[1/2] In this video, we compare SK Hynix and Samsung Electronics, exploring their business structures, sales performances, and stock movements. Tune in for insights into the semiconductor sector and discover why the market views these companies so differently. This is not an investment recommendation, but rather an analytical overview.

(p1) Lets compare and analyze whether SK Hynix is different from Samsung Electronics. Recently, Ive only been posting Shorts with AI voice, but Ive made a long video and will try to record it with my own voice as much as possible.

(p2) Naturally, my videos are not investment recommendations. My goal is to provide insights through analysis.

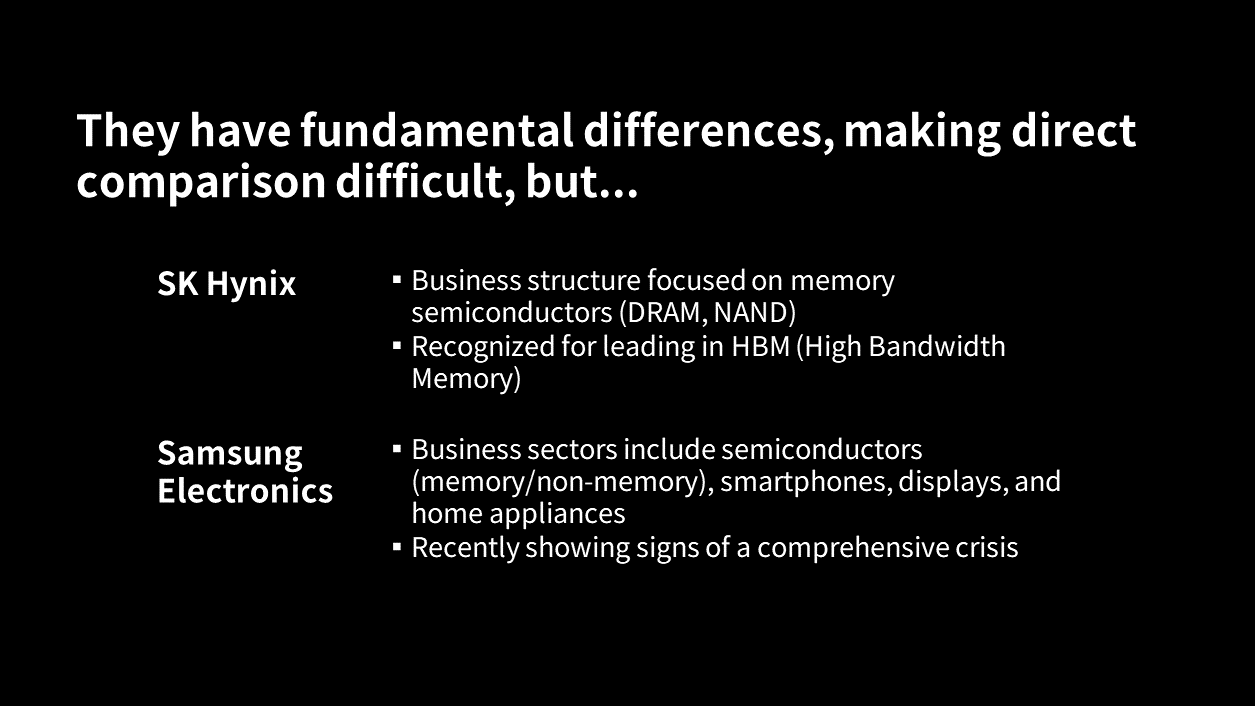

(p3) There are basic differences between SK Hynix and Samsung Electronics. SK Hynix has a business structure focused on memory semiconductors, and it has been evaluated to be ahead in HBM recently. Samsung Electronics, on the other hand, not only includes a semiconductor business that also covers nonmemory but also includes more business sectors such as smartphones, displays, and home appliances. Recently, there have been many articles and videos suggesting a total crisis. Therefore, a simple comparison is difficult, but since the current issues shaking both companies are similar regarding HBM, I will boldly compare them.

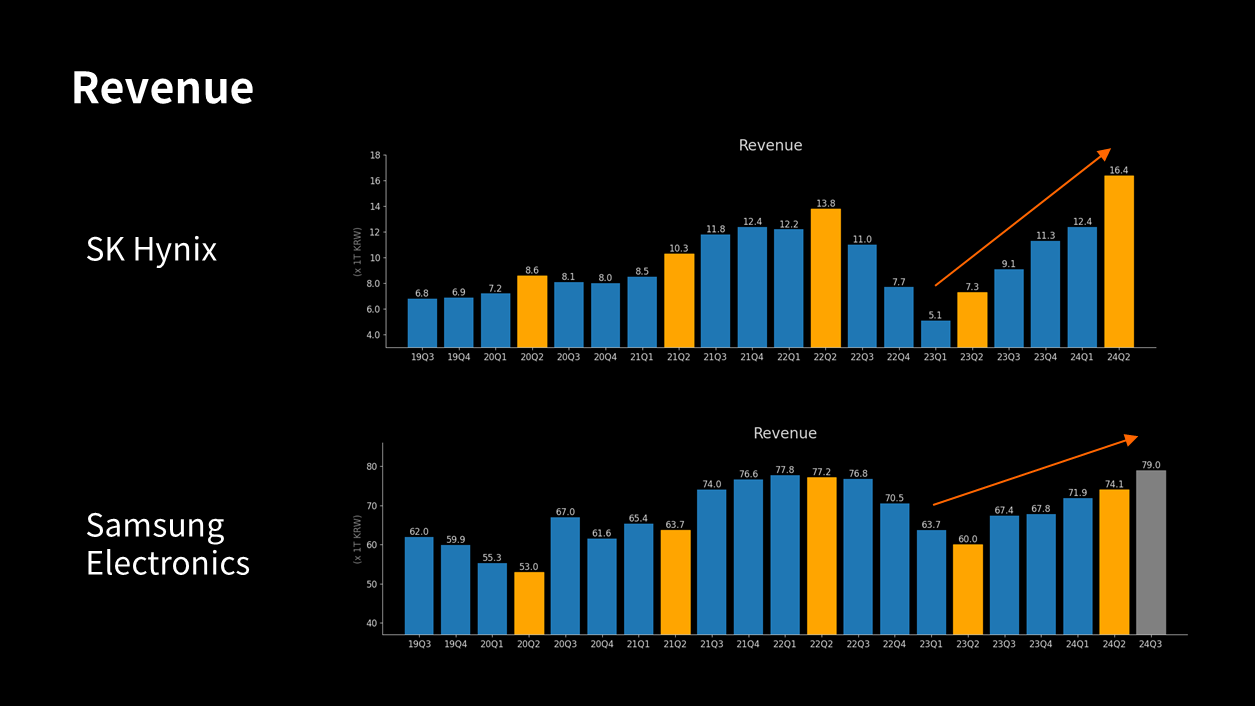

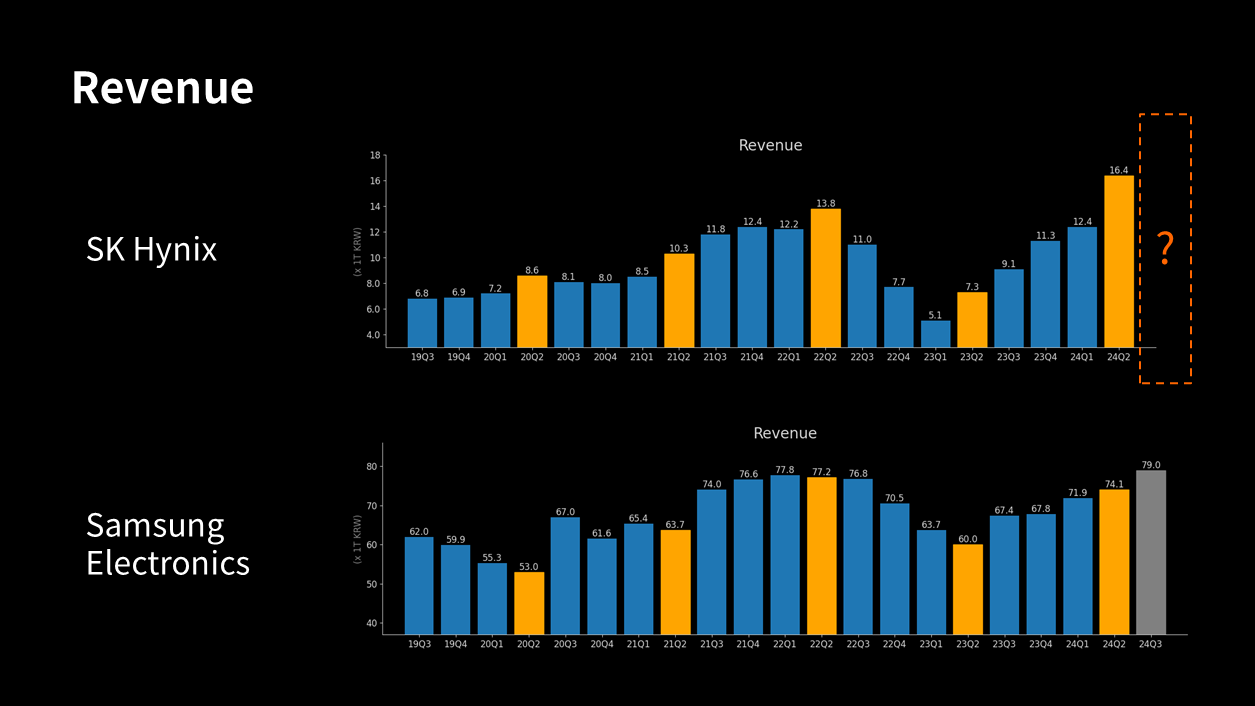

(p4) Lets first take a look at the quarterly sales for the past five years. There is a scale difference between the graphs of the two companies, so please be mindful of that. SK Hynix hit the bottom in Q1 of 2023 and is showing a recovery since then. Especially, it grew significantly to an alltime high in Q2 of 2024. Due to its simpler business structure than Samsung Electronics, it has greater volatility.

(p5) Since Samsung Electronics saw growth in sales in Q3 of 2024, it seems that Hynixs sales results should be better, so Im curious about how much it will be announced, whether it will be higher or lower than market consensus.

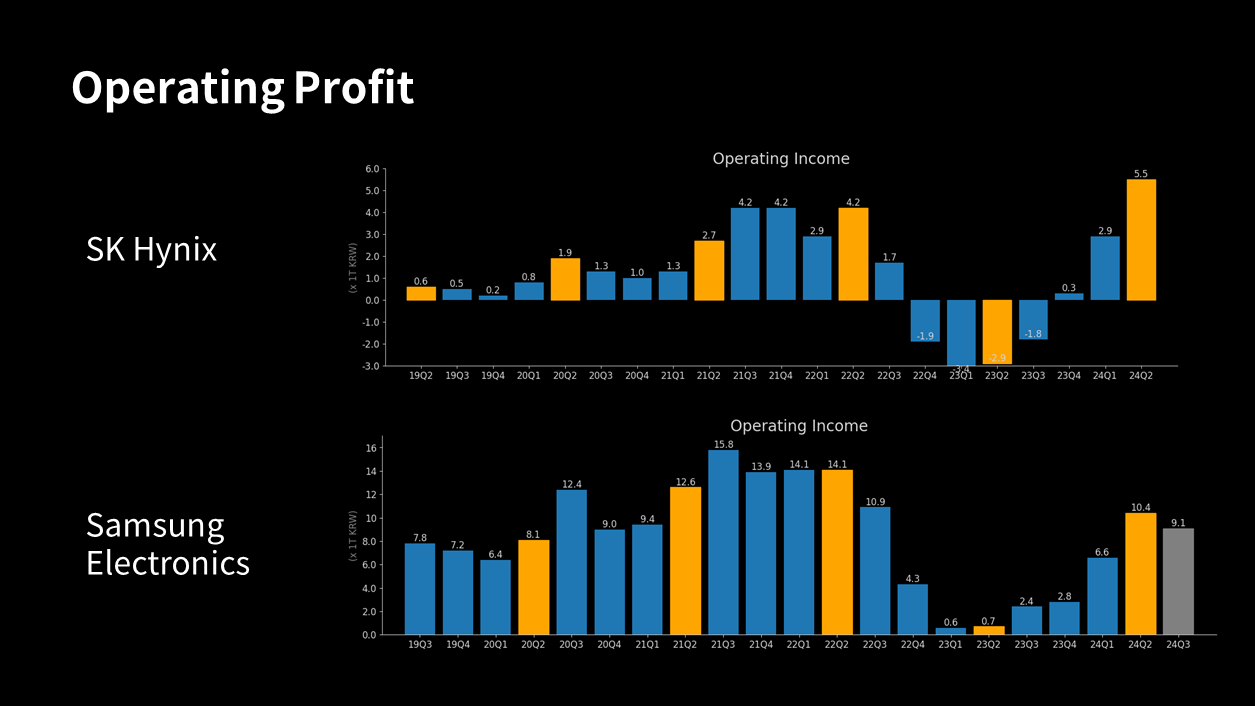

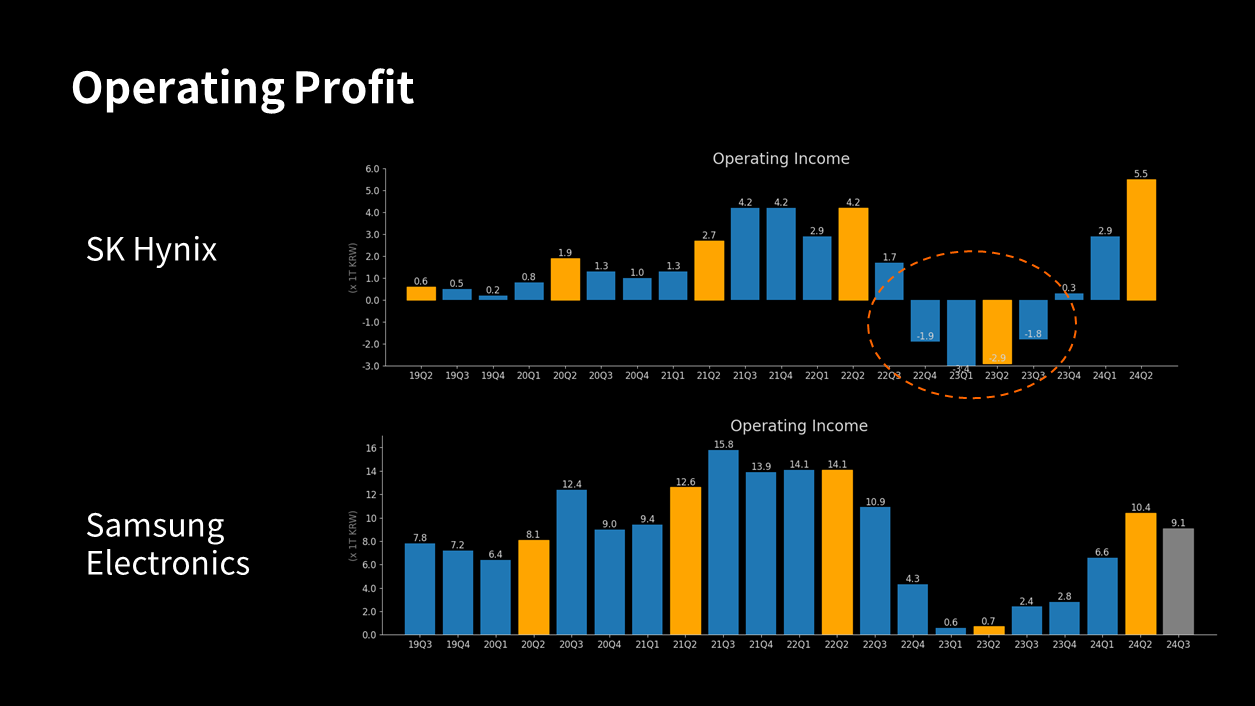

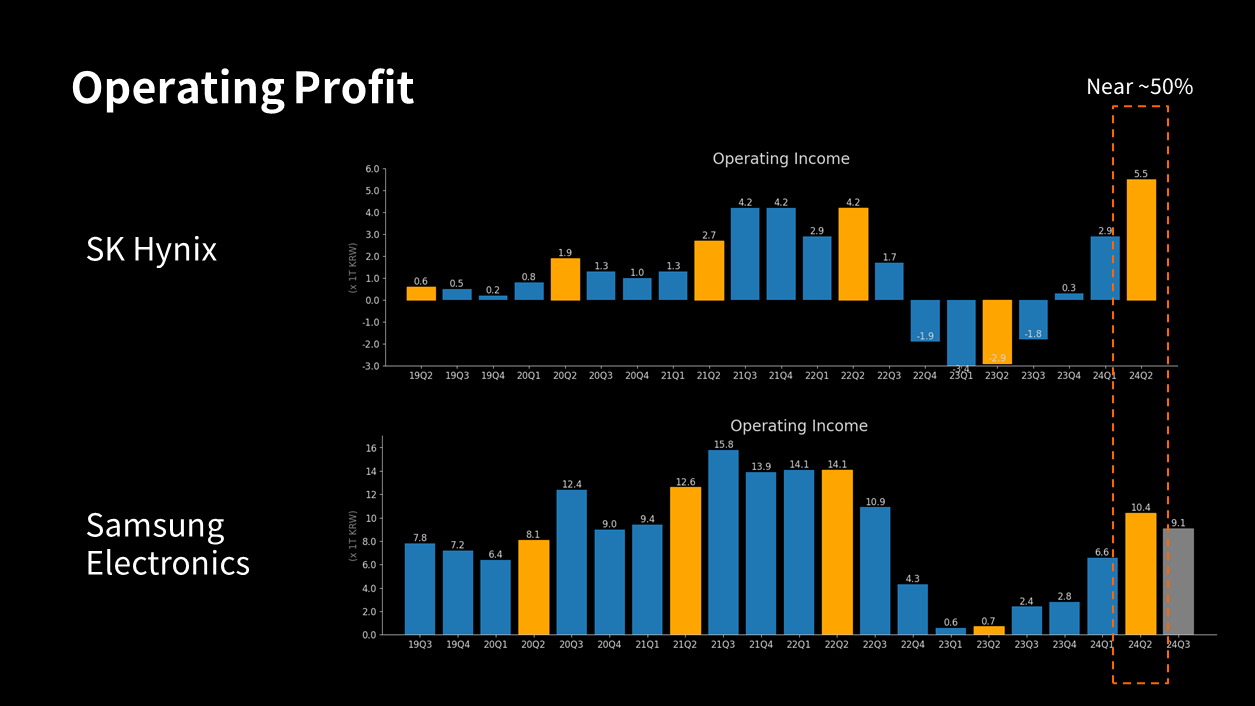

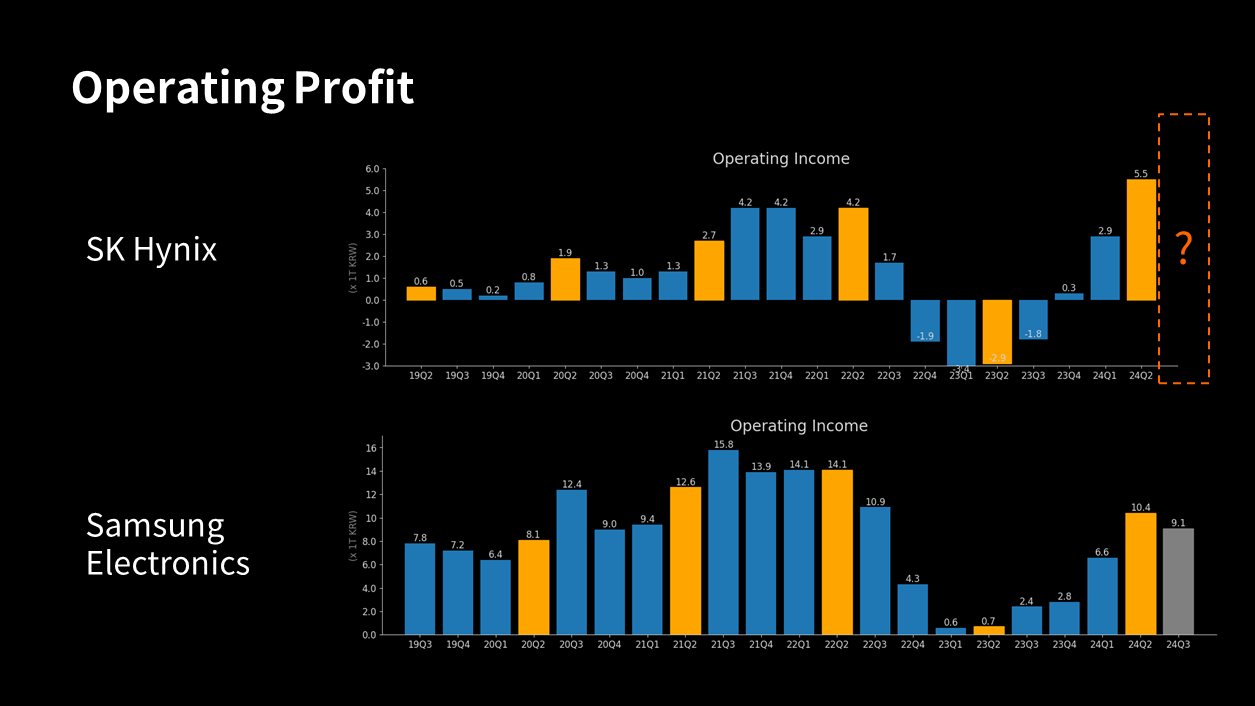

(p6) Lets also compare the quarterly operating profits.

(p7) Looking specifically at the semiconductor business, Samsung Electronics also experienced a loss of 15 trillion KRW in 2023, similar to Hynix. Since SK Hynix only has a memory business, its losses are more starkly revealed, and we can see that the scale of the losses was significant.

(p8) However, looking at Q2 of 2024, we can see that Hynixs operating profit reached about 50% of Samsung Electronics. Considering the scale difference in sales, this can be regarded as quite a good performance.

(p9) With the performance announcements for Q3 of 2024 imminent, it would be good to observe how they will be revealed.

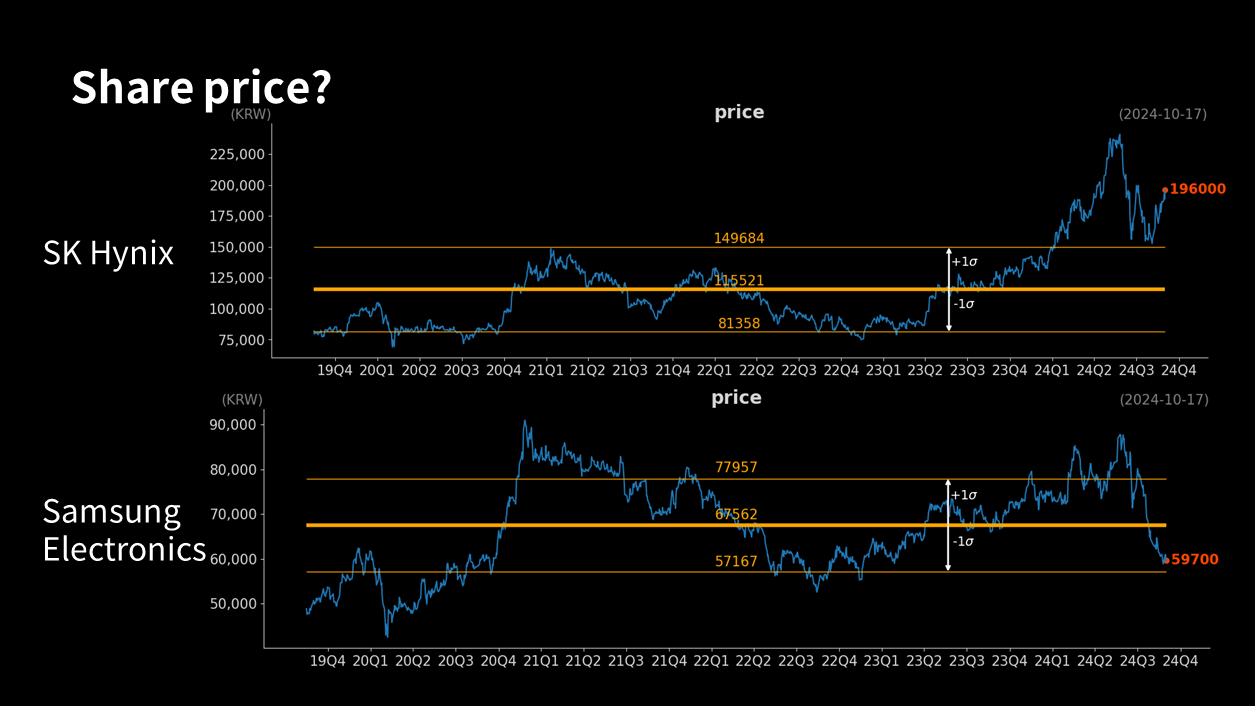

(p10) How have stock prices moved?

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

[1/2] SK Hynix vs. Samsung Electronics: A Deep Dive

x: None, y: None