[1/3] Join us as we analyze Samsung Electronics' performance for Q2 2024. We explore revenue growth, stock price trends, and the factors impacting Samsung's valuation. Discover what this means for future investments!

(p1) Lets analyze Samsung Electronics performance for the second quarter of 2024.

(p2) Of course, it is not an investment recommendation.

(p3) Three key questions we are addressing here.First, what was the last quarters performance of SEC? SEC is by the way Samsung Electronics?Second, will SECs sharp price decline continue?Lastly, who is driving this stock?

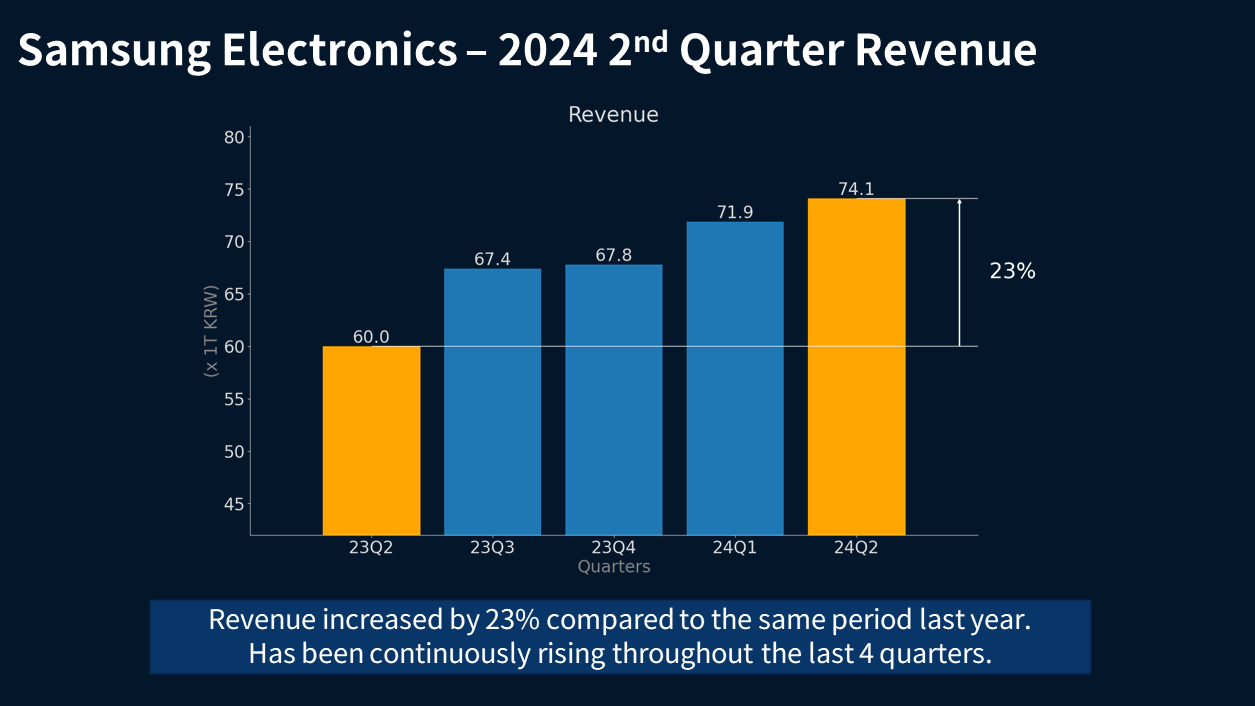

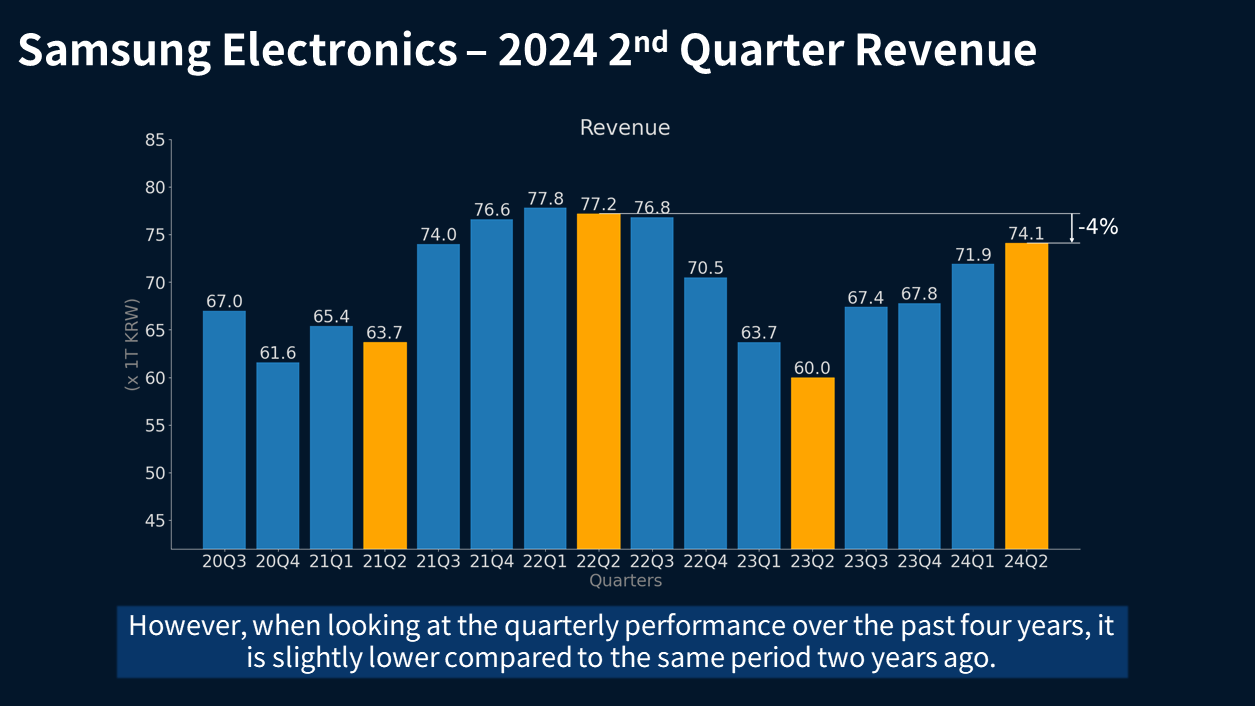

(p4) In the second quarter of 2024, revenue reached 74 trillion KRW, marking a 23% increase compared to the second quarter of 2023. It has been continuously rising over the past four quarters.

(p5) However, when looking at the quarterly performance over the past four years, it is minus 4 percent lower compared to the same period two years ago.

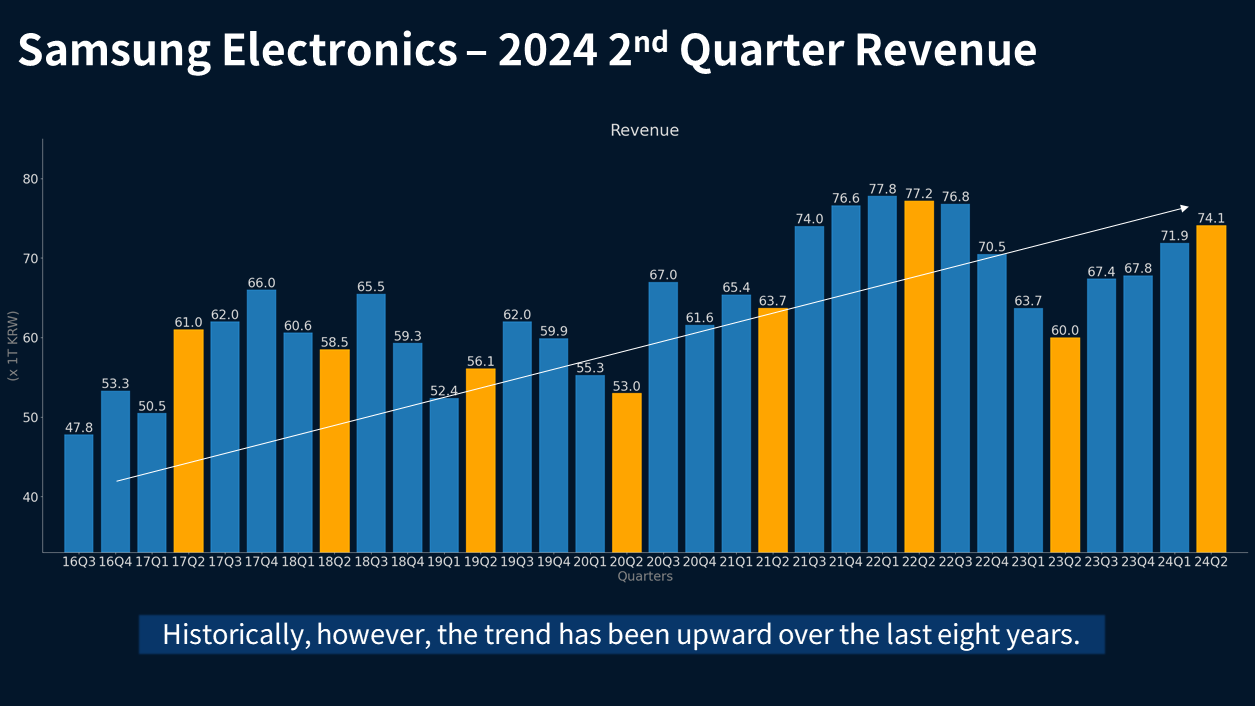

(p6) Looking at quarterly revenue performance over the span of about eight years, we can still say that the overall trend is upward. It is natural for a growing company to experience rising revenue.

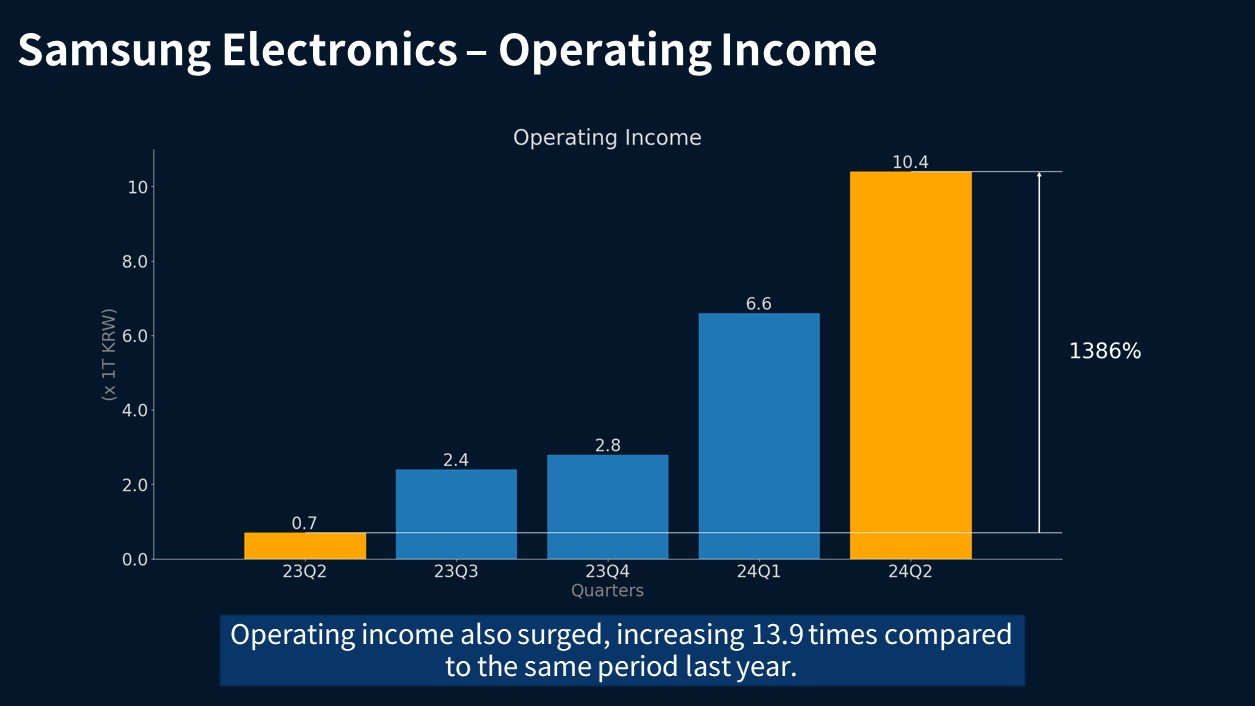

(p7) The difference is even more pronounced when looking at operating income.In the second quarter of 2024, operating income is at around 10 trillion KRW. In comparison to the second quarter of 2023, it has increased approximately 13.9 times. This significant increase can be attributed to the poor performance in the second quarter of 2023.

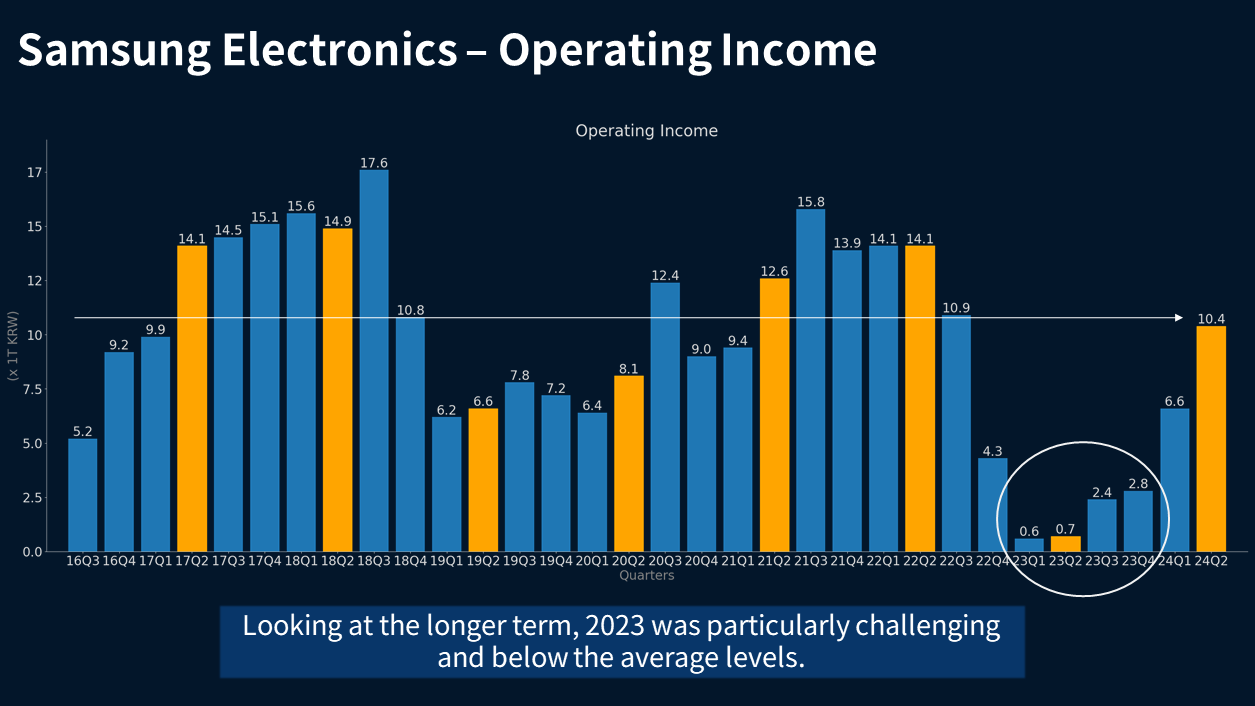

(p8) However, when considering the quarterly operating income over the past eight years, we can say that the performance in the second quarter of 2024 is approximately at the average level. In fact, it indicates that the operating income in 2023 was quite poor.

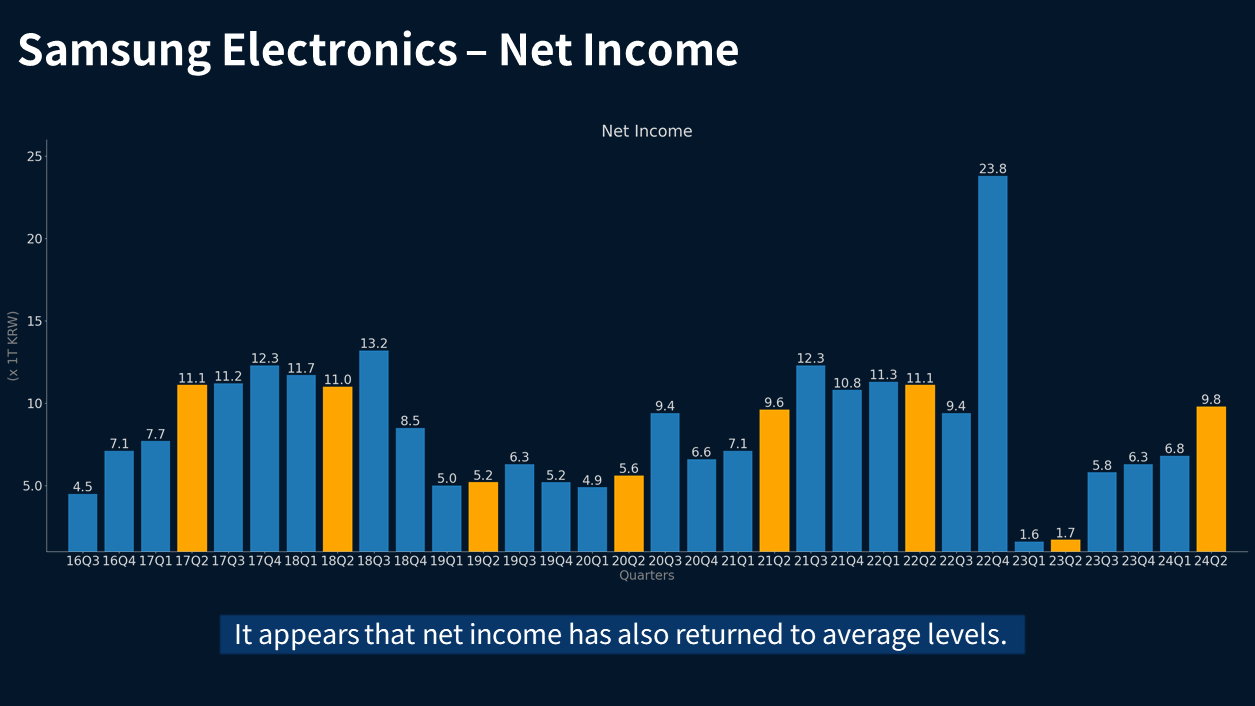

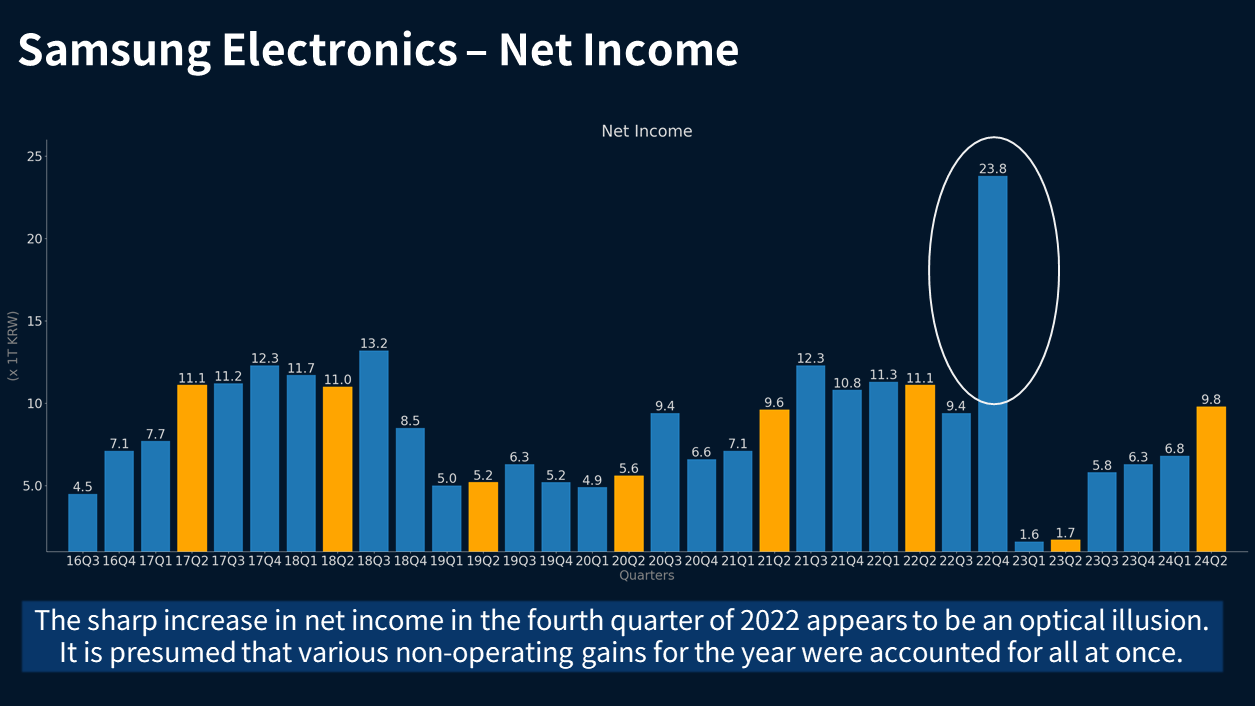

(p9) A similar trend is observed in net income as well. In the second quarter of 2024, net income seems to have returned to average levels. However, its worth noting that the first half of 2023 was particularly poor.

(p10) One notable point is the sharp increase in net income in the fourth quarter of 2022, which appears to be somewhat of an optical illusion. This surge seems to have resulted from the accounting for various nonoperating gains, such as asset sales and mergers and acquisitions, all being recorded in the fourth quarter of 2022. Since this is not directly related to todays topic, we will move on.

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

[1/3] Samsung Electronics Q2 2024 Performance Review

x: None, y: None