[2/2] In this video, we compare SK Hynix and Samsung Electronics, exploring their business structures, sales performances, and stock movements. Tune in for insights into the semiconductor sector and discover why the market views these companies so differently. This is not an investment recommendation, but rather an analytical overview.

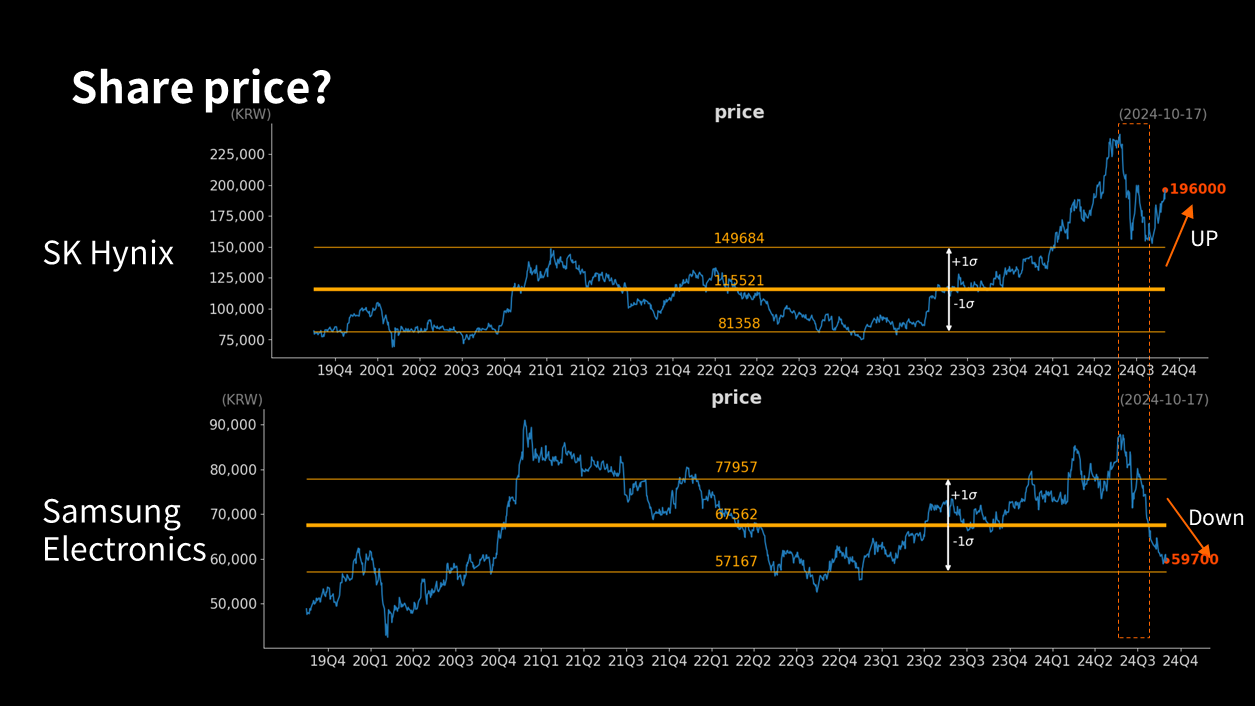

(p11) They moved similarly at first, but then SK Hynix rebounded while Samsung Electronics plummeted. Its not that a significant issue suddenly occurred, but at some point, the markets evaluation of both companies completely changed. There is a harsher assessment on the company that is falling, as if it has been waiting for such a decline.

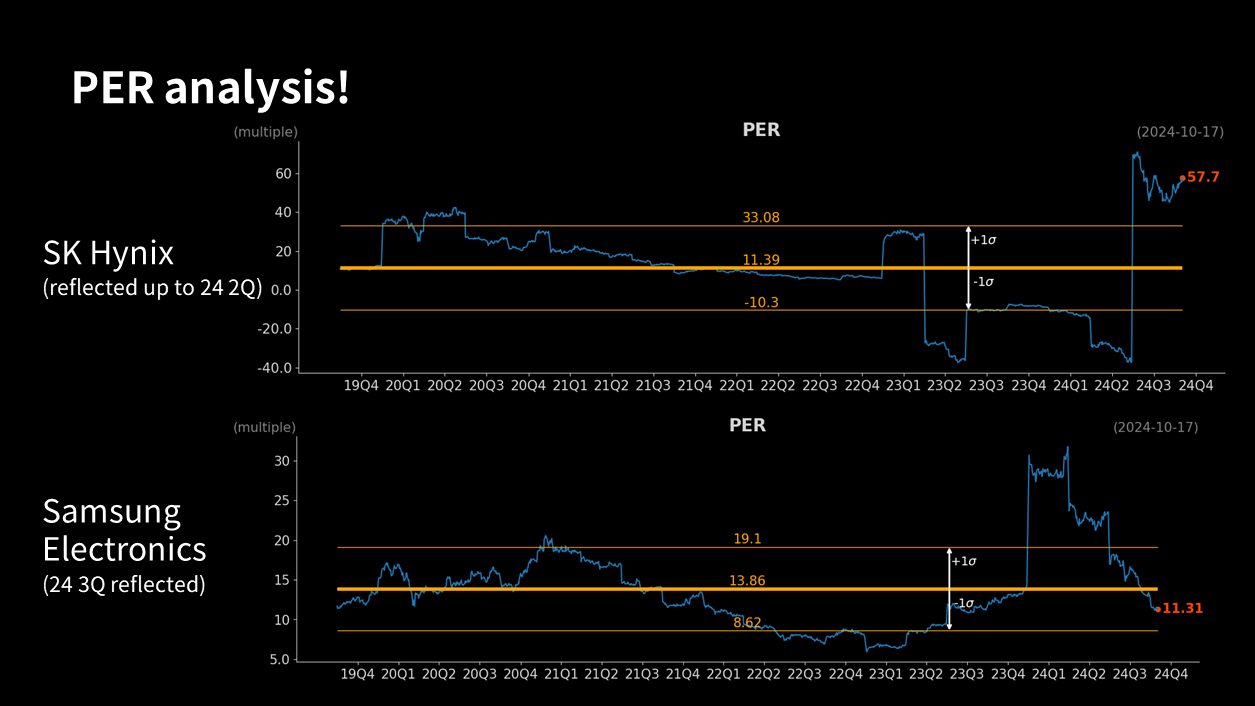

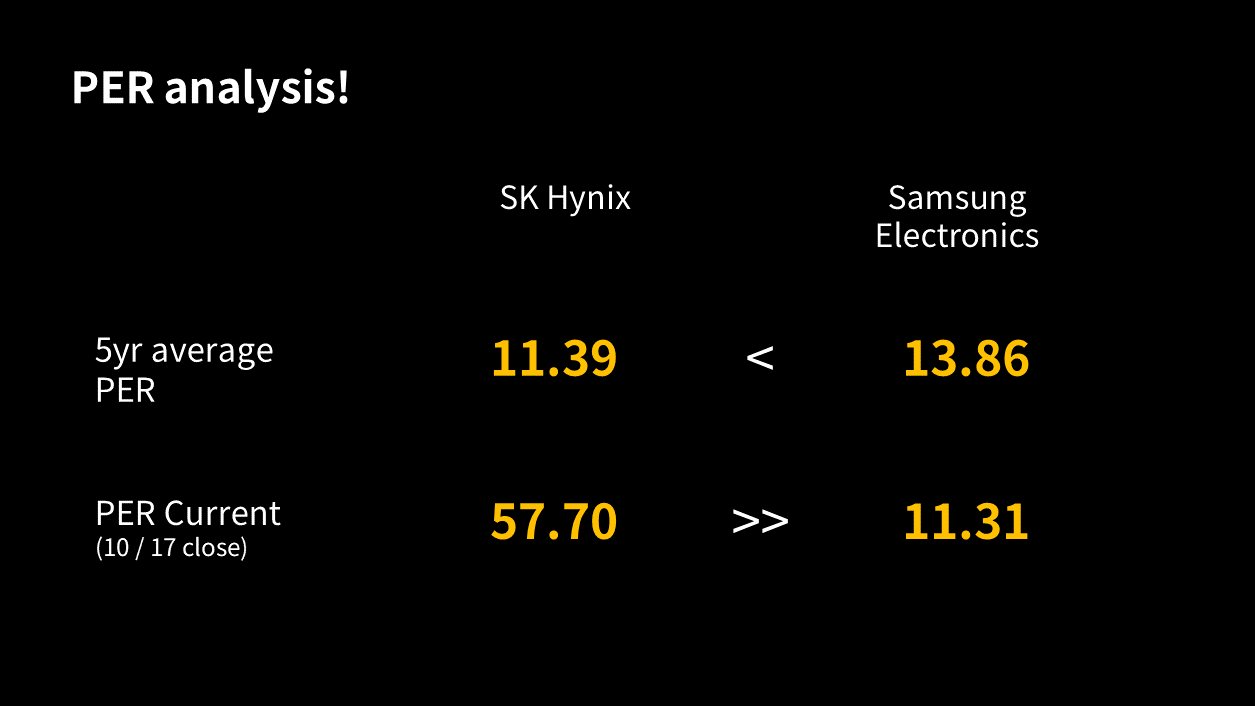

(p12) If we calculate the PER by dividing the net income of the last four quarters by the market capitalization, the two companies show a difference. Since performance changes every quarter, please be aware that there may be jumps in the PER calculation. Its not common to view PER in a time series, but I think its quite meaningful. SKs data only reflects up to Q2 performance, while Samsung Electronics includes estimated results for Q3 in its calculation.

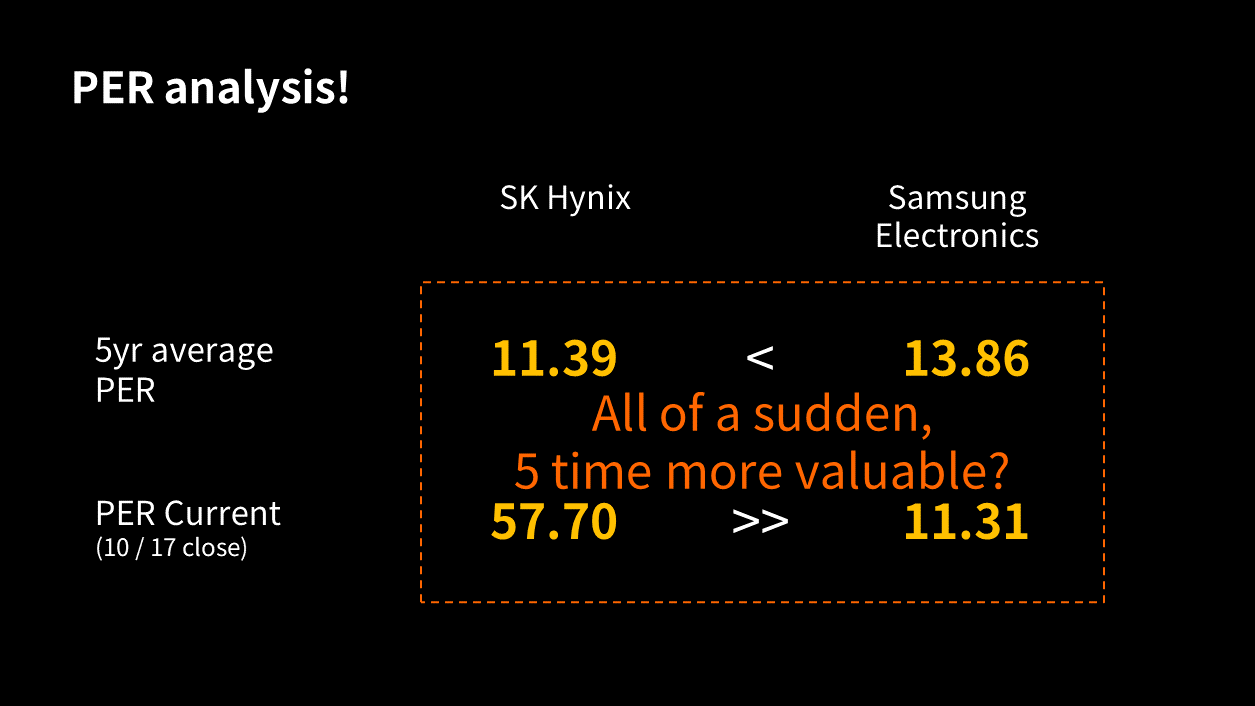

(p13) The results show that the average PER over five years is higher for Samsung Electronics. This indicates that the market has evaluated Samsung Electronics more highly over time. However, currently, SK Hynix has an overwhelmingly higher PER. Of course, the high PER may be partly due to losses in 2023, but the difference is still too large.

(p14) Is it normal for such a reversal to happen suddenly, with nearly a fivefold difference? It seems reasonable to think that the market might be reacting excessively.

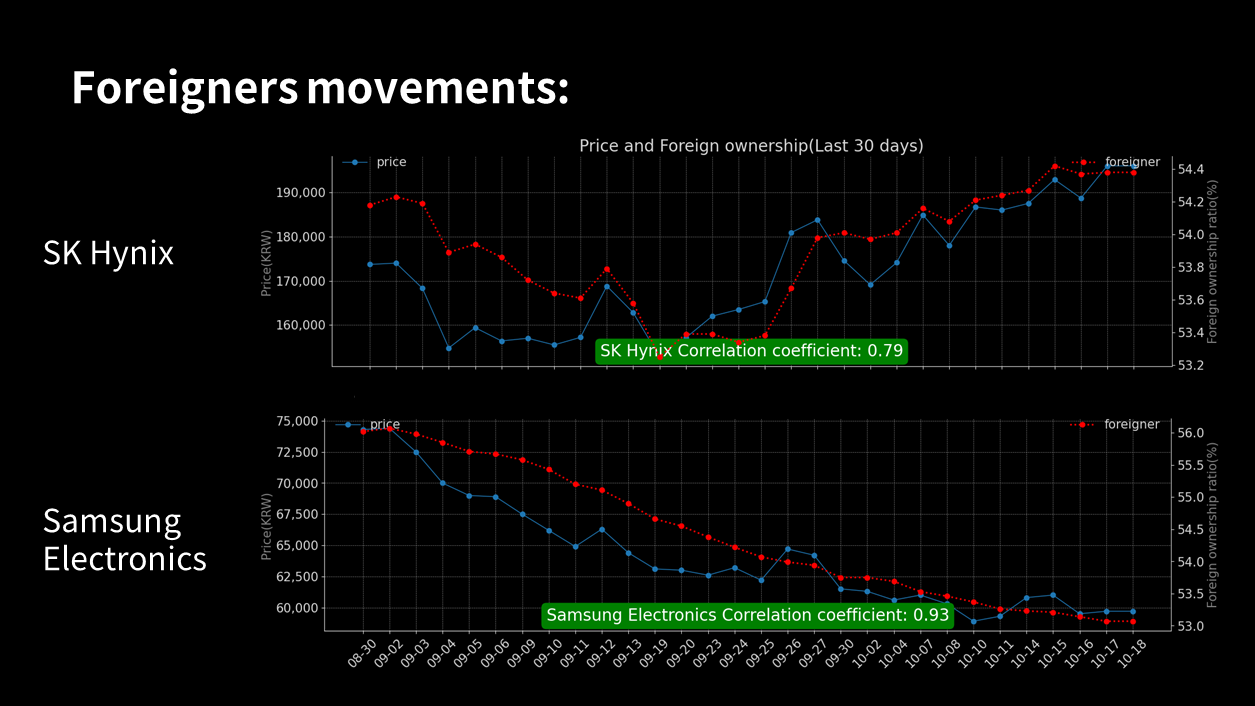

(p15) Now, lets see what smart foreign investors think. Here is the correlation between foreign ownership rates and stock prices over the past 30 days. SK Hynixs foreign ownership rate declined somewhat before rising again, with a correlation to the stock price of about 0.79. Samsung Electronics foreign ownership rate has continuously decreased, yet it has an impressive correlation of 0.93 with its stock price.

(p16) To summarize, while a simple comparison between the two companies is difficult, they are both currently affected by the same market issue regarding HBM, so I have boldly compared them. Looking at the PER, which reflects performance, it appears that the two companies are excessively evaluated differently. From a supplydemand perspective, it is clear that foreign investors are leading the decline in Samsungs stock price, while for SK Hynix, it seems that they are not driving the price up but rather adjusting their holdings by slightly increasing SK while reducing Samsung. I have provided this simple comparison, and at this moment, the strategy of going long on Samsung and short on SK Hynix might make sense, assuming the two companies cannot differ so significantly. Again, this is certainly not an investment recommendation.

(p17) Thank you.

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

[2/2] SK Hynix vs. Samsung Electronics: A Deep Dive

x: None, y: None