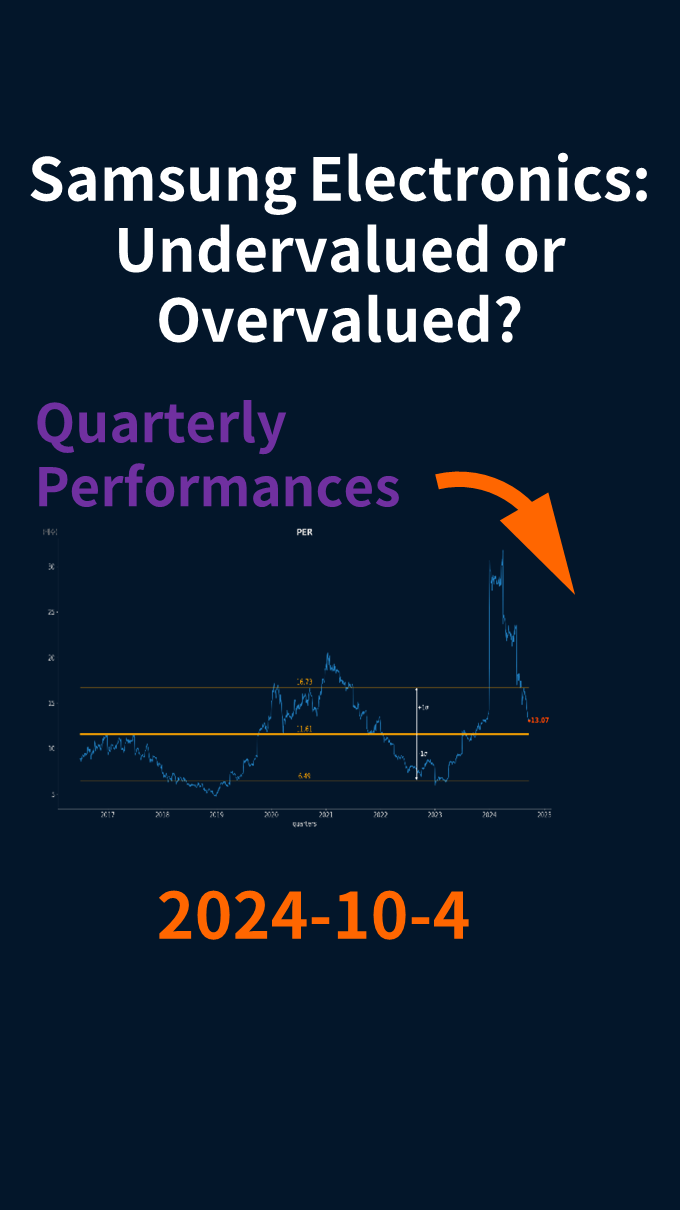

Join us as we evaluate the current PER of Samsung Electronics against its historical averages. Is the recent drop a signal of undervaluation, or is it still holding on to an overvalued status? Let's dive into the numbers and find out!

(p1) Looking at the sharply fallen Samsung Electronics PER, is it undervalued or overvalued? Lets evaluate it based on the stock price as of October 4, 2024, at 2 PM.

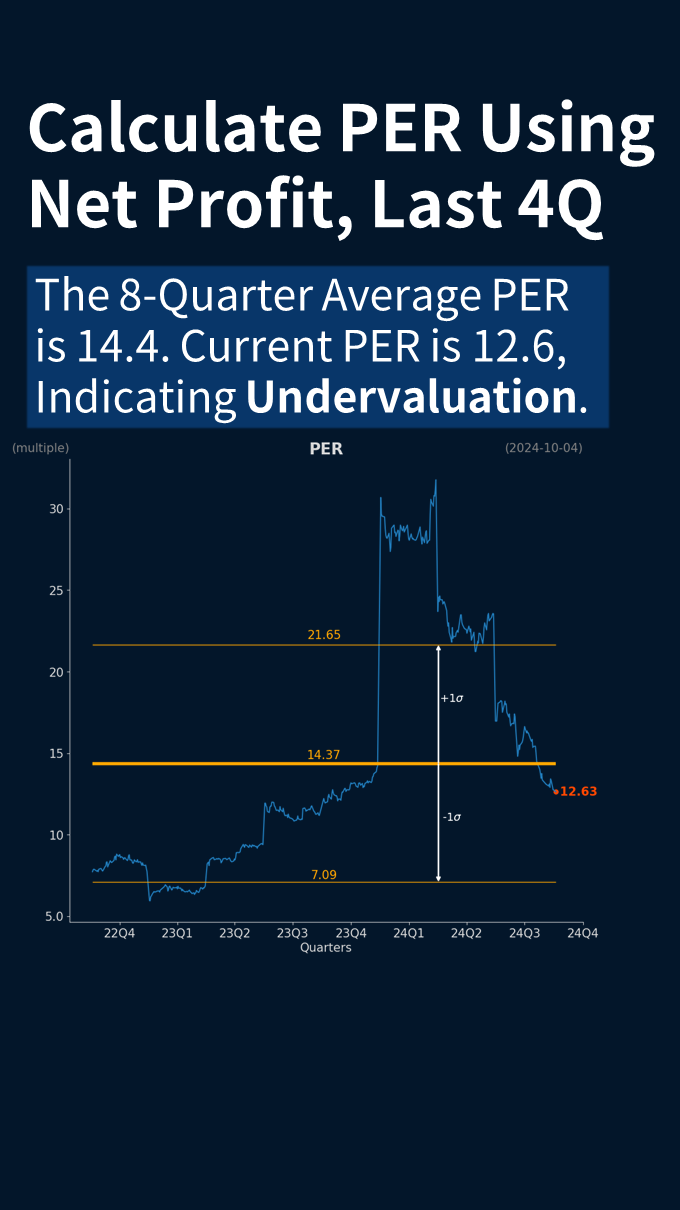

(p2) PER is the number obtained by dividing the market capitalization by the net profit of the previous four quarters, and there may be a jump at the start of the quarter. The average PER of Samsung Electronics over the past two years is 14.4. With the current PER at 12.6, it could be seen as undervalued.

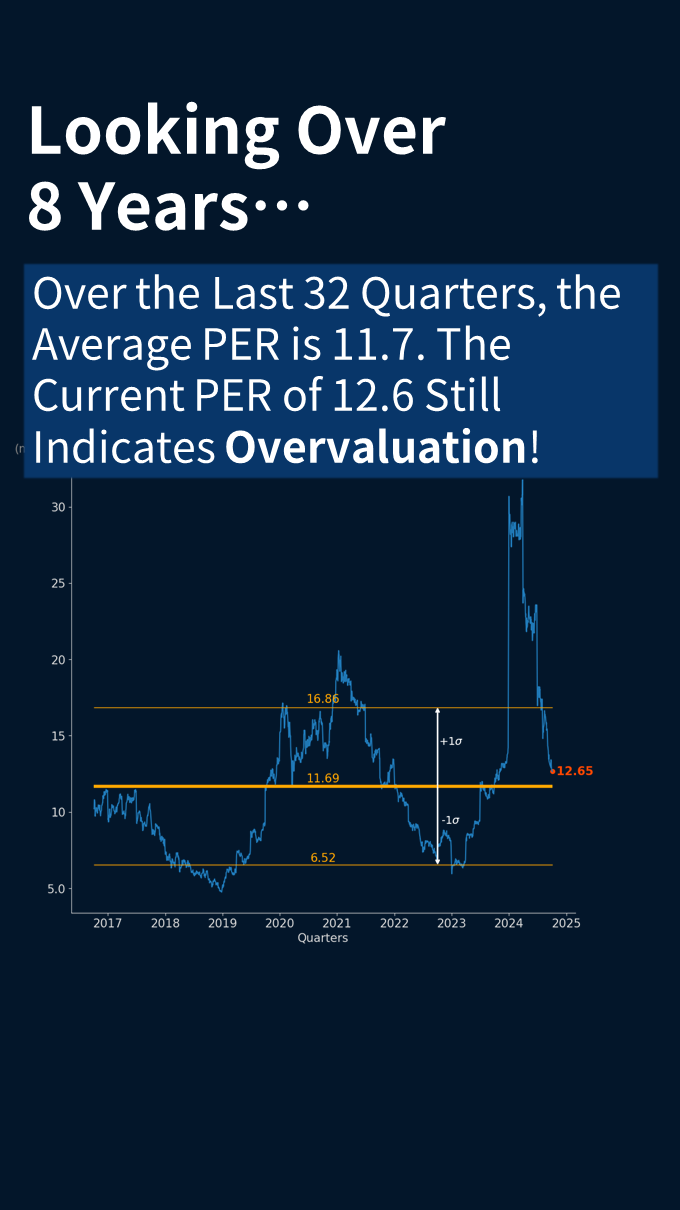

(p3) However, what if we calculate it over a longer period of 8 years? The average PER is 11.7. The current PER is higher. Cant we still see it as overvalued? If we consider the appropriate PER for the electronics industry to be 10, it is still overvalued.

(p4) Just how much more does it need to drop? The fact that it suddenly plummeted recently is the most surprising thing. This was Quarterly Performances. This is not an investment recommendation.

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

views: 263

SamsungElectronics

Finance

Investing

StockMarket

PERAnalysis

Samsung Electronics: Is It Undervalued?

x: None, y: None