Explore the recent performance of SK Hynix compared to Samsung Electronics over the past six months. Discover the reasons behind their differing valuations, including PER analysis and stock trends. Stay tuned for insights on this sudden shift in market perception!

(p1) SK Hynix is currently performing well, and we will look into the differences compared to Samsung Electronics.

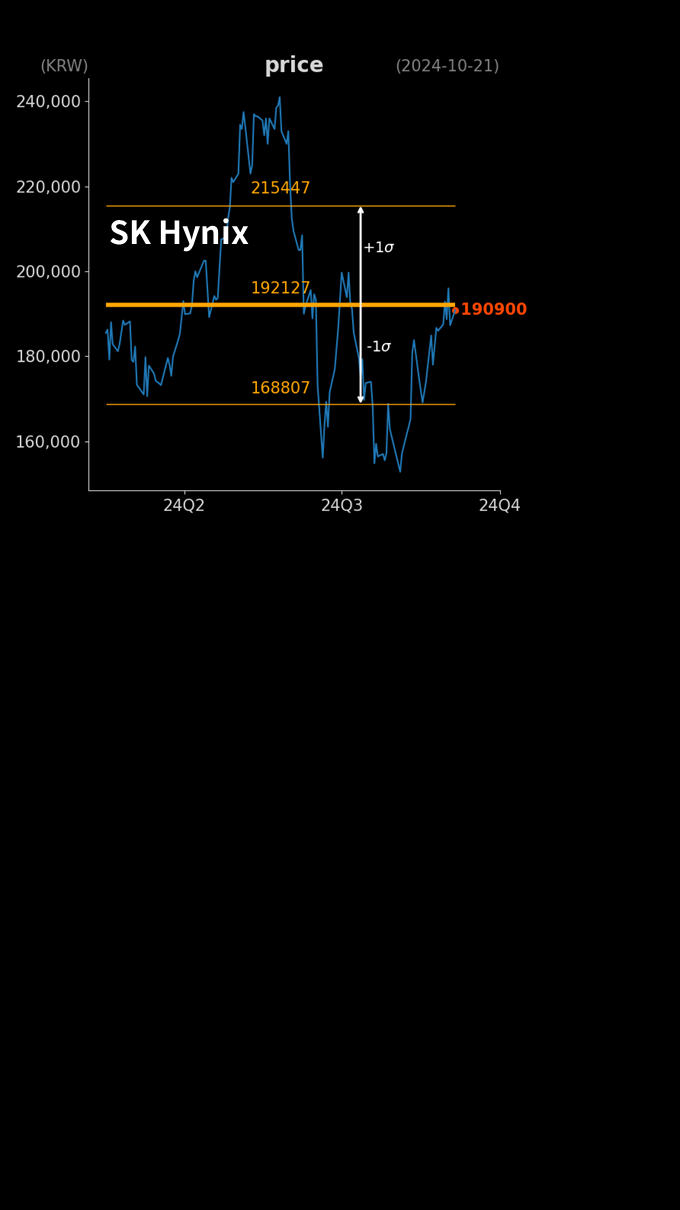

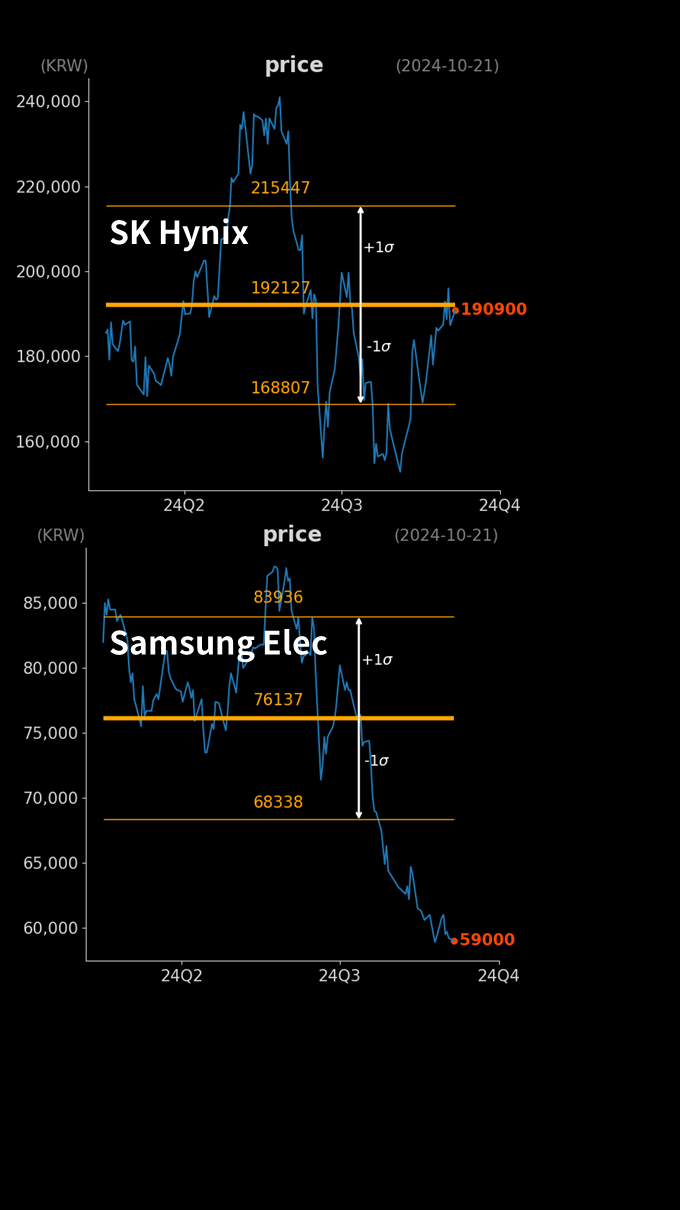

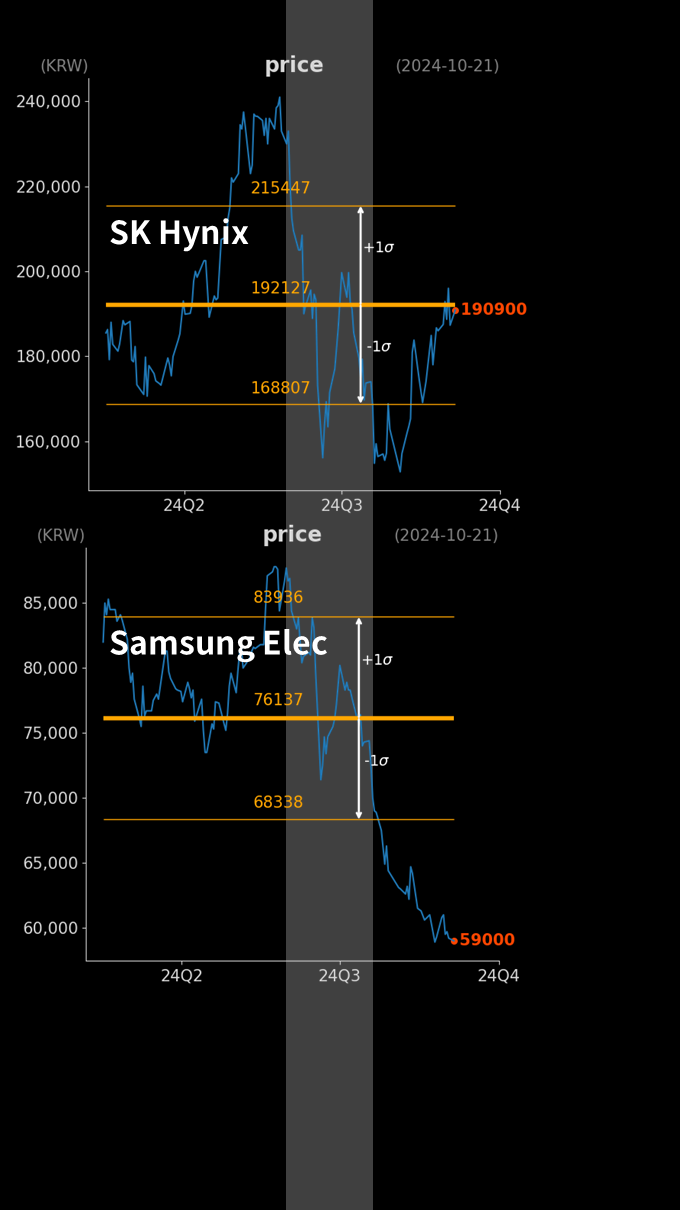

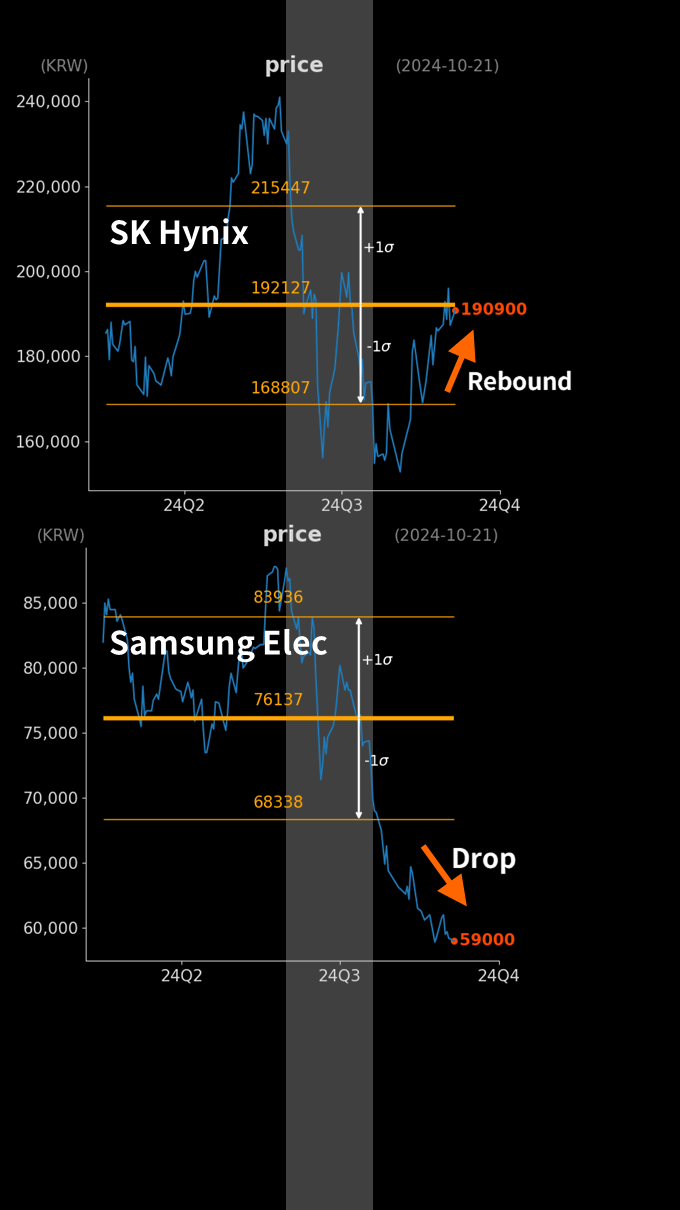

(p2) Here is the recent 6month stock trend of SK Hynix.

(p3) This is the stock trend of Samsung Electronics over the same period.

(p4) For a while, the stock prices of both companies moved similarly.

(p5) However, at some point, Hynix rebounded while Samsung plunged.

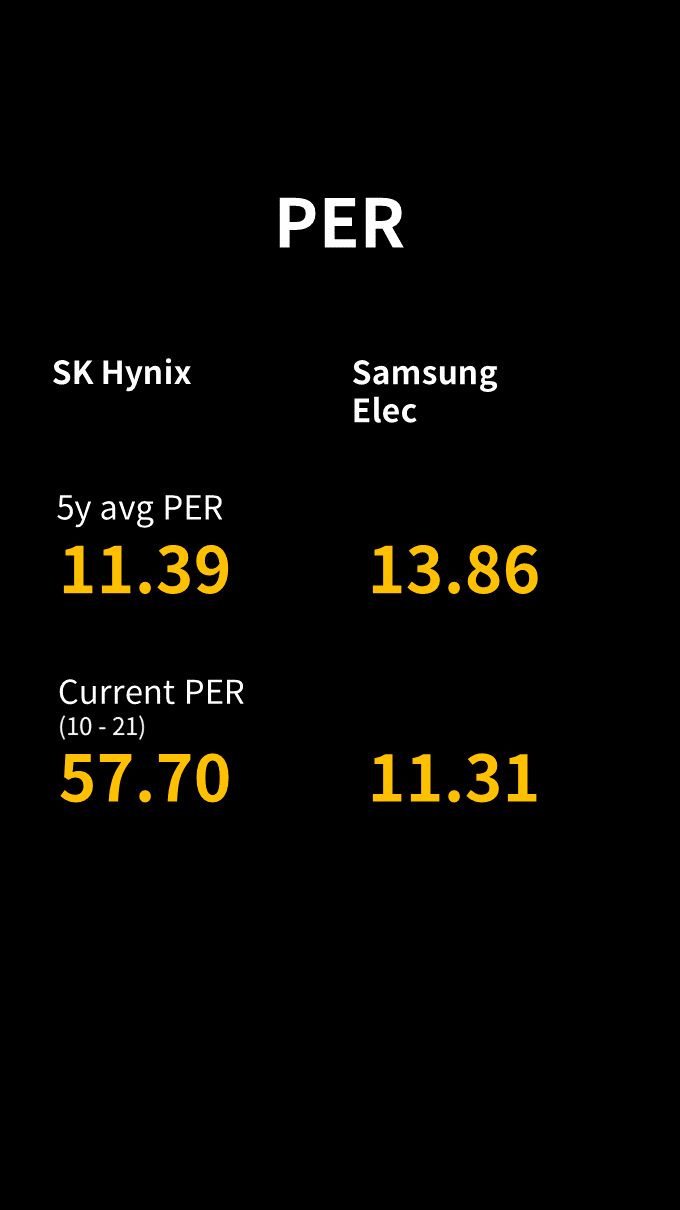

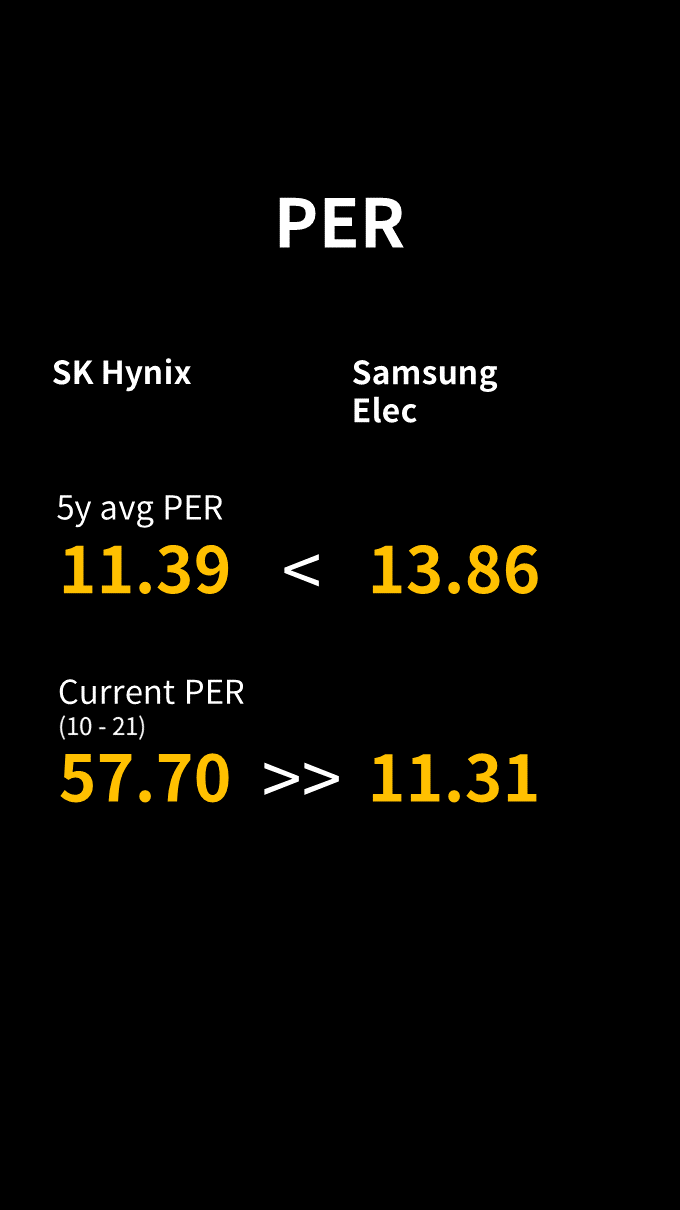

(p6) Lets compare the PER of both companies. Here are the average PER over the past 5 years and the current PER.

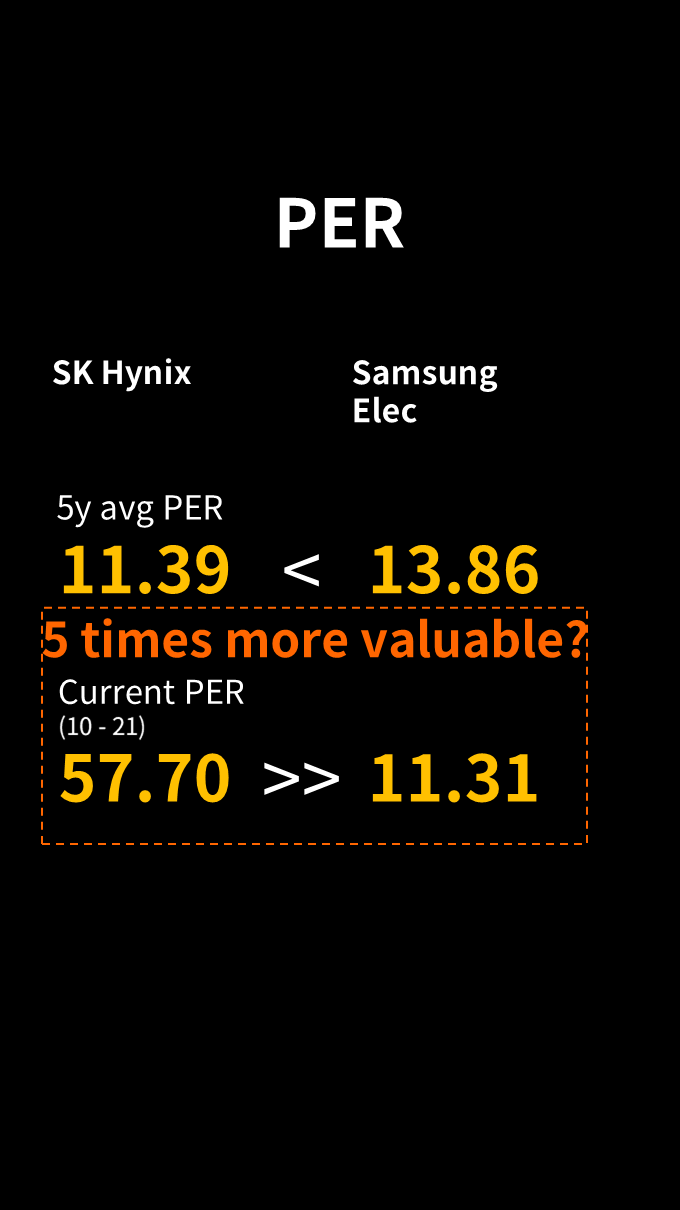

(p7) The average PER over the past 5 years is higher for Samsung, meaning the market has valued Samsung more highly. However, the current PER is significantly higher for SK Hynix.

(p8) Is it possible that such a sudden inversion in valuation occurred, leading to a nearly 5fold difference?

(p9) I will summarize the reasons for the differing valuations of both companies in the next Shorts. Still, even if there are reasons, such a drastic difference in evaluation could be excessive. Thank you.

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

SK Hynix vs Samsung Electronics: A Stock Comparison

x: None, y: None