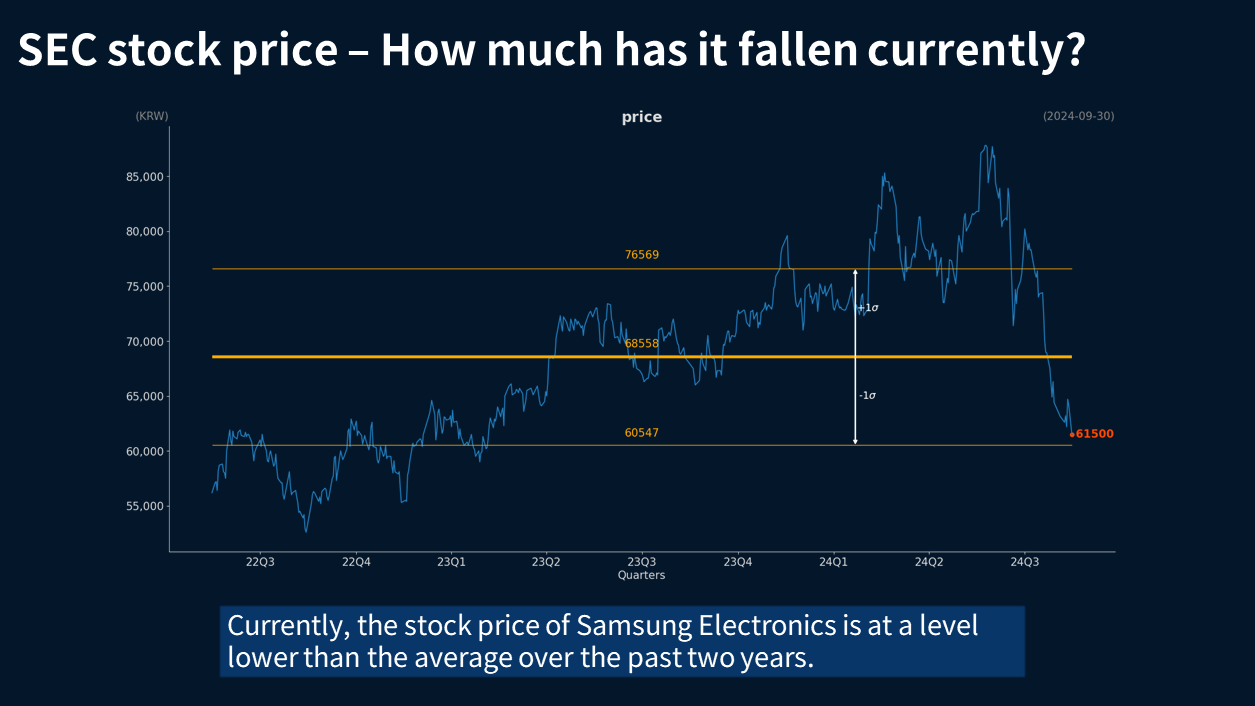

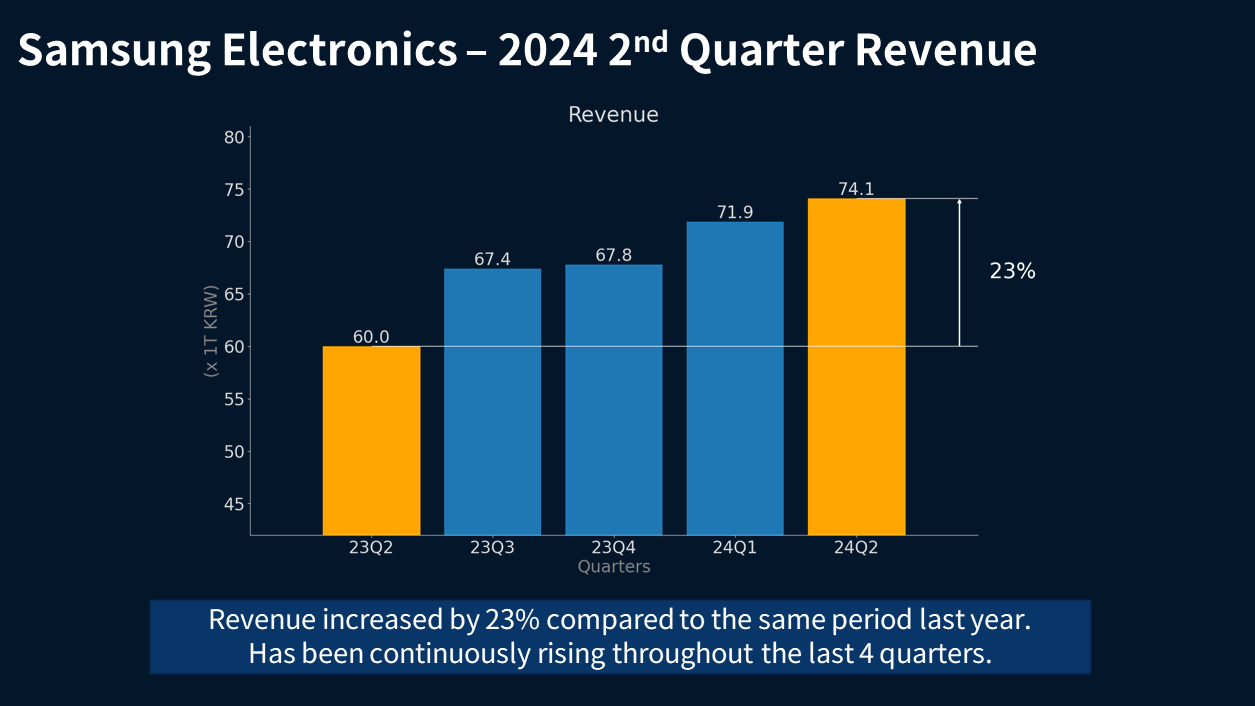

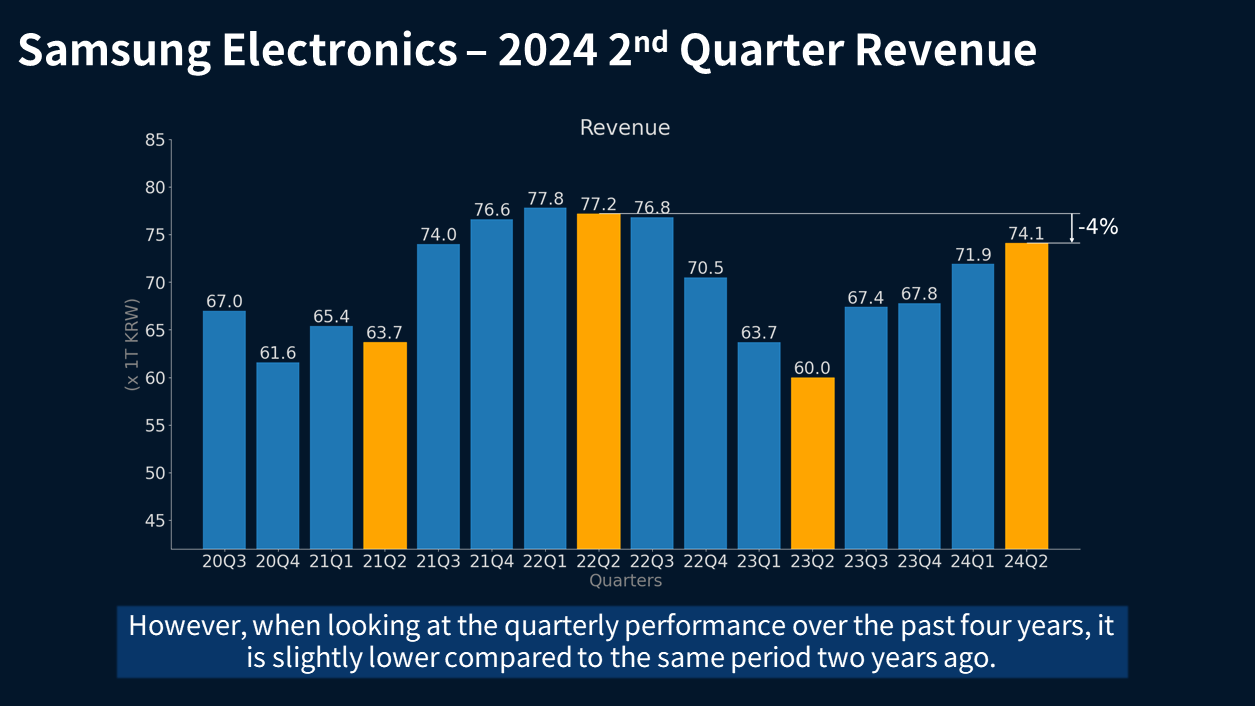

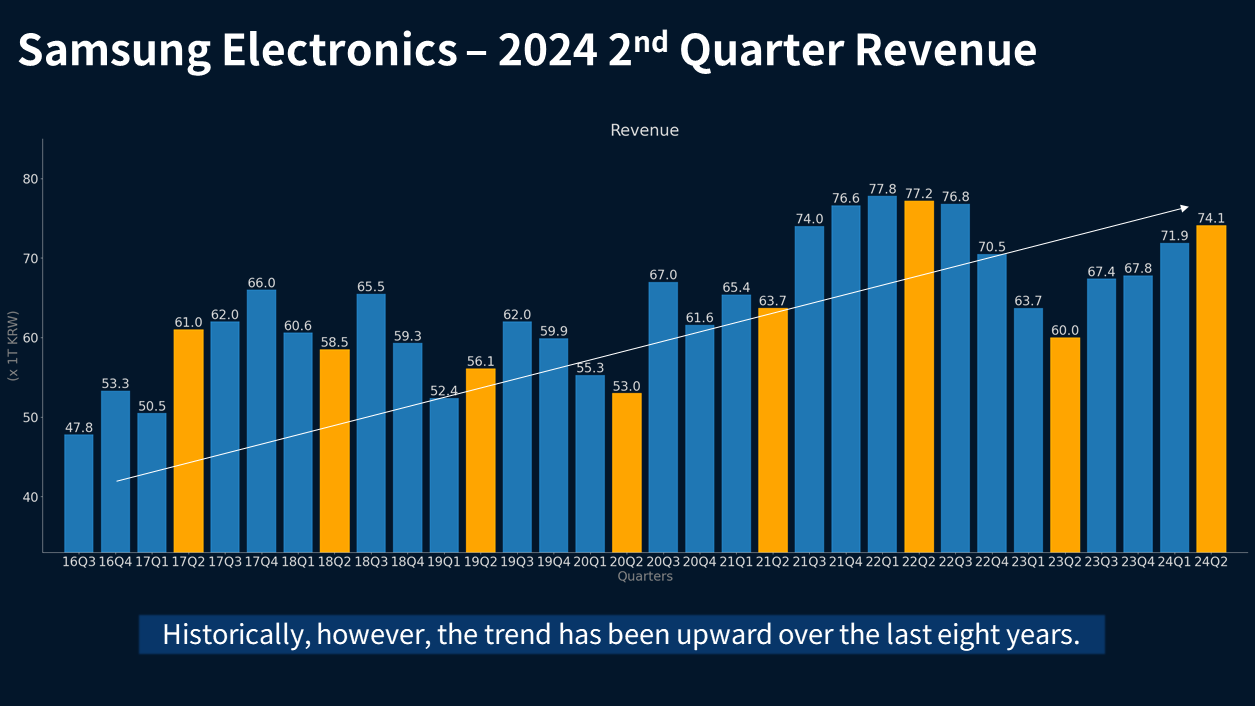

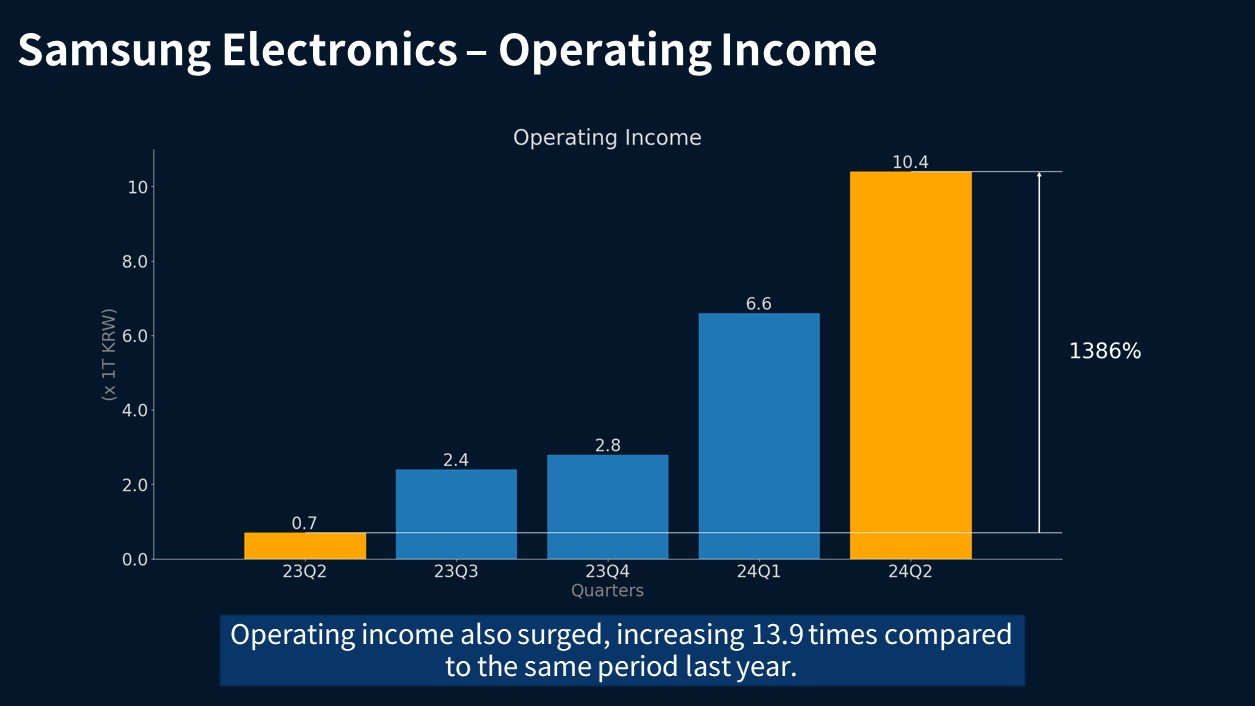

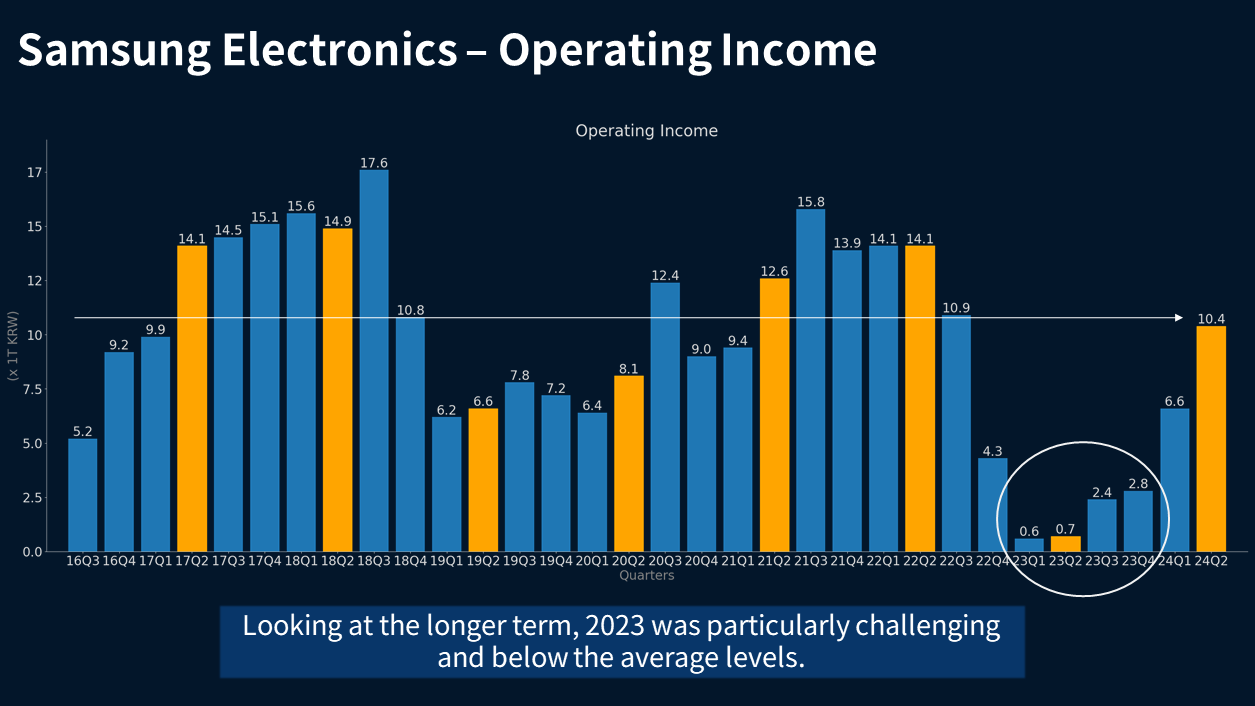

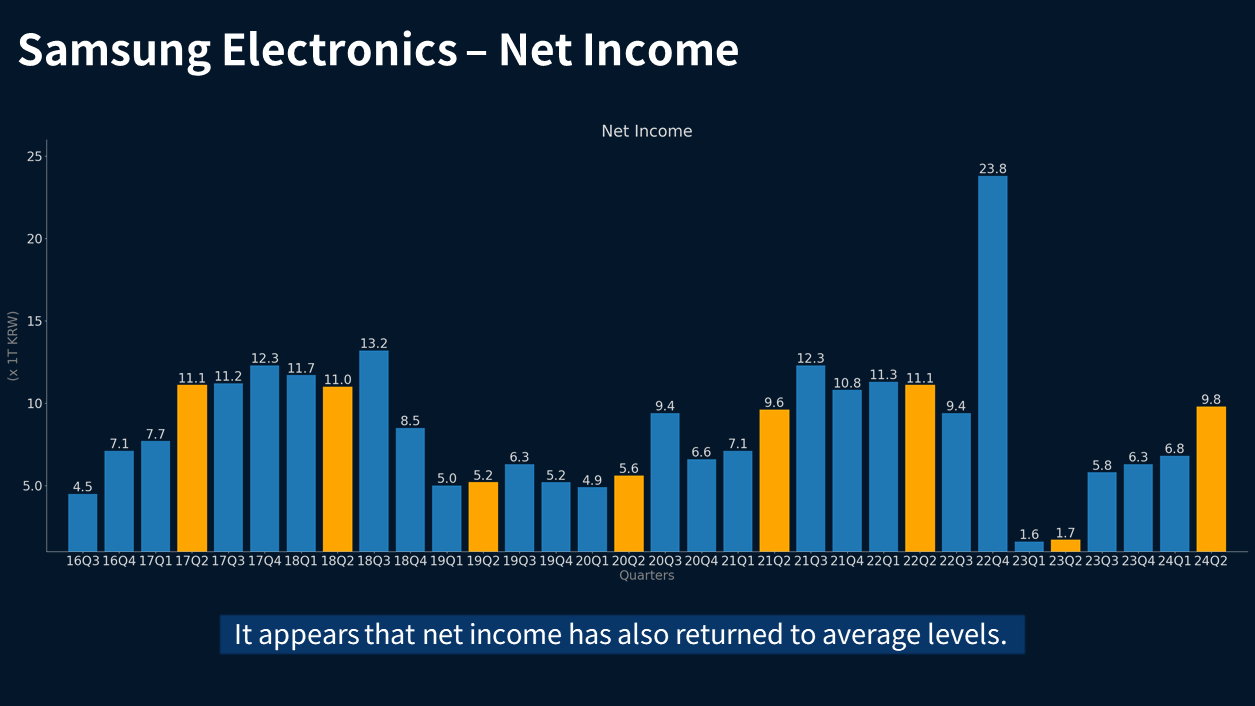

[2/3] Join us as we analyze Samsung Electronics' performance for Q2 2024. We explore revenue growth, stock price trends, and the factors impacting Samsung's valuation. Discover what this means for future investments!

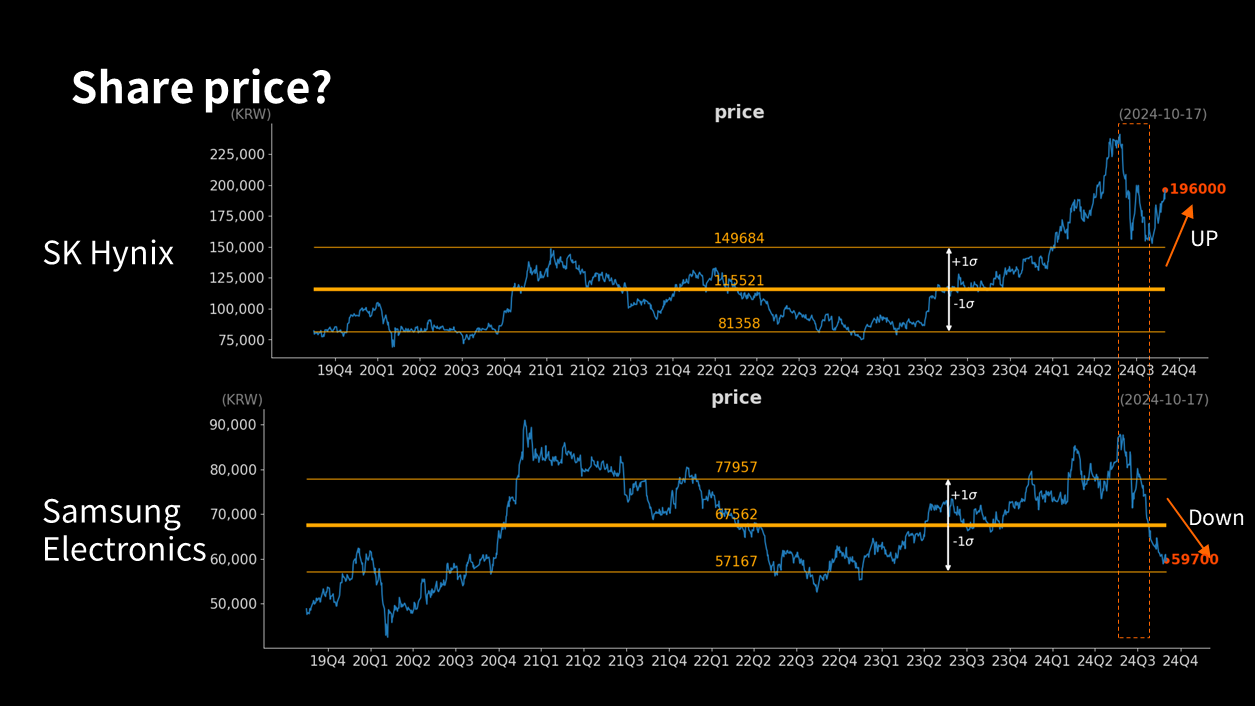

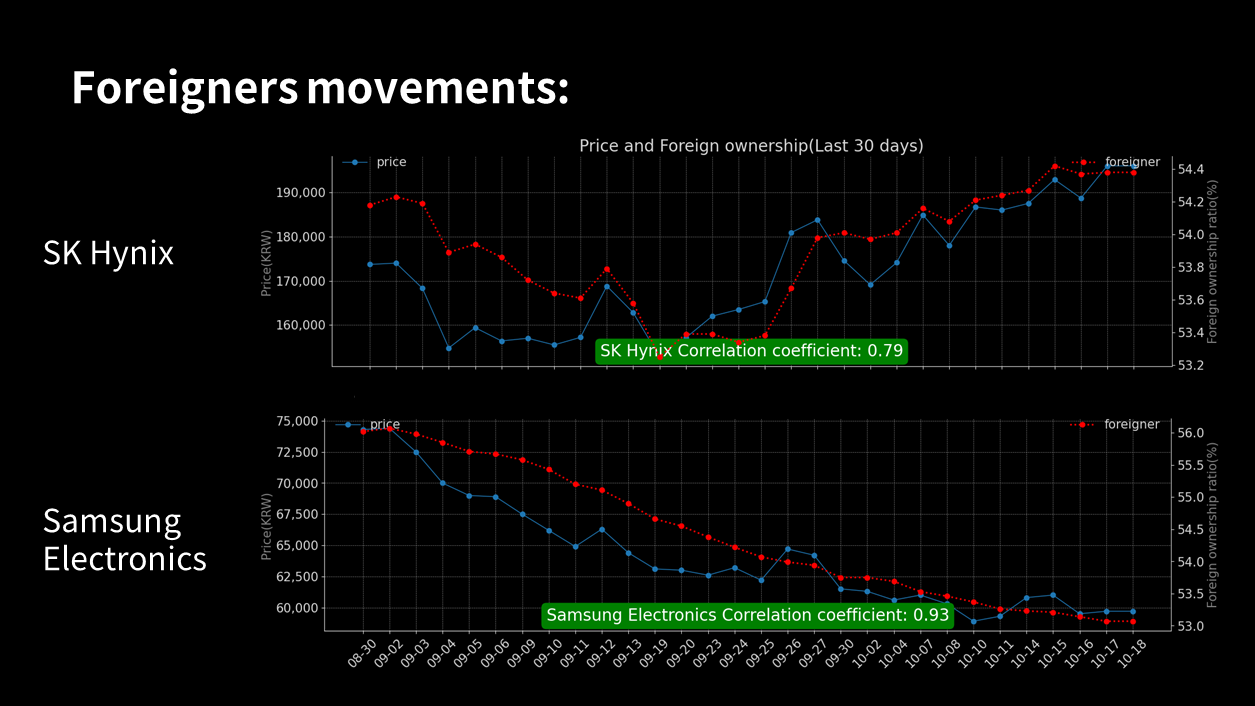

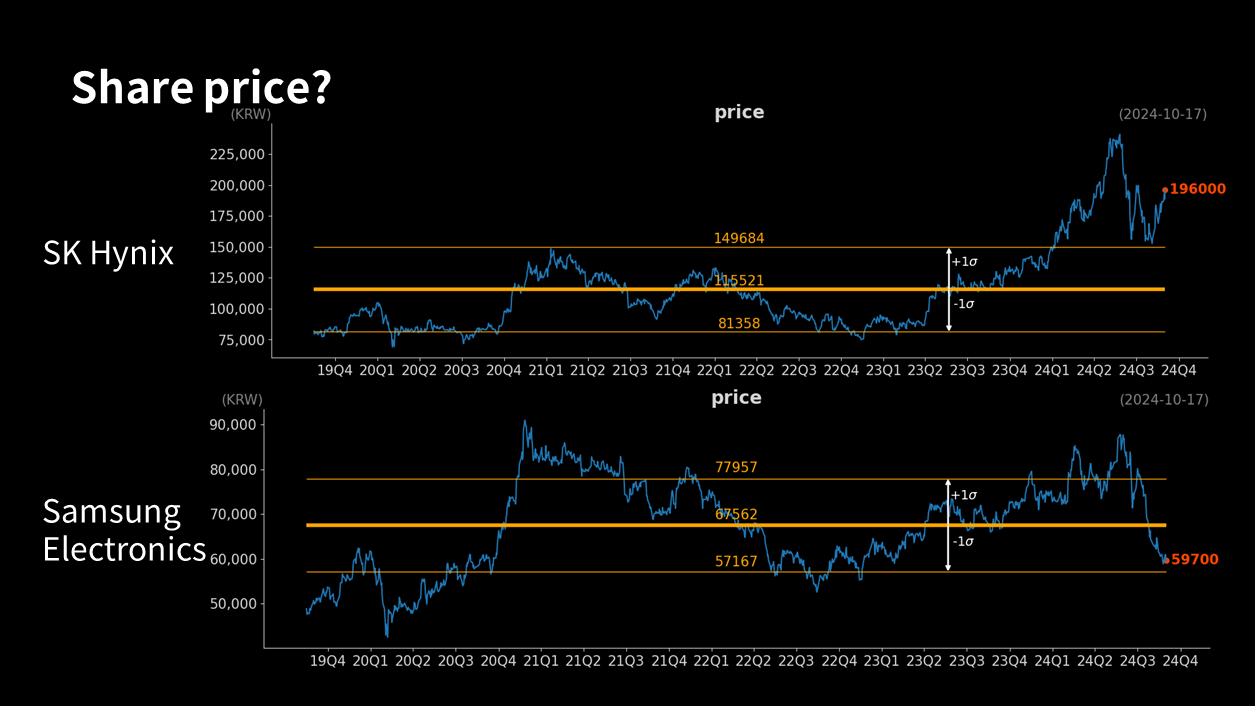

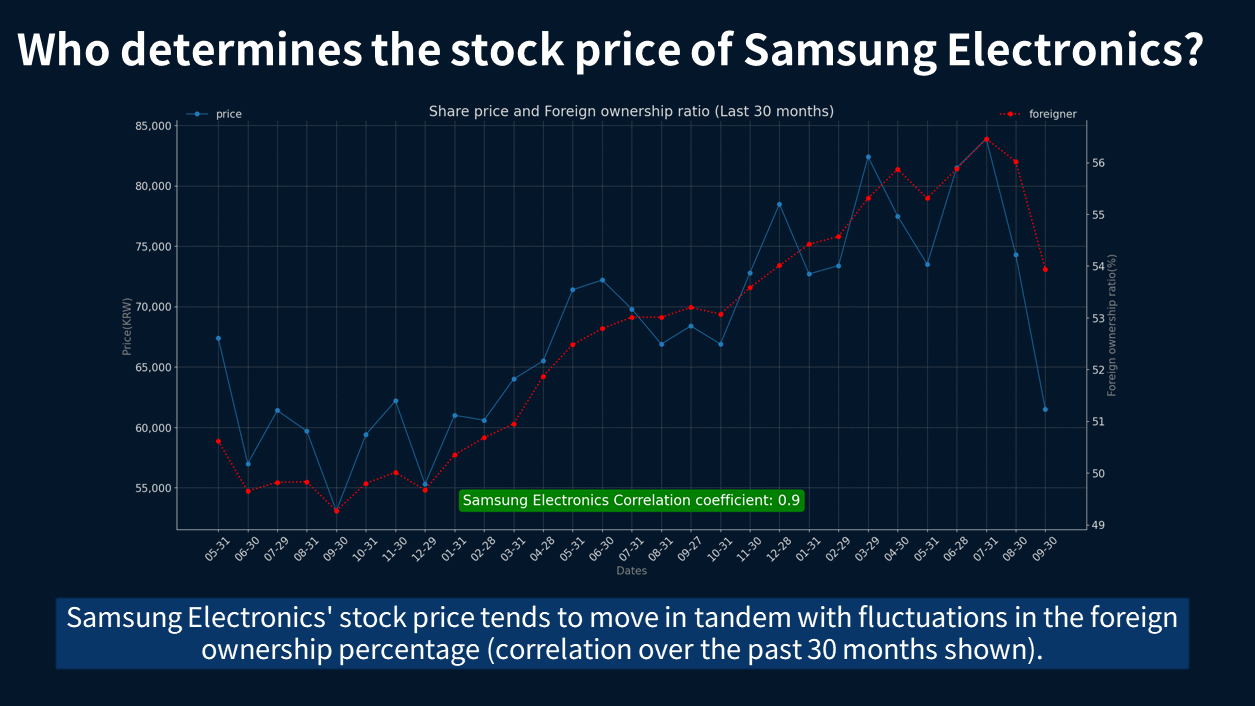

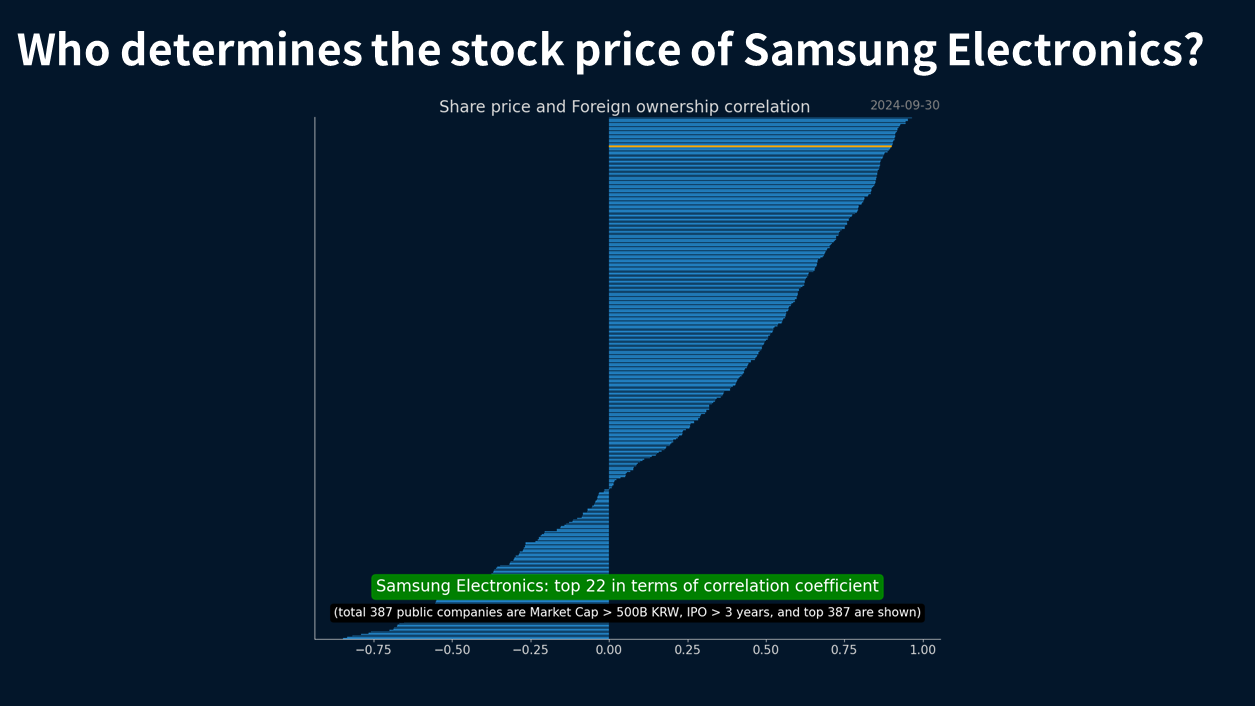

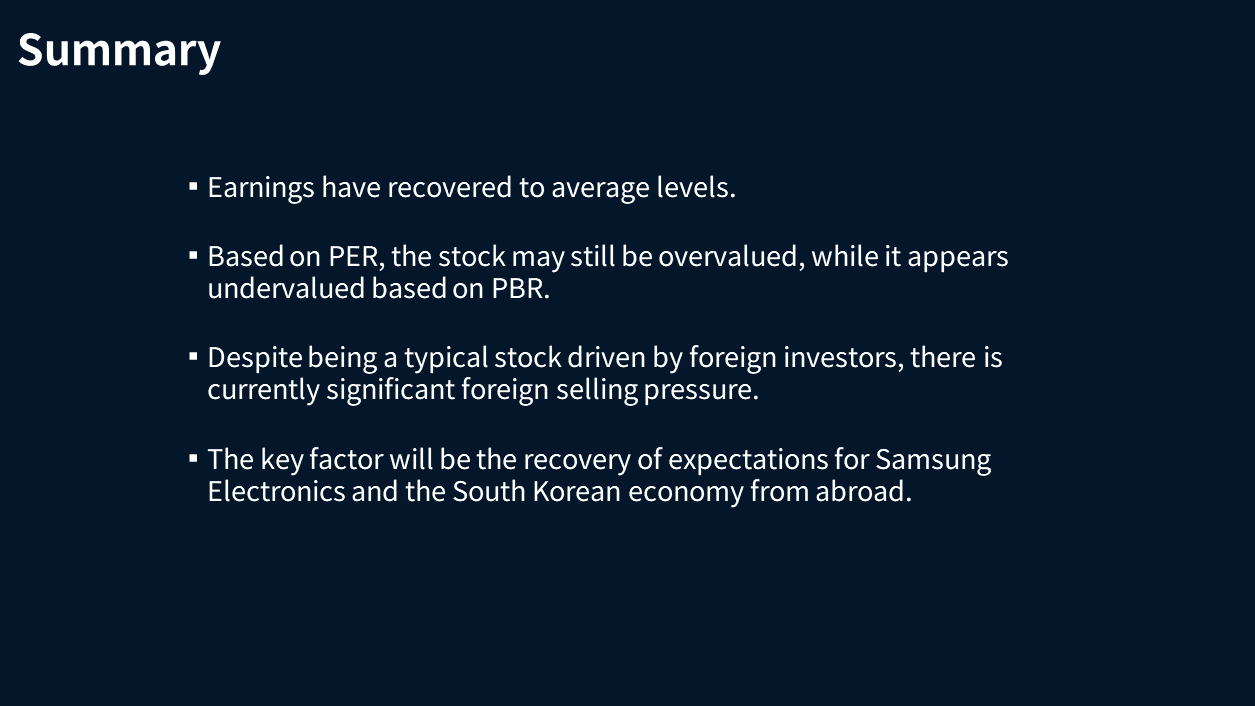

(p11) Lets examine the stock price in relation to performance. I calculated the average quarterly stock price over the past two years, and we can see that it has consistently risen until the previous quarter. This seems to be an unusual phenomenon, especially considering that the performance in 2023 was quite poor. There was a notable divergence between performance and stock price while performance declined, the stock price increased. Of course, performance is not the sole factor influencing stock prices, but we can say that the movements were contrary to expectations based on performance.

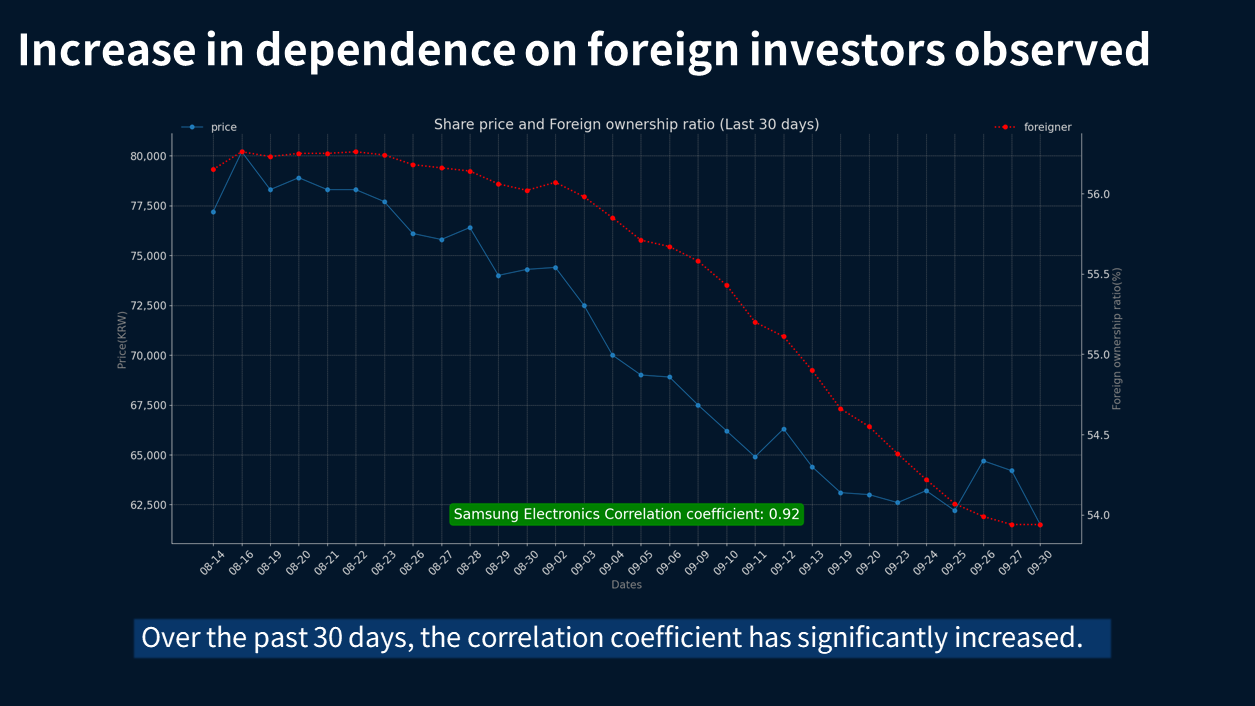

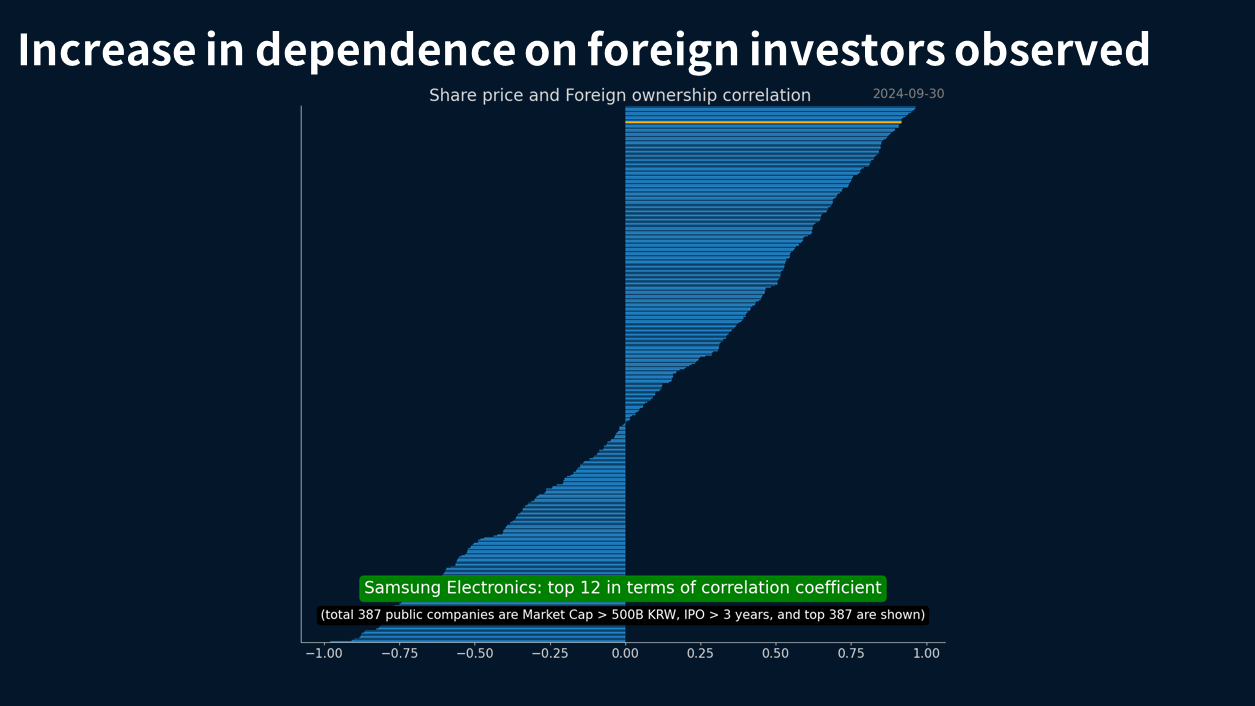

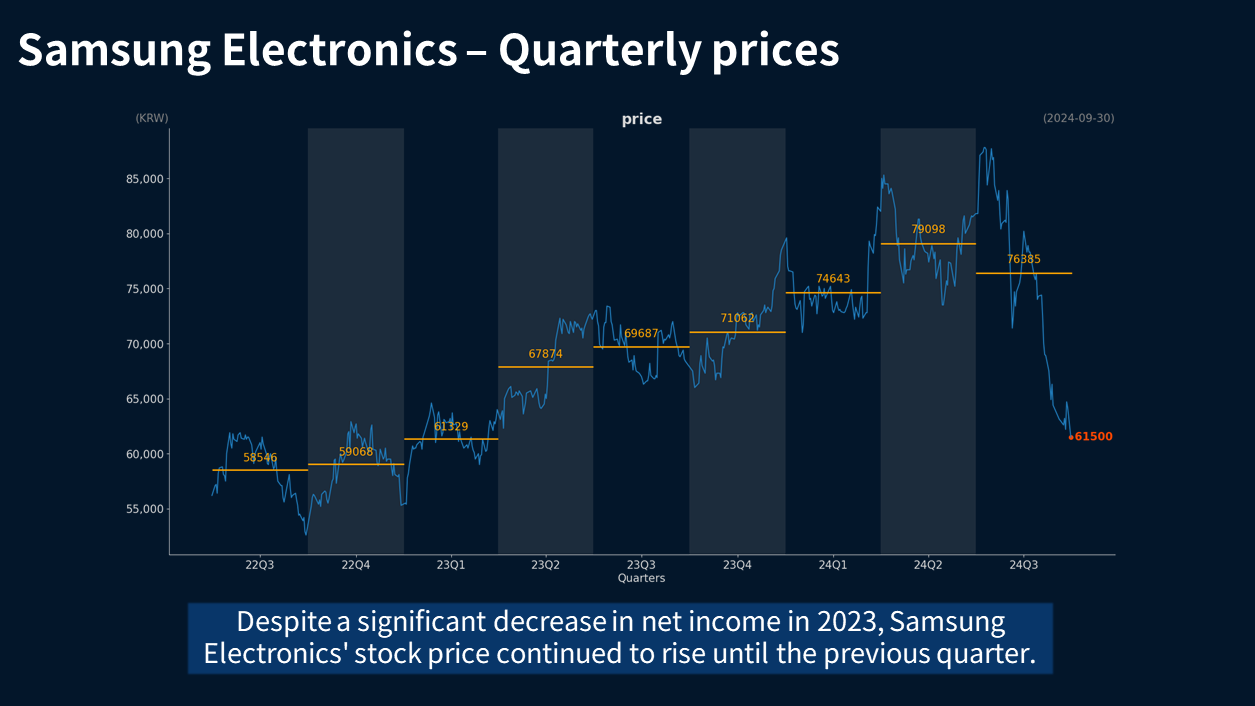

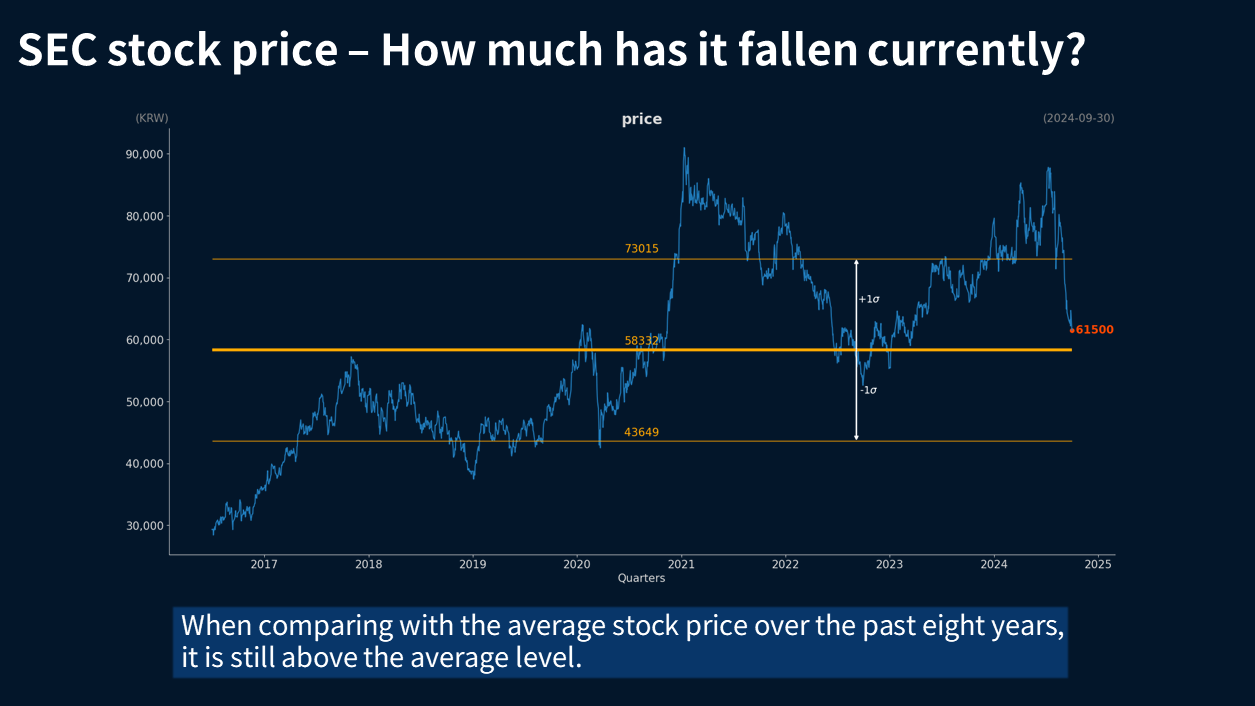

(p12) As of the end of September, we will examine how much Samsung Electronics stock price has fallen. The average stock price over the past two years is 68,600 KRW, and it is currently at a lower level than this.

(p13) Compared to the average stock price over the past eight years, current prices are still higher, but they are approaching that average rapidly. I briefly compared them with the average stock price, and after examining recent stock decline issues, I will also discuss the fair value of Samsung Electronics.

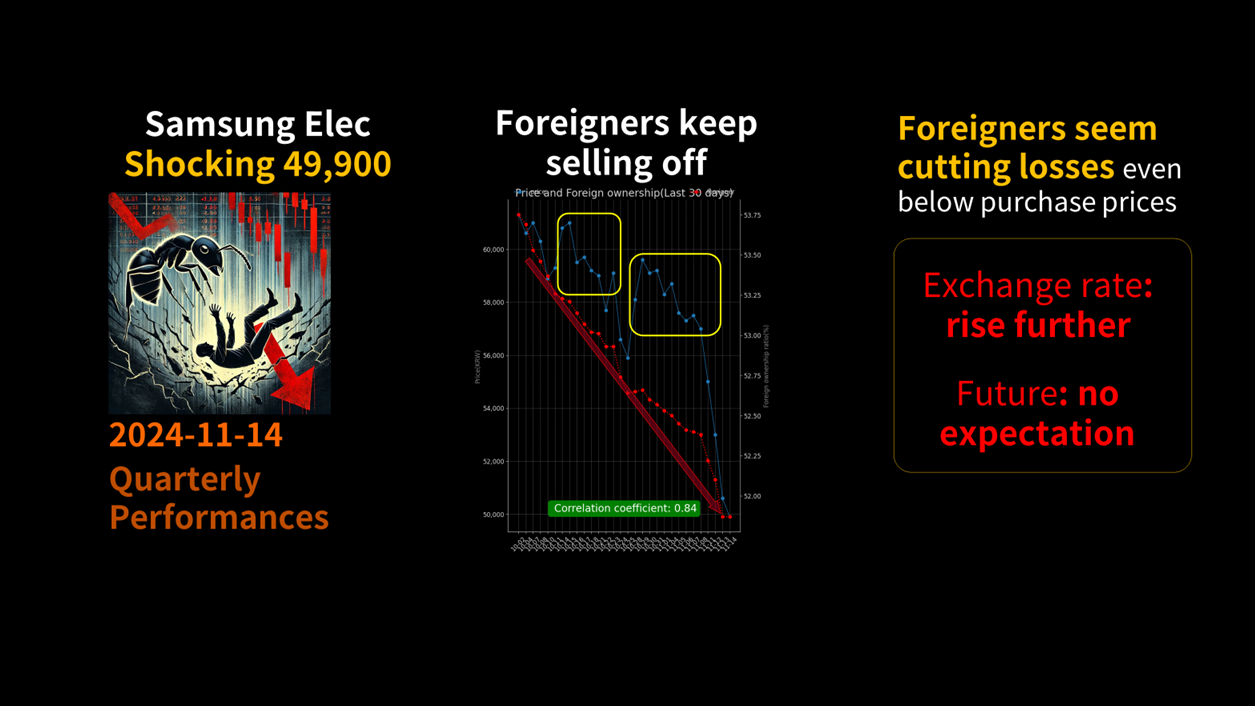

(p14) The reasons for the recent decline in Samsung Electronics, in my view, are as follows. First, there are worries that there may already be an oversupply of HBM in the memory semiconductor sector, which has been widely reported in the media. Second, there are concerns that the U.S. export restrictions on China could negatively affect Samsungs relationships with its Chinese customers. Third, there are fears that the economic recession will lead to a general decline in performance across Samsungs nonsemiconductor divisions. Fourth, there are apprehensions regarding the lack of longterm competitiveness in the semiconductor sector. Lastly, unlike during the tenure of former Chairman Lee KunHee, there are concerns about whether Samsung can achieve management reform under the current leadership of Lee JaeYong, given the different social atmosphere and personal style.

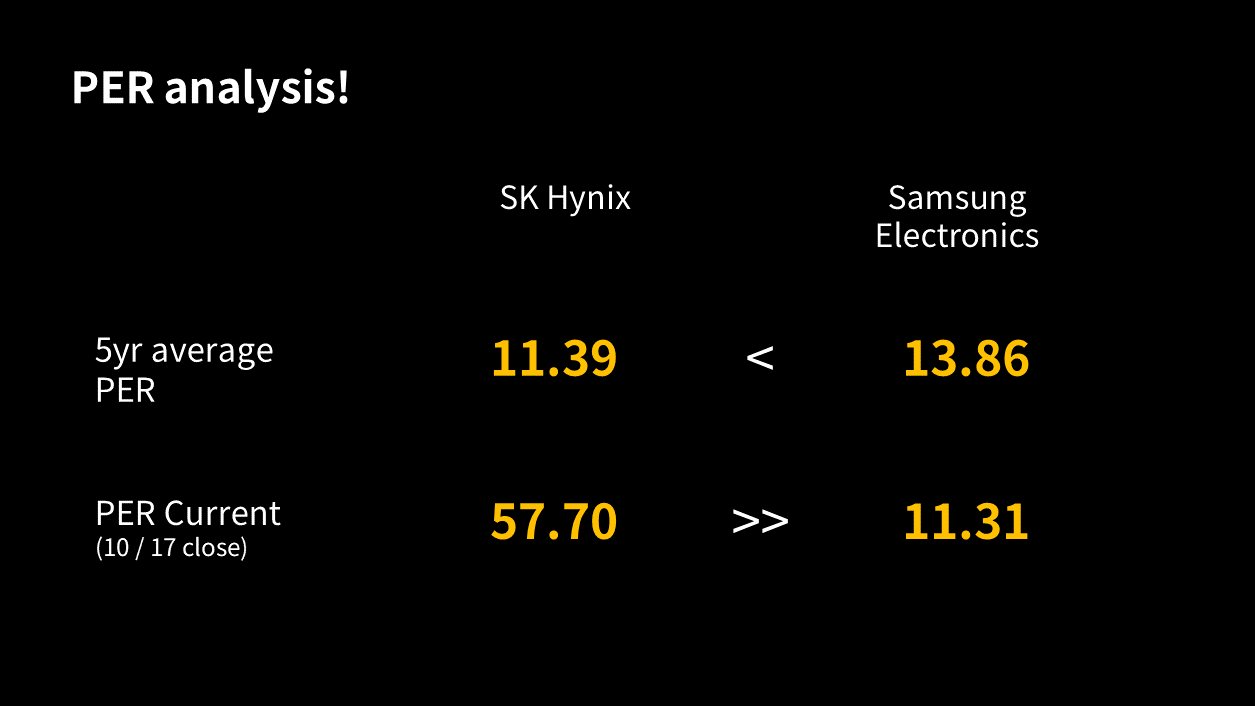

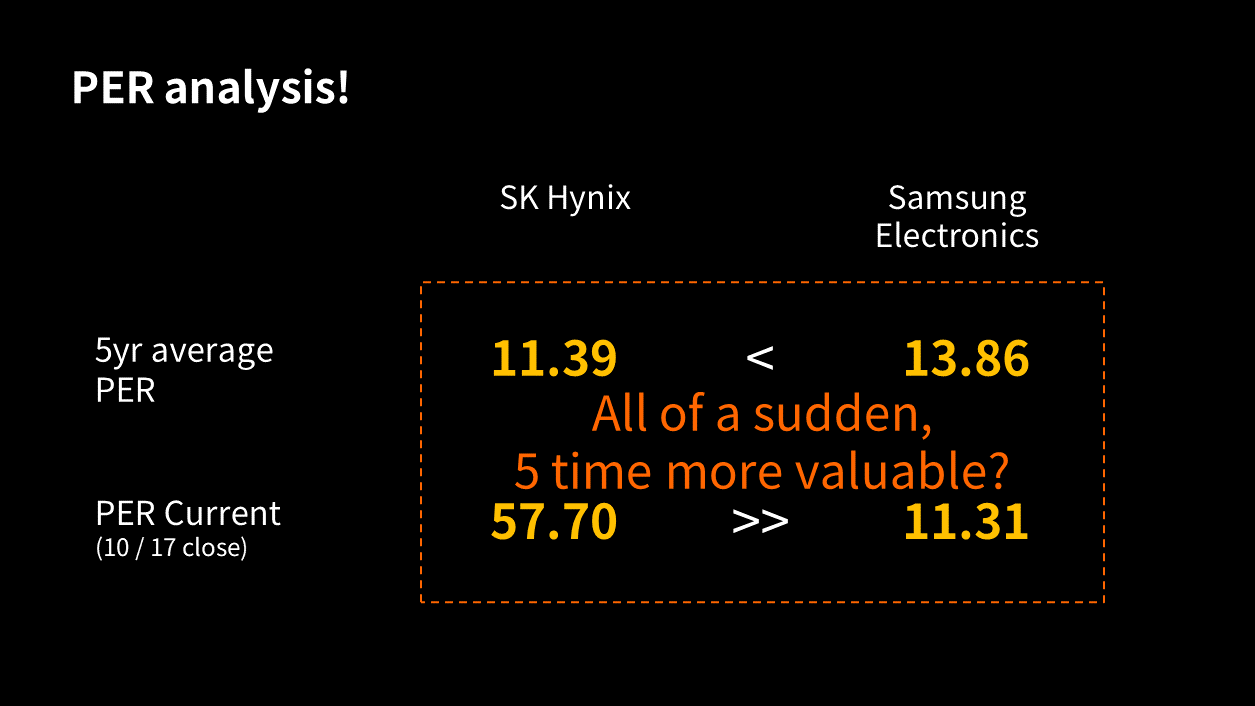

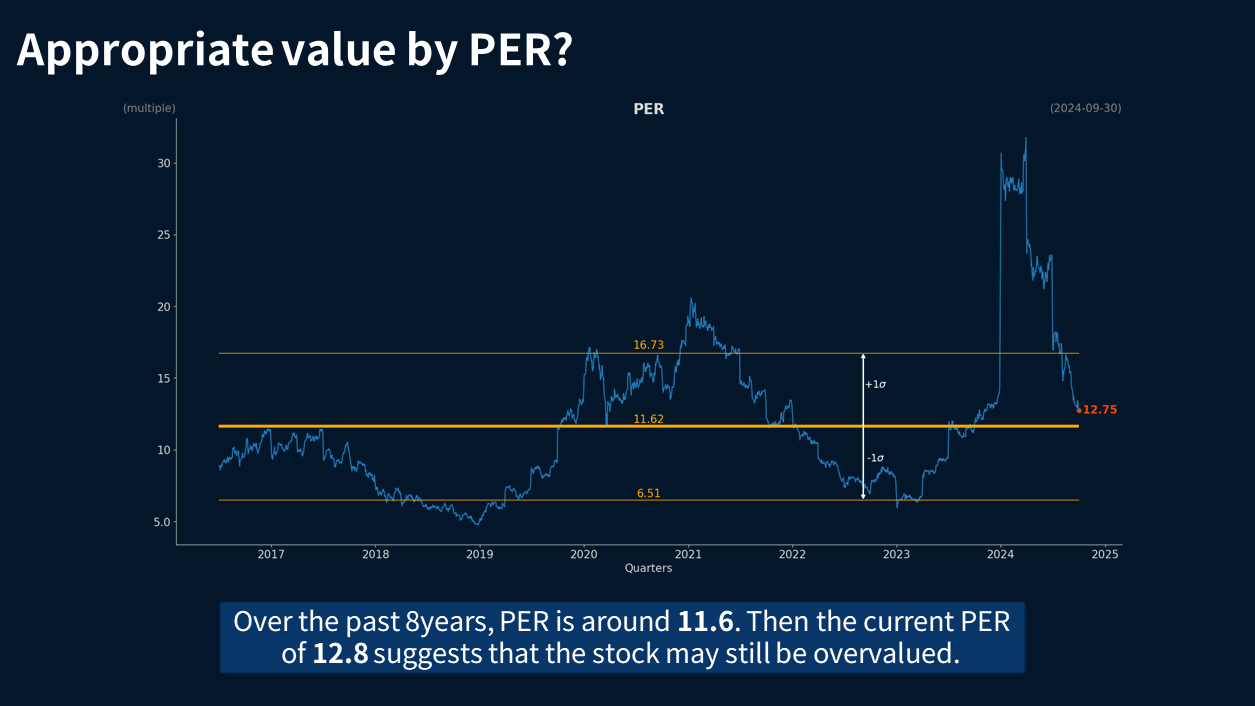

(p15) The most important question is always, What is the appropriate value for Samsung Electronics? We would like to discuss the value considering the performance results.

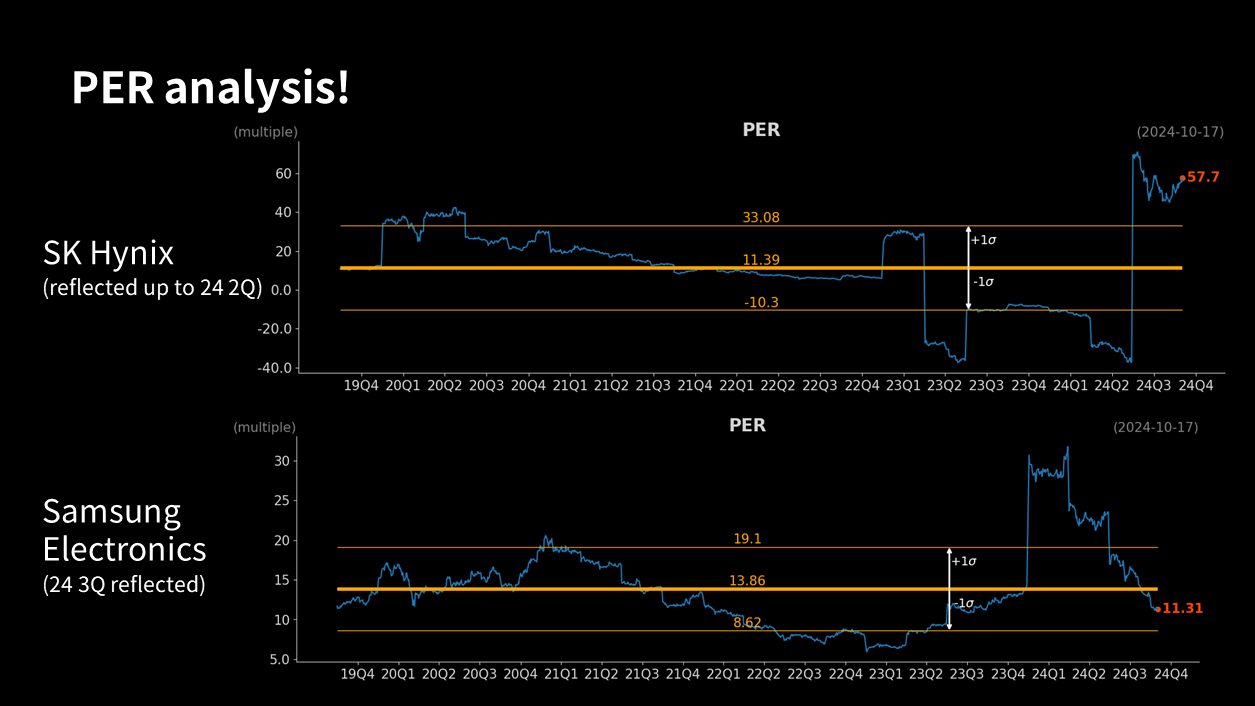

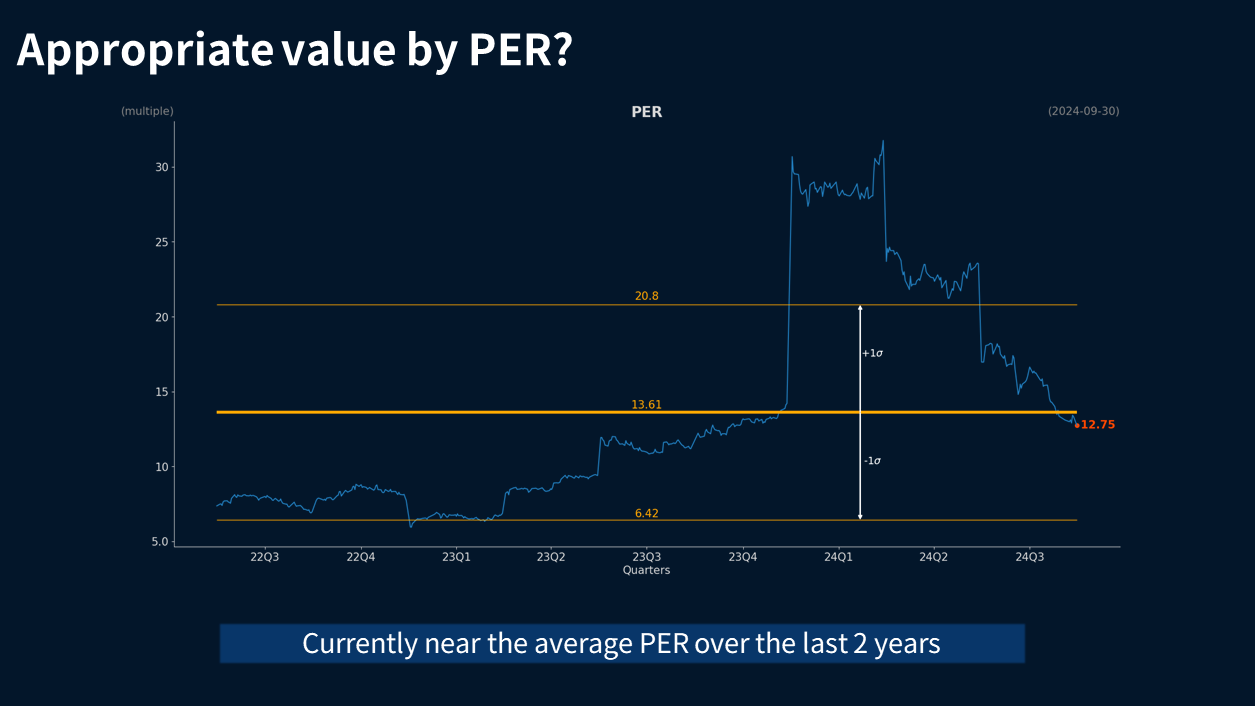

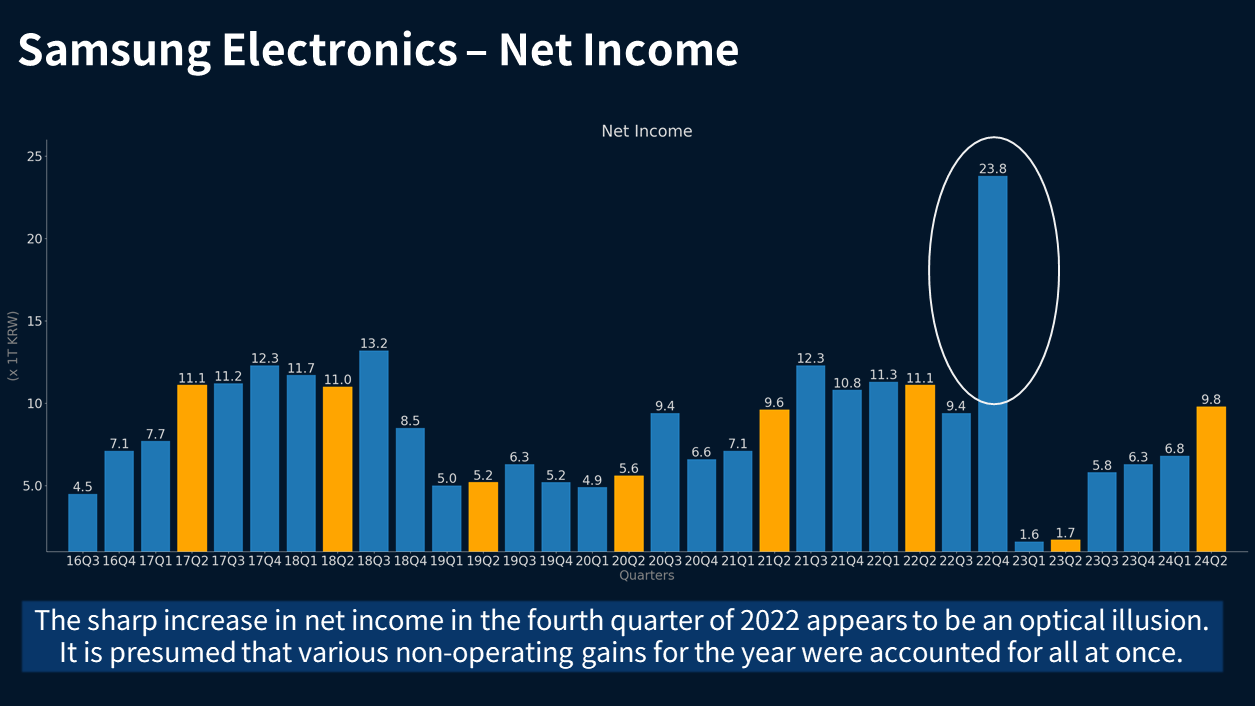

(p16) The most important indicator is probably the PER. We calculated the rolling PER based on the previous four quarters by dividing the market capitalization by the earnings. Currently, the PER is 12.8, which shows a recent decline. Interestingly, while the performance in 2023 was very poor, the PER for 2024 has soared. This suggests that despite the poor earnings, the stock price did not drop, leading to a situation where the first and second quarters of 2024 were overvalued.

(p17) When looking at the average PER over the past two years, we can see that the current PER is approaching the average level for that period.

(p18) When looking at the average PER over the past eight years, it is around 11.6, and the current PER is somewhat higher than this level. This suggests that there may still be room for further declines in the stock price.

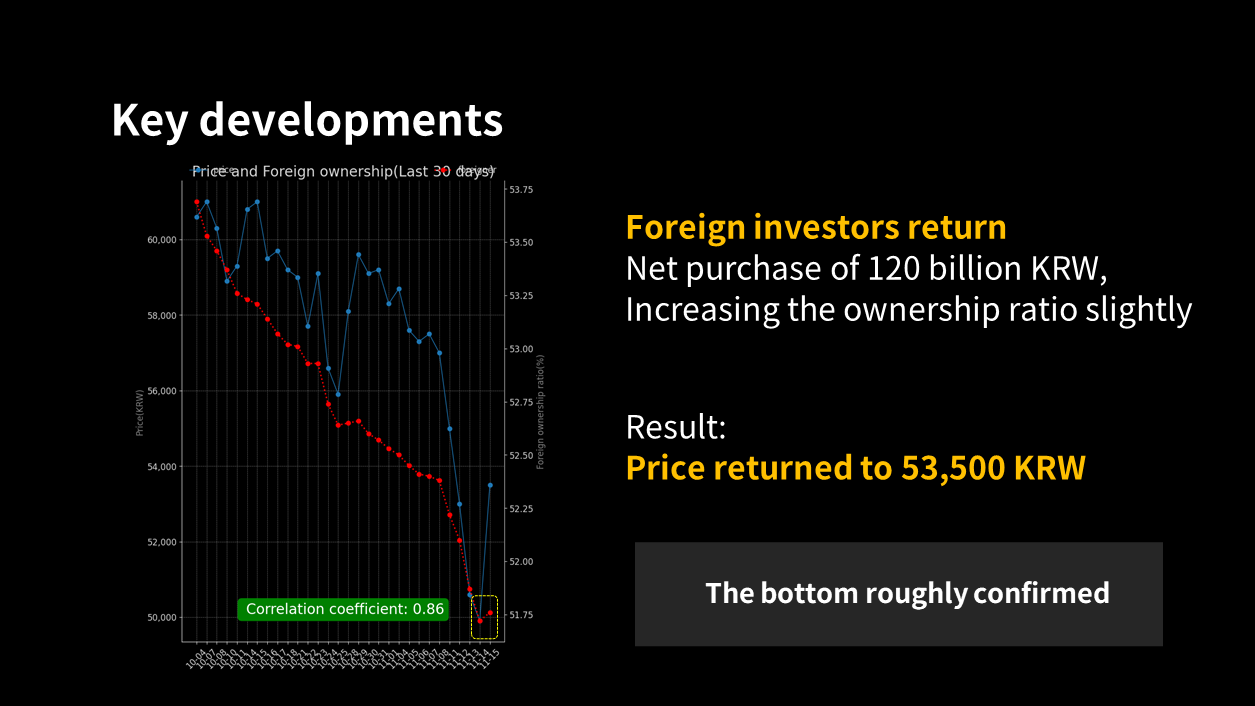

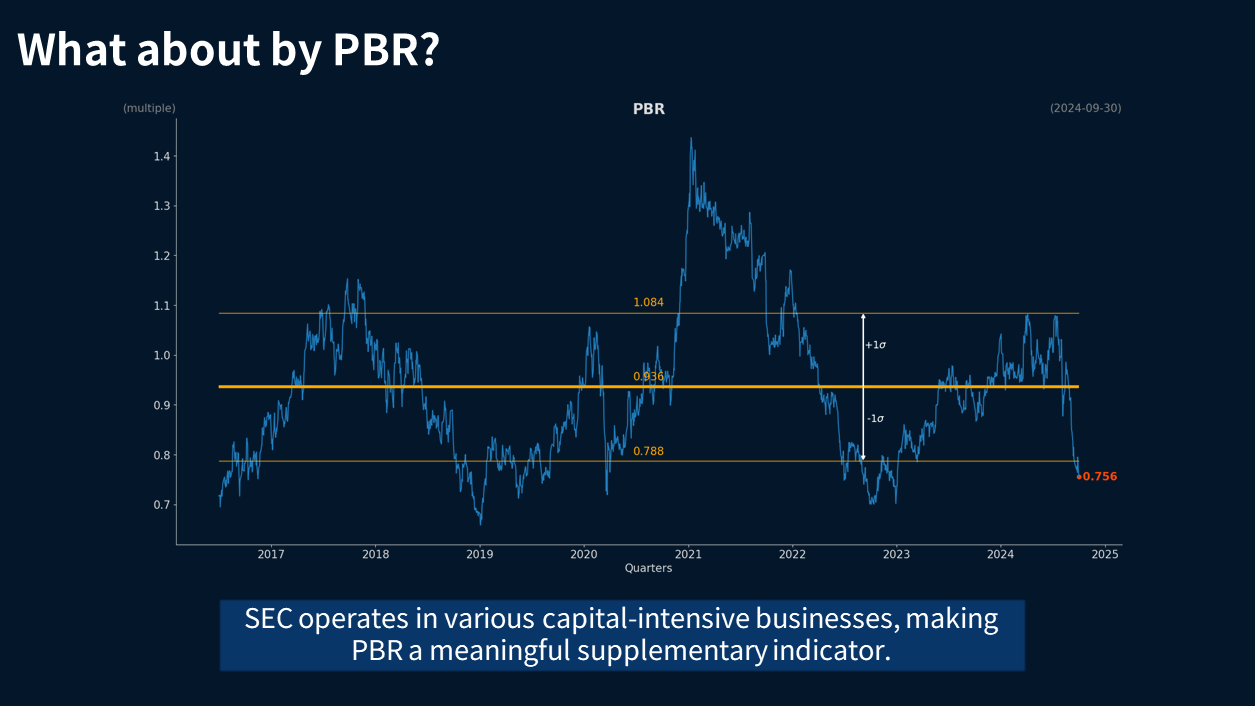

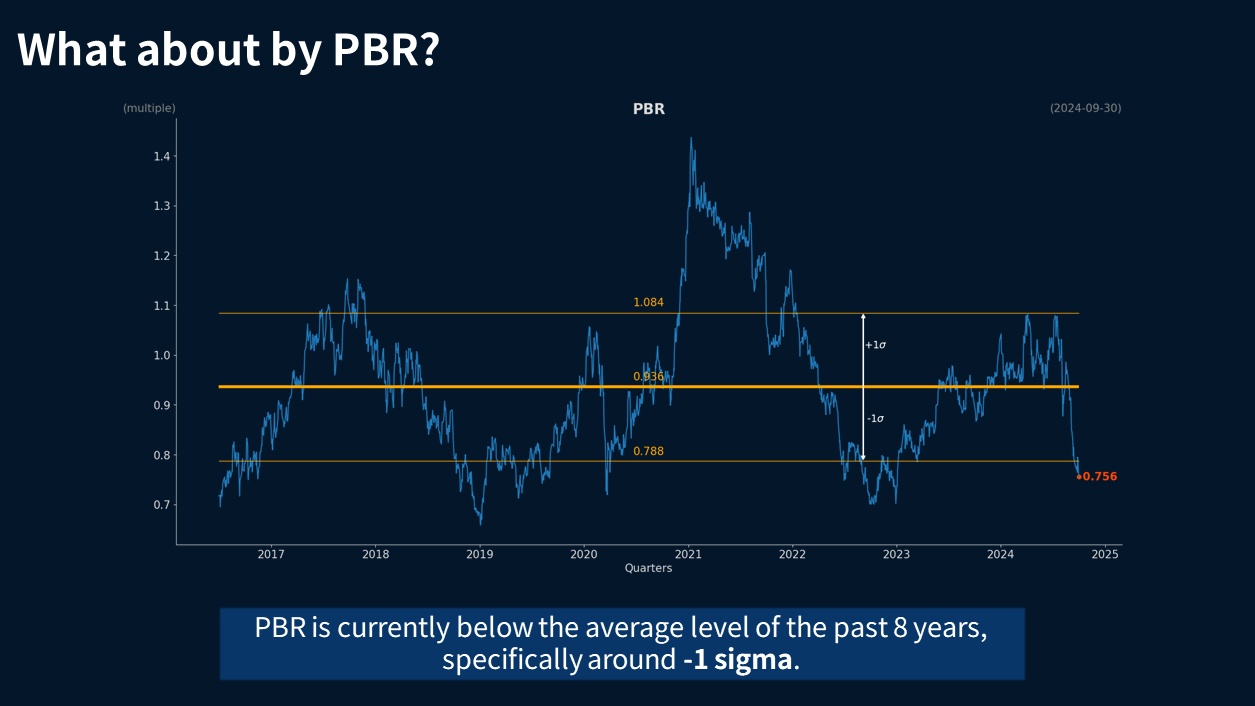

(p19) On the other hand, the PricetoBook Ratio or PBR is typically a useful metric for financial institutions or capitalintensive companies. While Samsung Electronics engages in both B2B and B2C operations, it still involves largescale investments and possesses significant assets, which makes calculating PBR a valuable supplementary indicator.

(p20) It can be observed that the current PBR is approximately 1 sigma lower than the average PBR over the past eight years. Here, sigma refers to the standard deviation, indicating that the drop is statistically significant. This suggests that the stock is trading at a notably lower valuation compared to its historical average, which could imply potential undervaluation.

Youtube Link - Issue Tracker