[1/2] In this video, I summarize the crucial developments in the stock market after Trump's election. We explore Samsung Electronics' recent performance, the market's response, and the potential impact of U.S. policies on domestic industries. Stay tuned for insights and analysis on these key issues!

(p1) Since Trumps election, I will take some time to summarize the progress on the key issues I discussed through Shorts.

(p2) We do not offer investment advice.

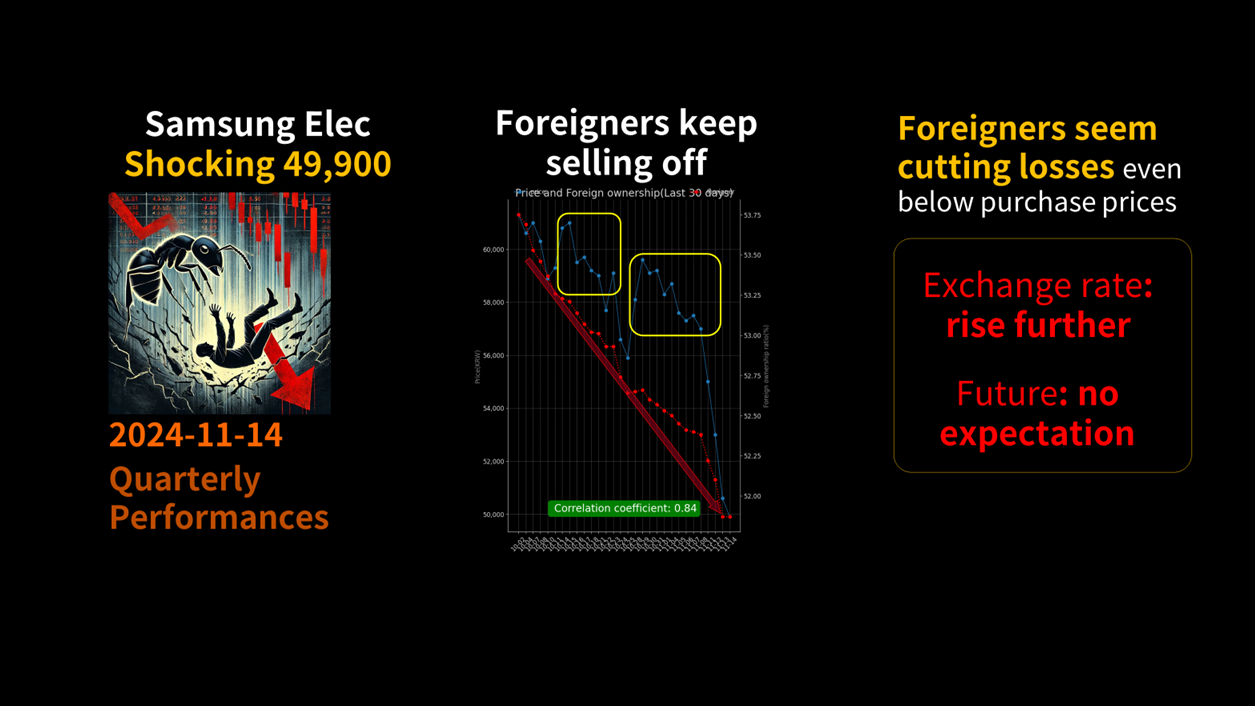

(p4) On November 14th, Samsung Electronics closing price dropped to the 40,000 won range, and I analyzed this situation and reported it.

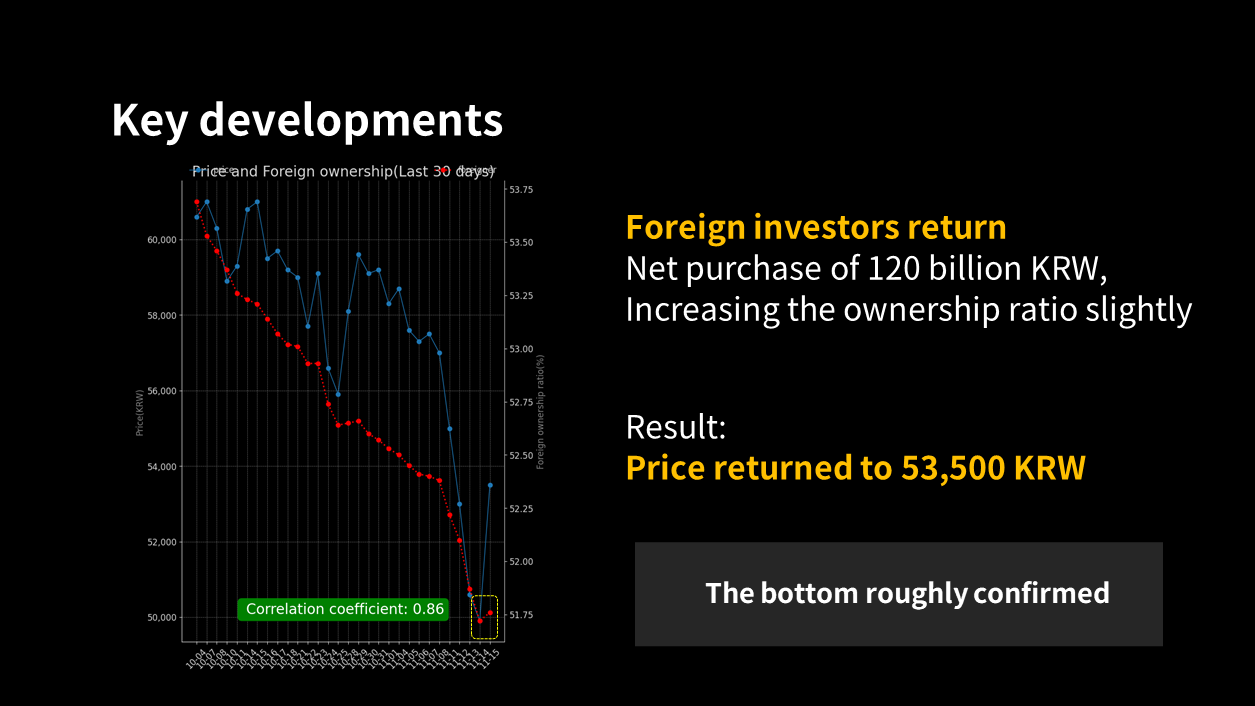

(p5) I will summarize what happened afterward. First, Samsung Electronics announced an emergency buyback and retirement of its own shares worth 10 trillion won. Typically, the buyback and retirement of shares is considered a more efficient shareholder return policy compared to dividends or other methods, which led to a positive market reaction. Also, it seems that the perception in the market was that a PBR below 1.0 was too severe. In the past, situations where the PBR fell below 1.0 have typically recovered within a few months.

(p6) Consequently, on November 15th, foreign investors made a net purchase of about 120 billion won, resulting in a slight rebound in shareholding ratio, and the stock price surged significantly, eventually closing at 53,500 won. Though its unfortunate that it dropped so far, I believe we have confirmed the bottom.

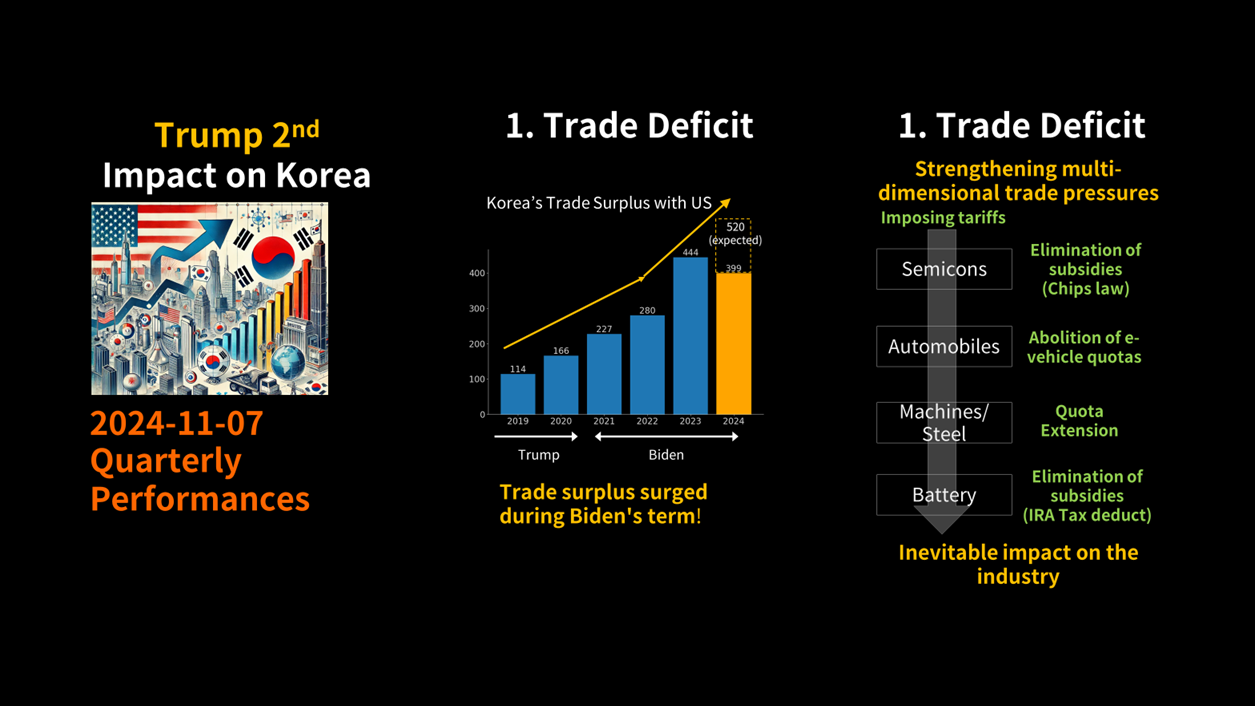

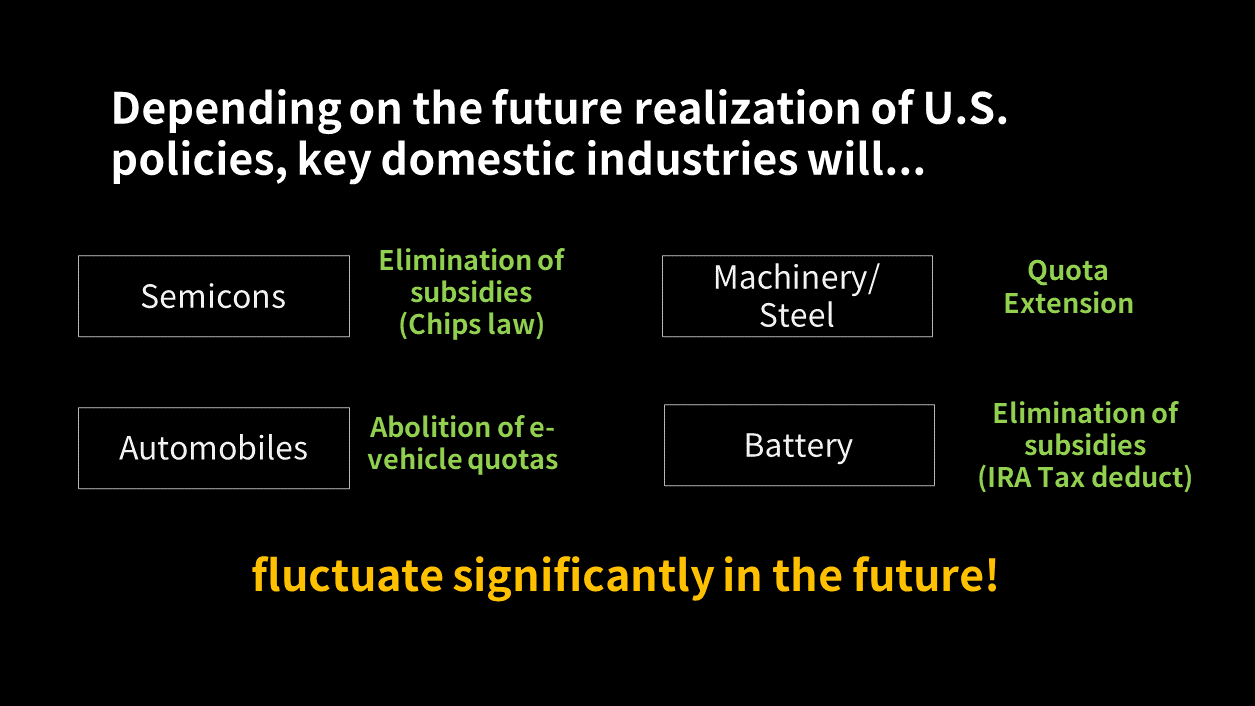

(p8) Additionally, on November 7th, shortly after Trumps election, I analyzed the impact of his secondterm policies on domestic industries. There was a suggestion that various industries would be affected to address the U.S. trade deficit.

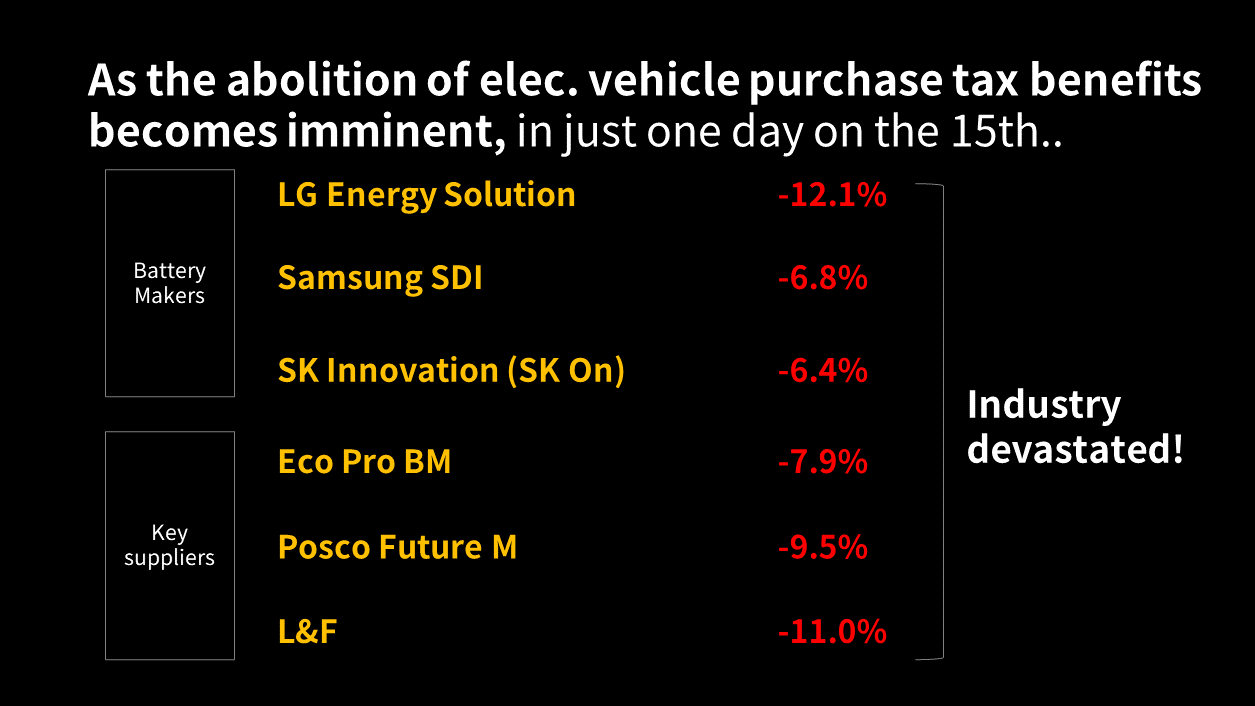

(p9) In reality, Trump recently reaffirmed that tax benefits for electric vehicle purchases would be eliminated, and even Musk reportedly agreed with this, prompting the market to react within a day. As you can see, batteryrelated stocks were completely devastated. The vulnerability of the domestic industrial structure is becoming increasingly apparent.

(p10) Going forward, domestic leading industries are expected to swing significantly depending on the realization of U.S. policies. This should be seen as a foreseeable future.

Youtube Link - Issue Tracker

Please allow location access in your device (how to turn on location access)

Delete?

[1/2] Analyzing Market Reactions Post Trump's Election

x: None, y: None