In this video, we explore the concept of triple strength and weakness in economic cycles, focusing on the current situations in the U.S. and Korea. Discover insights on market trends and why now may be a pivotal time for investment in Korean stocks. Join us for an enlightening discussion!

(p1) Today, we will look at it from a macro perspective.

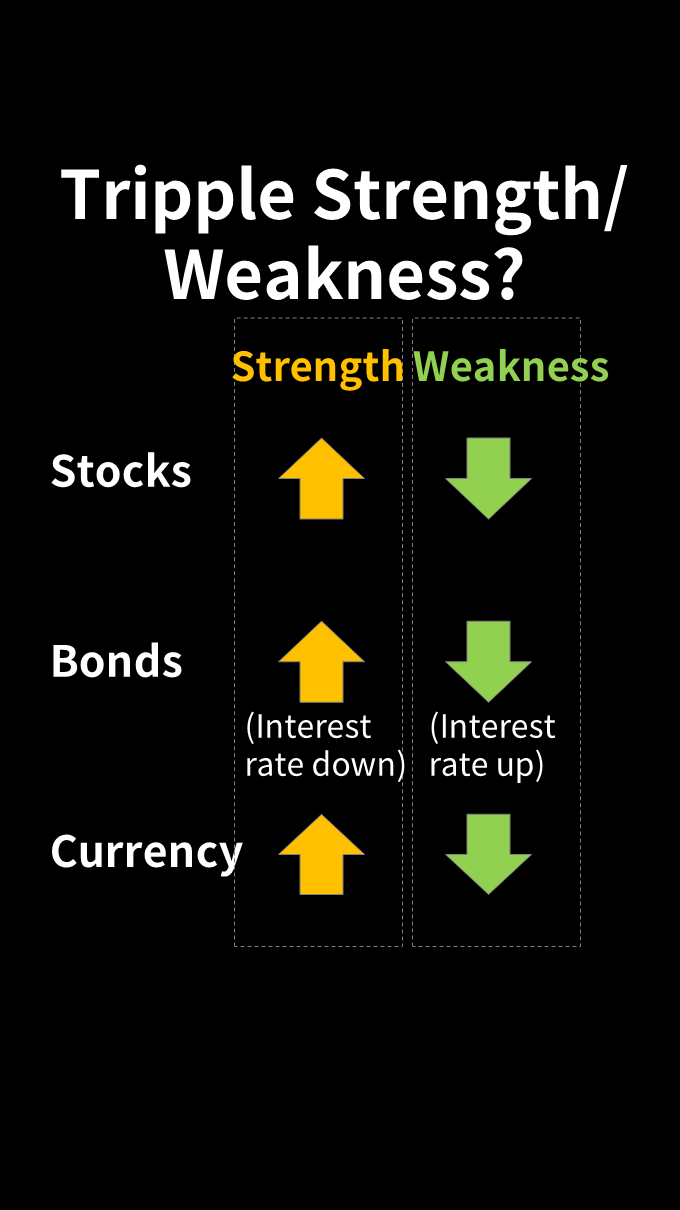

(p2) When stocks, bonds, and exchange rates all rise, it is called a triple strength, and when the opposite happens, it is called weakness. It is a very important concept to observe cycles.

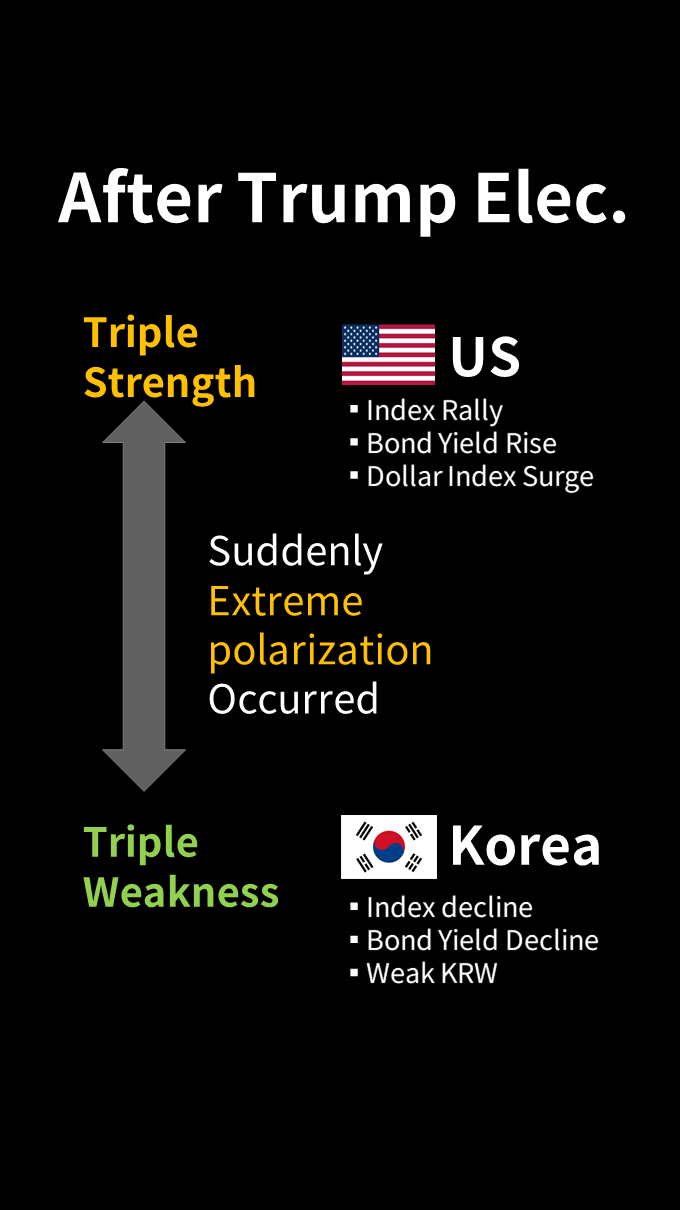

(p3) Since Trumps election, the U.S. has shown a triple strength, while Korea has exhibited a triple weakness. Extreme polarization has occurred in a short period.

(p4) The causes of triple strength and weakness. The current situations in the U.S. and Korea are very similar.

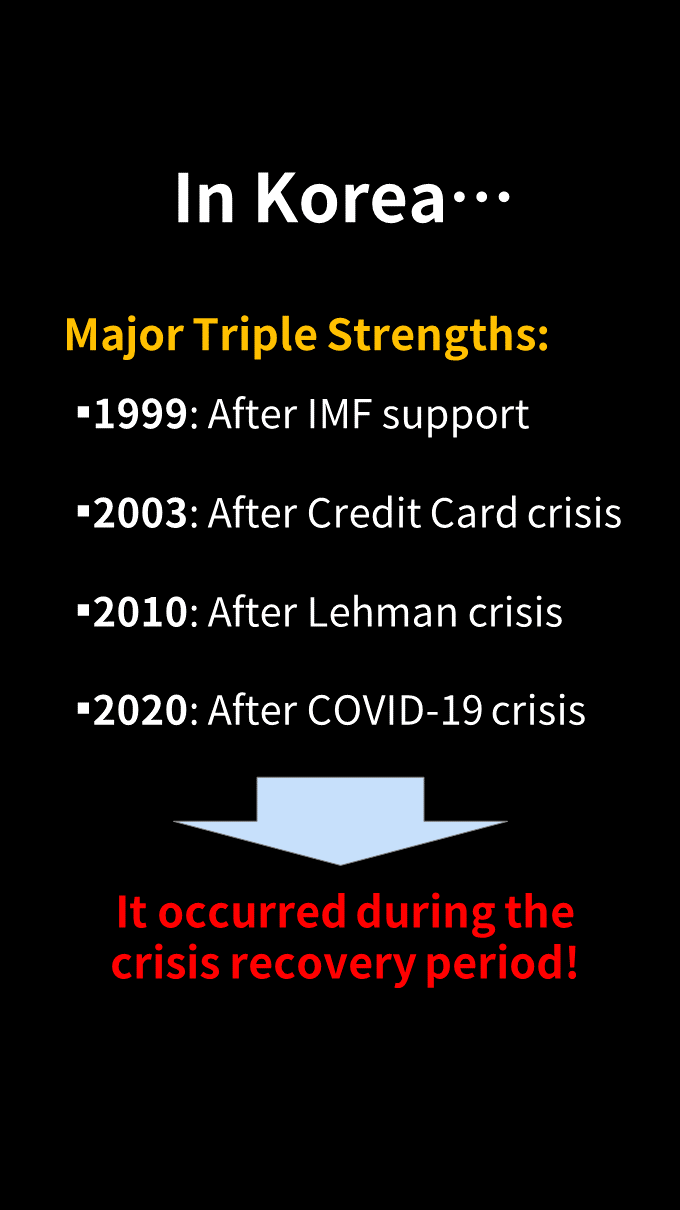

(p5) In our country, significant triple strengths have appeared four times in the past 20 years. All occurred during recovery periods after crises.

(p6) The economy is a cycle. The U.S. cannot maintain its triple strength, and Korea will soon enter a crisis recovery phase. Today, a head of a securities companys research center mentioned that now is the time to increase cash holdings. Should we sell our falling stocks to increase cash? Thats truly absurd. I believe, on the contrary, that now is a time when the attractiveness of the Korean market is gradually increasing. Thank you!

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

Understanding Economic Cycles

x: None, y: None